Why the Market’s Worst Enemy is its Participants

Read through a good number of articles over the weekend and, while not completely unanimous, the general consensus was all pretty negative.

One of the tougher things about this business is often being out of step with mainstream thinking.

Markets need disruption - no disruptions, no risks, no reward. In hindsight, investors tend to overlook the numerous interruptions on the way up the mountain that lead to good returns.

Why Be an Optimist?

Optimism tends to be more productive over time.

Anyone who has ever created anything was and is an optimist - whether that was a business, a service, a piece of art, a song, or any success at all from any channel of life.

Try and find me a member of Forbes 400 who is or was a perma-bear, or anyone who is successful or who has built great wealth that is always pessimistic. You’ll spend a long time looking but there aren’t any.

Being an optimist doesn't mean I don't think bad things will happen. In fact, I’m certain they will and that they must. That’s how we fix things and move higher up the mountain.

If we all walked into our offices tomorrow and the internet sent us an email saying all is good, all is solved, there is no conflict, no needs, no issue to build around, no problem to eradicate, no technology to create and no gaps to fill, we'd all be in limbo…..and we’d have to go break something.

US Stats Updates

Let's review a couple things.

The Leading Indicators Index (LEI) fell for the first time in four months in May after posting its biggest increase in 10 months in April. The LEI fell 0.2% but that was after a 0.6% jump in April to what was then a new cyclical high.

The culprit was a sharp increase in jobless claims, which subtracted 0.23ppt from the LEI.

Keep in mind that most of that jobless claims spike has already been erased, so I suspect we see it flow the other way in June's data.

The biggest positive contribution came from the interest-rate spread (+0.16ppt). Other contributions, whether positive (real consumer goods orders, ISM orders index, real core nondefense capital goods orders, building permits, and the leading credit index) or negative (stock prices and consumer expectations) were relatively small.

May’s Coincident Indicators Index (CEI) was flat at its record high, following a 0.2% gain in April and no change in March. The CEI hasn’t posted a decline since January 2013, climbing 7.5% over the period.

Three of the four components contributed positively to the index last month, while industrial production is subtracting again after being the biggest positive contributor in April. Output fell for the seventh time in nine months, contracting 0.4% in May and 1.9% over the period.

And finally, the three remaining components of the CEI continued to climb to new record highs:

1) Personal income--excluding transfer payments--increased for the 30th time in 31 months, up 0.3% m/m and 9.8% over the time span,

2) Real manufacturing & trade sales increased for the fourth time in five months by a total of 1.4%, and

3) Non-farm payroll employment was fractionally higher; it hasn’t posted a decline since July 2010.

YES: Brexit is an Issue, Not an Armageddon

The reward for patience in the face of uncertainty is better deals.

Honestly, do we really believe a lot of business will literally disappear because of Brexit? Delayed, yes? Gone, no. As was the case in 2008-2009, money did not just disappear; it moved. Likewise, Brexit will cause business to move not vanish.

Will people stop doing something because two or three years from now there will be an agreement for the EU and Britain to work together on new terms? Do we really understand how much did not change by the vote ordo we just need something to fret over?

As I’ve always said: The market's worst enemy is its participants.

We have scared ourselves to the point where every market move contains some new monster. American households have about $86 trillion in net worth, allowing for the $1.5 trillion we shaved off in the markets Friday, with what is likely a little more to go this week.

Do we really feel they will never do anything productive with those assets?

Given hundreds of years of history, inclusive of all the setbacks, I'd take the other side of that trade.

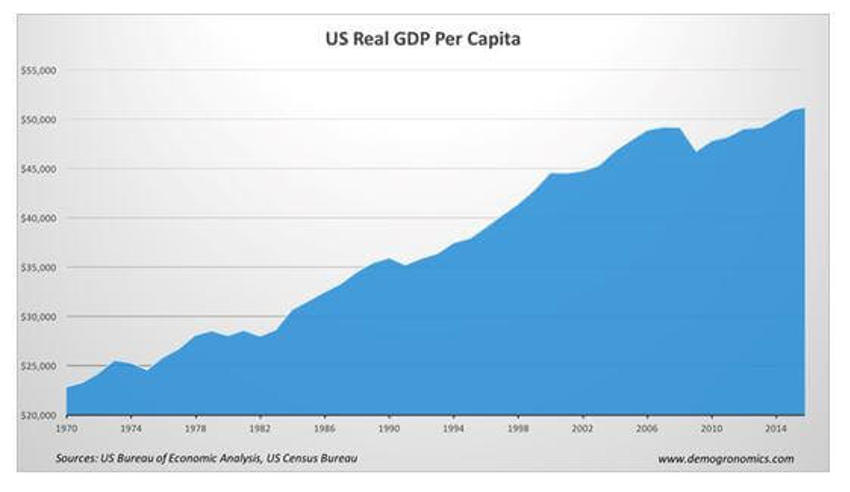

Here is a picture of per capita GDP growth over the years since 1970. And I’m pretty certain many things far more significant than Brexit took place during that time:

Being Pessimistic

Pessimism always sounds so much smarter than optimism.

An expert espousing that Brexit will drive a massive influx of doubt and uncertainty, and that both business and markets hate uncertainty, sounds very sharp. Surely a whole lot more intelligent than, "Uncertainty always exists, and then the storms pass...."

The reason there are so many pessimists comes down to two points as I once read:

1) Pessimists are persuasive. They exploit fear and doubt. Josh Brown wrote, "Pessimism is intellectually seductive and the arguments always sound smarter, especially when they dovetail with our own worries." There's a mountain of evidence proving that people hate losing money far more than they like making it. That makes us more susceptible to following the pessimists' warnings than the optimists' outlook.

2) Many people either lack a living wage or live beyond their means and take too much risk, which removes the possibility of sticking it out through the long term.

We try to be pragmatic in our optimism. Are you investing in stocks for the next 5, 10, 20, or 30 years? If so, then you're going to experience multiple recessions, many dozens of pullbacks, and more than a few crashes.

That said, history suggests strongly however, that those who can stick it out through the ups and downs will very likely enjoy big returns in due time.

They have the house's odds on their side.

In Closing...

First a cartoon from Alan Steel and our Scottish friends which may be fitting:

Under the category, "nuttier things have happened" there is a slim and outside chance that all of the fretting about Brexit might be for naught.

On Friday, while stock markets were panicking around the world, the website of the House of Commons crashed.

Dr Ed Yardeni tells us that so many users were aiming to sign a petition for a do-over of the Brexit referendum that the website couldn’t handle the traffic.

That isn’t officially on the table right now. But what is on the table is a possible second independence referendum for Scotland to leave the UK. Scotland, along with London and Northern Ireland, voted to remain in the EU.

The more things change, the more they stay the same. While much suspense will unfold, the UK will continue to do business with the EU and vice versa.

In the meantime, if you’re not careful you can easily mistake drama for fact.