Why “All Is Well” Doesn’t Sell

The summertime economic calendar remains light, so expect loud noises about small things.

That’s because the scribblers and commentators can write that "all is well," because it doesn’t sell.

However, even as the second stage of the summer haze kicks in, which lasts until about 1st August, the upcoming earnings season should still be a solid surprise to the upside (though you might not see that printed / online in many places.

Commentators will be trying desperately to find the negative in all the positives.

So here’s the Thomson Reuters' forward data as at Thursday 7th August:

- Forward Looking 4-qtr S&P 500 earnings estimate: $139.21

- P/E ratio: 17.5(x)

- PEG ratio: 1.82(x)

- S&P 500 earnings yield: 5.74%, nice increase over last week's 5.56%

- Year-over-year growth rate of fwd. est.: +9.58%, down from last week's +9.75%.

Now, keep in mind that the "forward 4-quarter" look now includes Q3 2017 through to Q2 2018.

The S&P 500 earnings yield rose primarily because the S&P 500 was unchanged on the week (with lots of internal churn, so some sectors were down), while that forward estimate continues to increase at a pretty solid 9% annual rate.

One data point that’s tracked by Thomson Reuters is the overall "estimated revised higher" vs. "estimates revised lower" over the course of a quarter. Once again, in the 2nd calendar quarter of 2017, the upward revisions outnumbered the downward revisions.

Good News?

ISM Manufacturing and Services data both were solid to round off the week, and both beat expectations as previously noted.

Take note: The ISM Manufacturing came in at 57.8, which is both an increase and a beat of expectations. The special part, however, is this: ISM notes that if we annualize at this level, we would have a corresponding real GDP increase of 4.6%. Collectively the ISM data YTD suggest a gain of 4.1%.

It’s like I have often stated, we need to recognize that our reporting process for GDP is likely misleading or simply outdated, and is not capturing all the growth that’s actually unfolding.

And it’s always nice to review these things and read what is being said at the ground level by respondents. I think you’ll find the remarks (below) helpful during the summer's meandering haze and chop:

- "Overall, business is strong. We are seeing price increases for packaging and handling materials as well as some MRO supplies." (Plastics & Rubber Products)

- "Overall, demand is up 5-7 percent and expected to continue through the end of the year, at least." (Transportation Equipment)

- "Demand is picking up; meeting budget expectations." (Electrical Equipment, Appliances & Components)

- "Business is still very robust. Have continued to hire to match increased demand." (Computer & Electronic Products)

- "Business [is] steady; not great, but good and fairly solid." (Furniture & Related Products)

- "Business globally continues to show improvement." (Chemical Products)

- "Environmental regulations have strong effects on our business. We continue to watch for any changes as a result of the new administration." (Paper Products)

- "Dry weather helping demand." (Non-metallic Mineral Products)

- "International business outside North America on the upswing." (Machinery)

- "Metal pricing continues to drag down our profit margins, but we are very busy quoting new business, so our customers have a good outlook on the rest of the year." (Fabricated Metal Products)

- "Business is strong both domestically and internationally. Supplier deliveries are quick domestically, international supply chain is slowing. We are in a hiring mode." (Food, Beverage & Tobacco Products)

And here’s a Few More Positive Tidbits...

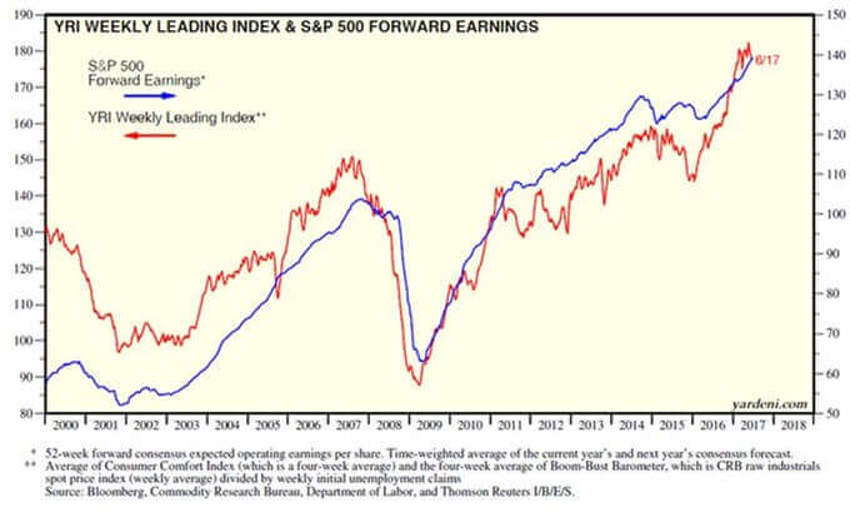

From our good friend Dr Ed Yardeni, the Weekly Leading Index (WLI) averages the BBB and the Bloomberg weekly Consumer Comfort Index. WLI tracks the S&P 500 even better than our BBB.

It’s also up in record territory with a gain of 13% y/y.

As noted above, forward earnings remain solid. Combined, these measures have both been highly correlated with the S&P 500 since 2000.

That’s because both have been highly correlated with the forward earnings of the S&P 500, which rose to yet another record high during the 6/29 week.

Have a look at the below chart from Dr Ed to put this into perspective:

Summary

Now, we can disagree about this, and we can worry about how others might interpret the data, and we can even fret over the minute-by-minute changes.

Or we can simply get on our surfboard, paddle out into the break and ride the waves.

Sure it’s choppy out there, folks. It’s summer. It’s supposed to be.

But our focus remains the same: Pray for that summer swoon, and think demographics not economics.

We stand by the idea we are in far better shape than the vast majority of investors currently realise.