Who Moves Less Wins

Sometimes, after all patience is spent and allowances for lunacy sold as expertise becomes exhausting, you just have to call it what it is: Plain old bullsh$$.

Here are some recent examples of this type of manure:

Reality Break...

- It's 100 points on a Dow Jones of 23,400.

- It's 100 points off an 8,000 point rally over the last 20 months...8,000 points!

- It's just 100 points.

But those headlines tell novice investors that a 100 point drop in futures is somehow a sure sign that the mood for risk has soured.

And let me tell you that if any investors feels risk is pervasive and somehow goes up or down based on mood swings then do yourself a favour and get out of the market now.

Sadly, if you didn’t hit the sell button based on those headline alone then there are a few more senseless daggers waiting for you in the bullet points below.

My favourite is "careening ever closer to the sun..." Creative, eh?

What a crock.

When I read streams of garbage like this I know the average investor, massively confused by what is unfolding in our Barbell Economy, will be swayed; and often in the wrong direction.

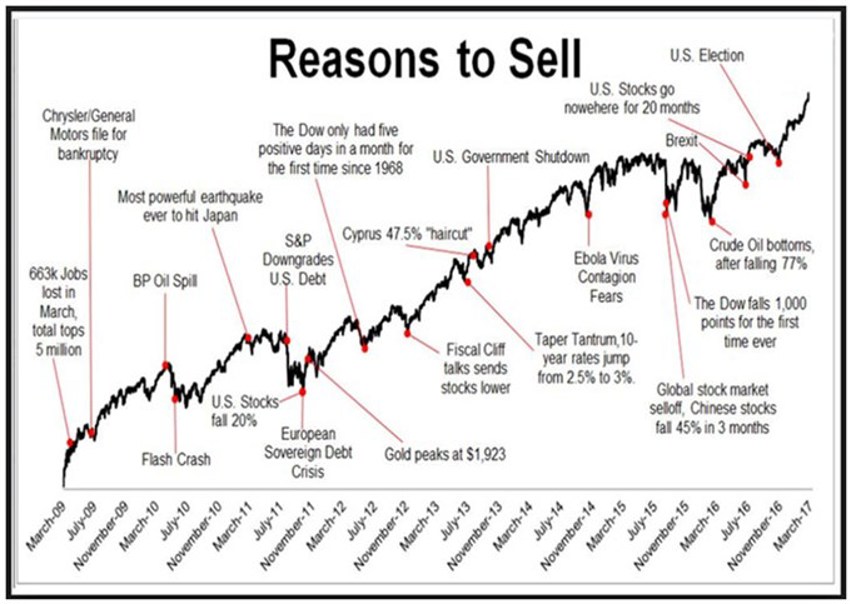

Have a look at this chart if you’re looking for reasons to sell:

Amusing, right? But notice the continuing upward trend despite all these events, many of which were deemed world-enders.

Another Shot?

It’s mind-numbing:

Note the darker skies and worsening pictures "as the mood sours."

These guys should be in advertising (oh yeah, they are).

Yesterday’s headline on CNBC was a cracker – and it was about that same 100 points.

"Dow Set to Open 100 Down as Uncertainty Plagues Investors

Do you really think that "Plagues Investors"?

Are you kidding me?

If these people had licenses they’d be fined for misleading the public.

Some Better Snapshots

How about a few more positive snapshots to subdue the A.M. apocalypse shout-outs:

Or Maybe This…

Long-term thinking always wins out over short-term trading.

Worrying about the next setback sells lots of ads but makes almost no money for you.

History proves that.

Find the problem in these last two snapshots above.

Eight years since 1933 have been down GDP years; three of them since 1982, and two of them were -0.04% and -0.01%

Demogronomics keeps us on the leading edge of long-term direction but demands a much larger, more patient view of the elements at work.

It's the long-term currents we need to invest in, not the short-term waves that make horrendous noise when they hit the shore.