When Money Follows Market Sentiment

The Q4 earnings season is staring us in the face.

My hunch? (And it’s just a hunch, by the way) is that we might have a few disappointments as we shift from the old ways to the new ways.

There will still be a grey area as we live through that window of new corporate benefits that are coming down the pipeline but haven’t yet arrived.

Add to that the (now standard) “Missed By Two Cents" reporting and the nervous nellies in the investor crowd could have knee-jerk reactions to the downside; which sets the stage for potential future upside if we’re patient.

In fact, by the end of Q1 thereafter, and its quarterly report, we should have a clearer view of the immediate landscape ahead as it relates to tax structure, repatriation, increasing dividends, buybacks and regulatory resolutions.

So, where do I think the soft spots are?

I'd hazard to point to maybe mid-January to the latter stages of February as a window.

We’ll be on the lookout for additional opportunities for long-term seeds of future benefit to be planted in that window of time. And I would further suspect we may find ourselves with a year just like last year, complete with choppy periods and scary spots along the way.

Remember the good news is that bullishness will likely vanish quickly at the first week of red ink, as it has done consistently for the last (nearly) eight years.

Stats From Friday's US Reports

The prevailing opinion is that America “fell short" on jobs last month.

But the revision from last month more than replaced the miss.

Internal strength was confirmed by the increases in hourly earnings: 0.4% MoM and 2.9% YoY. This could also explain the better than expected car sales numbers we saw. It could even set the stage for a positive surprise on retail sales as well.

Just be aware that the bears will quickly tell us that we have borrowed from the future strength.

I’ve heard that one for over 30 years now.

Boomers are starting to retire at a faster pace. There will be millions more Baby Boomers joining that channel over the next 15 years. The demands for more assisted living facilities, nursing homes, legal and illegal foreign nursing aids, and robots trained for geriatric care will be significant - and opportunistic for the patient investor.

A Squeeze? Not Really

Dr Ed Yardeni tells us that National Income & Product Accounts (NIPA) shows that labour’s share of National Income may finally be recovering: "Compensation of Employees fell to 60.7% of National Income during Q3-2014. It was back to 62.6% during Q3-2016."

Now, some of you may be concerned that this is bad for profits and margins.

We suspect otherwise.

Generation Y replacements are setting the stage for more efficient processes and technology tools across the corporate landscape.

Changes we cannot even define at this stage will cause things to, well, just work better and smarter.

Add this to the tax cuts proposed by the soon-to-be-installed Trump administration, and the combined processes should increase both disposable incomes and corporate after-tax earnings for consumers, and potentially in very significant ways.

Other Positives?

- Chemical activity ended the year strong

- Construction spending was up 0.9% to the highest level in ten years

- Home loan originations are stronger than they were one year ago

- ISM manufacturing reached 54.7, the highest level in two years (see below)

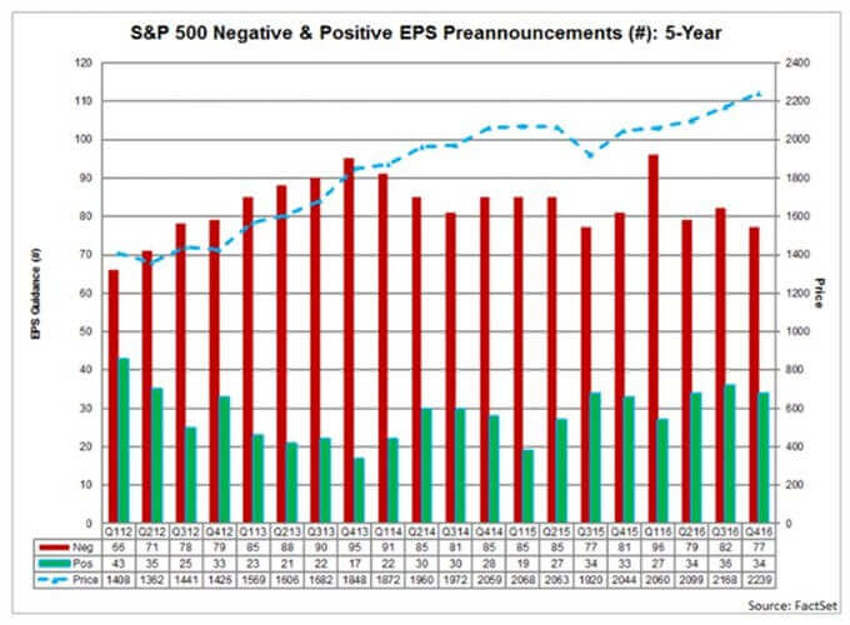

Additionally, Q4 earnings pre-announcements were more positive than usual in Q4 2016 according to FactSet.

Let's take a quick look:

In total, just 77 companies issued negative guidance for the Q4 data.

That’s below the 82 noted in Q3 and below the 5-year average of 83.

If indeed 77 is the final tally then it will be the third lowest number of the last 5 years.

On the flip-side, 34 companies in the S&P 500 issued positive EPS guidance for the fourth quarter. This is slightly below the number for Q3 2016 (36), but higher than the five-year average (29).

If 34 is the final number for the quarter, it will mark a tie for the fourth highest number of S&P 500 companies issuing positive EPS guidance over the past five years (Q1 2012 - Q4 2016).

That’s longer-term improvement that you won’t see in the headlines.

As For Last Week...

The first week of the New Year is always a foggy one; many of us are still out or only doing what is vitally important.

Here are a few highlights in case you were on autopilot…

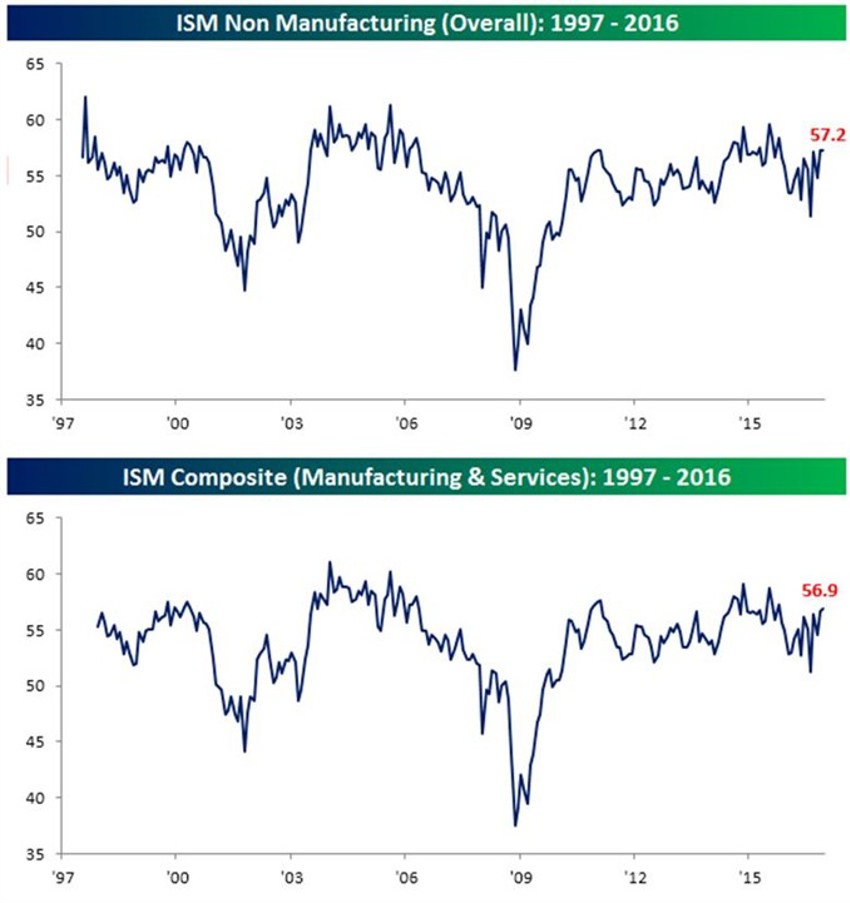

- There are (relative) improvements in the data on the manufacturing front as the energy cloud passes. The good news continued as ISM Services data was positive as well.

- The ISM Non-Manufacturing report for December beat expectations (see chart below) coming in at a level of 57.2. The overall ISM for the month of December was 56.9, which was up 0.2 points from November.

- The above reading is up two full points from a year ago, and now stands at its highest since October 2015. This provides more cover for the on-going better perspective that our "earnings recession" was driven by energy's adjustment, and little more.

Cost Breakout?

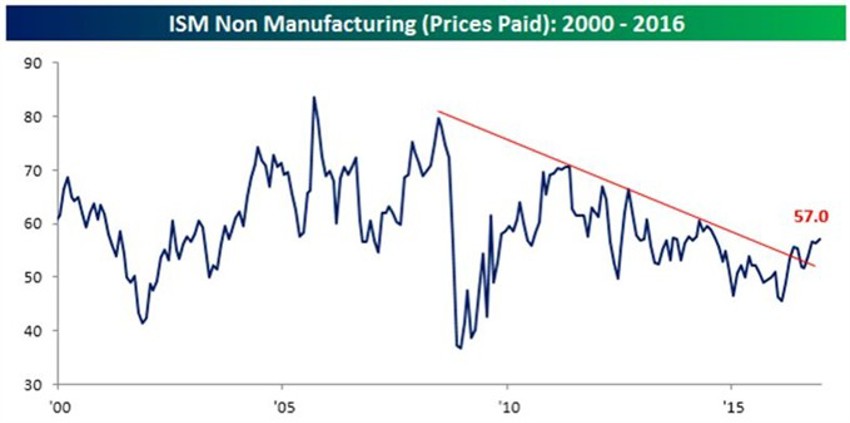

As 2016 was hitting its lows in early February and the world was shaking in its collective boots over $26 crude oil, we suggested the possibility that "deflation" had nearly run its course.

Some inflation is a good thing, and much preferred to deflation.

The third chart above hints that we may very well be seeing the beginning of a whiff of said inflation.

Rest assured that there will be a wave of experts telling us soon that inflationary pressures will roil the entire planet; sending some off into the darkness of hell. Oh, and it will be the worst we have ever seen and likely will come from the same experts who told us for years that deflation would be the death of us.

Reminder on Investor Sentiment

Earlier in the week, I noted that investor sentiment has picked up following the election result as many look forward with a more positive perspective.

That’s a good thing, but that sentiment has yet to be combined with any significant inflows on capital measurements.

In other words, the masses are not rushing into stocks and thinking the sky is all blue forever.

In fact, even though the AAII data has become more bullish:

“Even though the market is up from the election 8-hour overnight panic, bullish sentiment among individual investors still can't get over the hump. In this week's sentiment survey from AAII, bullish sentiment increased from 45.57% up to 46.20%. That is 105 straight weeks where bullish sentiment has been below 50%. For anyone counting, that is the second longest streak in the history of the survey (back to 1987).”

I stand by the same idea that we’ve have had for years: The stage is set for the market to move thousands of points higher before the masses start thinking that things are really good again, and following that up with real money flowing into the market.