When Folks Start Investing to Lose Money

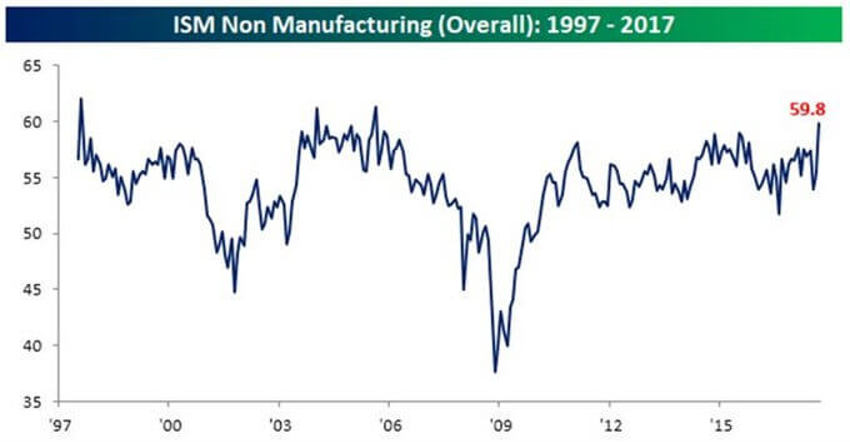

If the recent strong ISM Manufacturing data from September (hurricanes and all) didn’t make your day, perhaps the latest ISM report on the Non-Manufacturing (Service) sector will manage to.

Economists and analysts thought we would come in at a reading of 55.5 (the August read was 55.3).

The actual reading came in at a stout 59.8.

This is the highest level for the index since August 2005! It also clocked in as the fourth-largest one-month increase in the history of the survey going back to 1997!

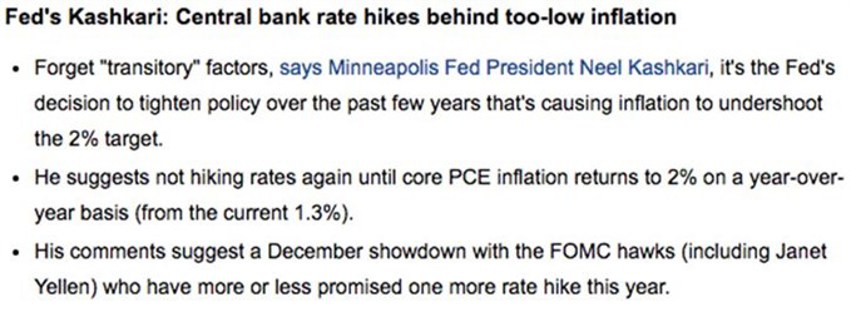

No-flation

The US Federal Reserve officials continue to struggle with the lack of inflation.

After all, QE was supposed to cause the mother of all inflation firestorms. So how could those predictions, gold-bugs and all, have been so wrong?

Well there is a tiny - and I do mean microscopic - chance that “they” are beginning to understand this is a structural change driven by the slow-moving but long-lasting demographic powers afoot:

My Hunch?

I suspect Ms Yellen may use a low read on US jobs to suggest that we can wait for the next rate hike just a tad bit longer.

But, heck, that's just a hunch.

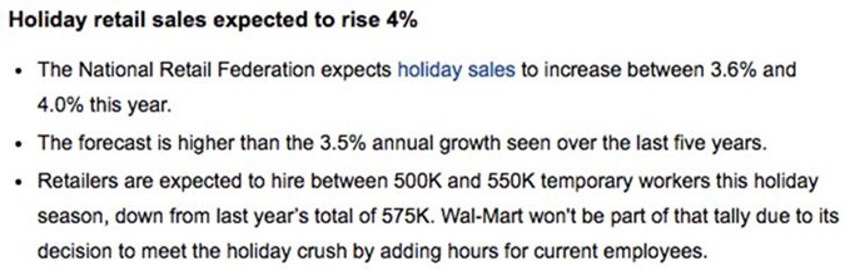

Holidays Are Almost Here

Before you know it, we will be mixing headlines about Q3 earnings beats into expectations on the all-too-analyzed Holiday Shopping Season.

The first numbers are out and the growth is expected to be solid.

They’re likely pushed higher by growing US wages and a solid employment base with plenty of jobs open for those looking for one:

The point?

Don't be swayed by all the bad news. There is plenty of good stuff happening.

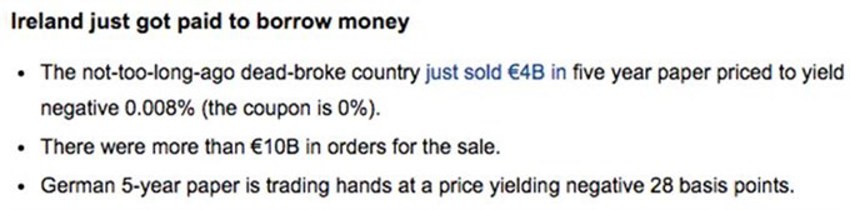

You Have Got to Be Kidding!

Under the "This is absolutely crazy" column, I bring your attention to Ireland.

Yes, Ireland.

I know March is a ways off in the distance still, but, after being basically broke just a short eight years ago, the country just got paid to sell bonds.

Their latest bond offering was bought at a negative yield!

And you thought investors were too bullish about stocks?!

Not even close.

Something to Ponder....

What if some investment management firm told you that "the only investments they buy for clients are the ones that sell for 43 times earnings - because they’re safe."

What would you think? Nutty right?

Well, that's what buyers of bonds in the US are doing right now as they line up each week setting records for bids...43 times earnings. Guaranteed:

In Summary

The next corporate earnings flood is now headed our way. Don’t overlook the impact of the latest manufacturing data as noted above.

It could be easily lost in the mess, so you must not let that happen.

Let's keep praying for a correction, even a mild one.

It would only take a week or two before there would be no one feeling bullish, and the world would keep on ticking.