What Masquerades As News

Not so long ago the biggest fear was that Trump would not accept things if he lost the US Presidential election.

How quickly the world changes, eh?

Now the media coverage for the first two weeks post-election is borderline hysterical – it’s simply a hate-filled process, and that’s not news.

Here’s an example: It was reported "by sources" that Jamie Dimon was in line for the post of Treasury Secretary in Trump’s new cabinet. The media took off with it; some in favour, some against – inflating and deflating the balloon of hot air on the topic in turns.

Then, reality set in. Trump announces that he doesn't respect Jamie Dimon and is not considering him for the Treasury post.

Story over. And there was never anything on record to confirm Dimon was ever in play.

These things keep coming up; opinions masquerading as news.

Long-term investors need to now look beyond/over/through that mess.

While I can tell you that I’ve being asked to appear on hundreds of TV/radio interviews and co-hosting assignments, I can tell you how many times I’ve been passed over because my opinion did not jive with their production storyline.

That's German for "We don't agree with you."

The Funny Thing About Records...

Earnings are rolling into new high territory as the energy price collapse gets managed.

Cash flows, cash balances and net worth, margins are all at or near record highs.

Yet millions of investors are still dealing with the same problem that arrived back when the Baby Boomer-driven secular bull market started in the early 1980s - the ghosts of high prices then remain the ghosts today, only 18,000 Dow Jones points higher.

In the last week alone a large number of advisors asked me, "Mike, what do I do now? We are at record highs and it seems awfully foolish to be investing now."

I told them that, when the Dow was breaking 1,000 and everything stunk, all I heard about was how it had taken seven years to, "Get back to where it was in 1974."

But the Baby Boomer age cohort was en route and drove the economy through the longest bull market in history.

Now imagine saying to yourself today, "I cannot invest in Dow 1,050 because it is at an all-time high."

That is how expensive fear can be.

Back to Records

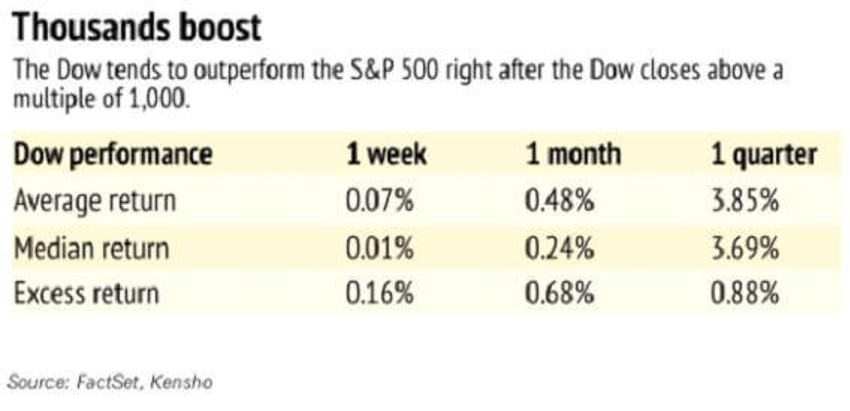

Note the data chart above. The Dow is once again hitting all-time highs and closing in on 19,000 for the first time as we speak. If history is any guide, that psychological triple-zero barrier suggests more gains are to come - conjuring up even more investor fear of heights.

We call it market altitude sickness, and it is very real.

Based on market data from the past 30 years, when the Dow has crossed levels like 2,000, 3,000, 4,000…all the way up to 18,000, the data suggests we can expect traders and capital to push it up even higher.

The trend is true, and not just for a quick one-week return but also one-month and one-quarter returns.

The chart above takes you back to January 1987, when the Dow closed above 2,000 for the first time. That's 17 different instances, all the way through the first close above 18,000 in December 2014.

By the way, many forget that having the Dow Jones cross 2,000 in January of 1987 meant it had doubled from August 1982 in just 4 years and 5 months, with almost no fanfare.

Using the Rule of 72, being able to double your money in 4.5 years is a tidy rate of return indeed.

The lesson?

Focus on percentages and not the big numbers.

This will become more and more vital as the numbers get larger.

Consider This....

Yes, bear markets are coming. They last on average 11 months and, in my career, I’ve lived through several of them.

So why do I always suggest we pray for a market correction?

Well, think about it; right now we’re at record highs. And every single correction and setback before now, in the history of markets, has proven to be an opportunity for the long-term, patient, disciplined investor.

Every single one.

It would serve everyone well to learn that lesson while remembering that it is not a guarantee, merely a review of history.

We All Have a Choice....

We can get lost in the small, short-term pictures under storms of media-driven, attention-getting monsters.

- or -

We can calmly recognize that with, patience, a long-term view and disciplined planning, the next 30 years are likely to look a lot like the last 30 years.

They will be driven by forces that are first derived from the direction of demographics.

In other words they will be driven by people.

Over the Holiday break, if you can focus on the idea that we have the very best demographic make-up for coming demand of the developed economies around the globe, you will arrive at the same conclusion: Our future is bright.

In Closing

The next few years should be very interesting.

January 20th, 2017 marks the beginning of Trump’s first term in office and starts the clock on his first 100 days, which are often viewed as the sweet spot for a new President to implement the changes promised on the campaign trail.

He has already taught us all not to underestimate him.

If he does everything that he promised to do then we could be in for a wild ride in 2017.

Stock prices could melt up on widespread deregulation and the repatriation of as much as $2 trillion in corporate profits from overseas.

A 10% tax rate on these funds would leave a huge amount of money that will probably be used mostly for share buybacks and special dividend pay-outs.

After the roller-coaster of regulatory pressure and heavy taxing hurdles of the last eight years, it’s hard to imagine real GDP growing by 4% again.

But that’s Trump’s goal. Can he do it?

Well, as Dr Ed Yardeni points out, "It certainly is possible if $2 trillion of corporate profits is repatriated, the government spends $1 trillion on infrastructure over the next 10 years, and individual and corporate tax rates are slashed."

Keep in mind, all good will come with plenty of new fears to replace the ones we have today.

Given that the economy is at full employment, 4% growth will require much more productivity growth than the economy has delivered since the late 1990s.

Otherwise, there could be a significant increase in inflation. In that case the Fed would be forced to normalize monetary policy more quickly and more normally.

Bond yields would continue to spike higher, and so would the dollar. In that scenario the stock market melt-up could be followed by a meltdown.

So pray for a correction and remain focused and disciplined.