What A Market Miss Up!

During the oncoming summer haze, expect low volumes, choppy markets, meandering directions and hiccups every time a new scary headline crosses your screen.

Here’s a good example:

This week the Chicago PMI came out. A headline hit early in the morning. It showed a 2% reduction in the index, and as such it was "reported" as bad news for the region.

In the next 30 minutes, but without nearly as much fanfare and no special retraction, the reading was “adjusted” after having been incorrectly reported in the headline!

And by a wide margin, too.

Instead of a 2% "miss" down - it was a 2% miss up!

The proper reading was over 59%, and marked the highest in the region in over three years!

And if it wasn’t so sad it would be funny.

Why?

Because too many folks out there still believe the "garbage" reported in so many areas.

Here’s the true tale:

"A measure of how well the economy is performing in the Chicago area rose in May to the highest level in 2½ years, showing the economy remains quite healthy in key regions of the U.S.

“The Chicago business barometer, or Chicago PMI, rose to 59.4 in May from 58.3, MNI Indicators said Wednesday after initially reporting an incorrect number. Any reading over 50 indicates improving conditions.

“Originally, the firm mistakenly reported that its Chicago-area gauge fell to 55.2, adding to downward pressure early Wednesday on U.S. stocks. MNI has not explained how the error occurred.

“The index has risen sharply since President Donald Trump took office in January promising to boost the economy with a series of pro-business policies.

“The energy industry in particular has been revitalized by somewhat higher prices that have spurred drillers to buy more rigs and other equipment used to extract fossil fuels, a bonanza for manufacturers of primary metals and fabricated parts.

“In a separate question, more than half of the executives surveyed said their companies plan to hire more workers in the next three months."

And yet, investor sentiment wilts yet again just as the summer haze dawns.

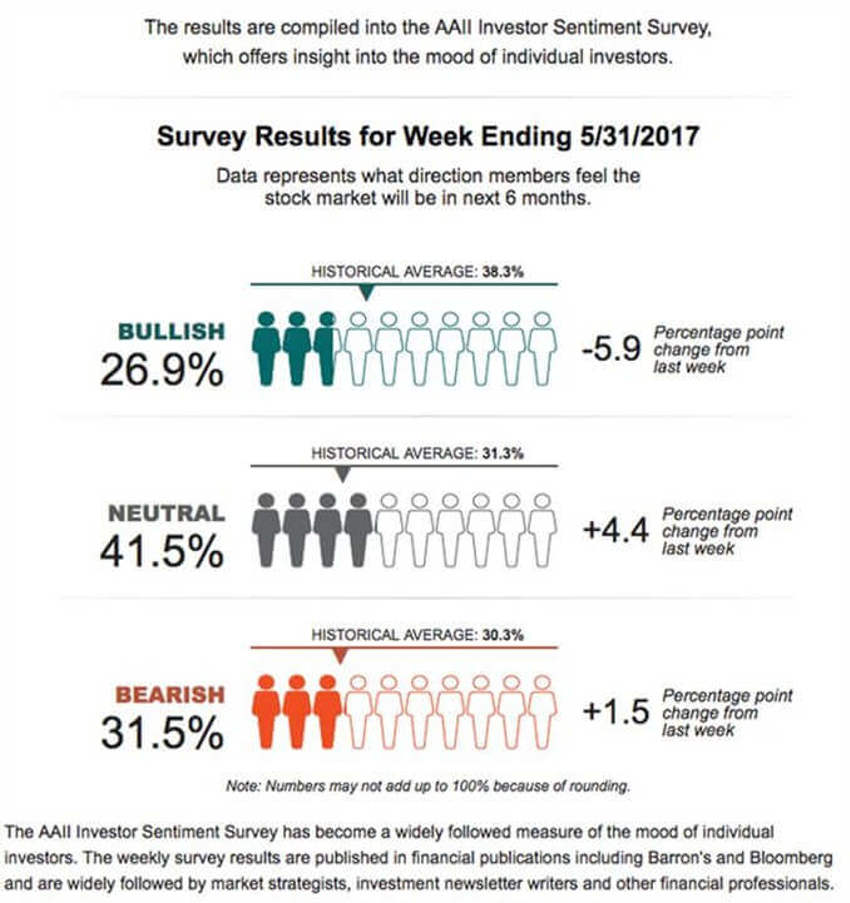

Here’s the latest picture on that for you from the AAII:

So, as we’ve seen in almost every previous summer since I joined this business, we can expect slow and choppy trade, and a general downward tilt and softness that has historically proven to be beneficial for the long-term patient investor.

History also shows us that it often ends in August with a "summer swoon" that tends to frighten everyone away for strong year-end closes.

This is not something to fear - especially with nearly 75% of the crowd already out of the bullish camp as noted in the latest data released early this morning.

This is very good news.

And yet it makes the latest jobs data seem even more confusing, right?

By the way, the data below is also good news.

Dirty Little Secrets....

Many have been watching the commission war going on between the large public financial houses on Wall Street.

In these notes a few weeks back, I hinted that soon we may find commissions are free.

I got lots of chatter back with the obvious question of how they would make money.

Ahh, yes, how would they make money indeed...?

Do The Quants Run Wall Street Now?

The above was the title of a piece in the Wall Street Journal on May 22, 2017.

It's a question asked often by the talking heads.

And it's why Wall Street has caused you to fall in love with their ETF's.

Easy, right? Cheap? Yes.

If the masses only understood the time bomb ticking inside of many ETF's, they would recognize them for what they are; order flow.

Now, I am more than confident that most who now embrace the "benefit" of ETF's have very little understanding of how they actually work.

But that’s for another note.

For now, let's focus on the article referenced above.

In that May 22nd piece, the Wall Street Journal revealed how the big hedge funds are more and more controlled by quantitative engineers seeking and exploiting stock market anomalies with lots of crazy, constantly adapting algorithmic models.

Dig a little deeper and you gain a sense of what is most likely happening. It’s all about order flow.

Think of it in the way that Facebook sells your activity to advertisers. Well, it seems Wall Street now makes a nice living selling order flow details – and the practices are almost identical.

Many big hedge funds look to buy that order flow "intelligence" from Wall Street firms to determine High Frequency Trading (HFT) order flows.

They then send all that data into programming processes which are far smarter than I am and get an "answer."

That answer then quickly helps the algorithm to decide if it wants to move into that flow, or not.

The seeds of this idea were planted years ago when the NYSE switched to decimal pricing. The sales pitch then is that it would "make things better for the public....."

Yeah, right.

What it did instead was squeeze bid/ask spreads, replace market makers and human specialists with computers, and began the channel flow of selling new and growing HFT data (order flow) to the hedge funds.

Selling order flow is now a big business (remember, soon it will look like "commissions are free").

As in the Facebook analogy above, if you think about the time you spend on the Internet each day sifting through popular website portals, going to your sites, your research, your shopping or whatever, know that we are all being tracked by an artificial intelligence algorithmic model that is being built from your personal searches and shopping patterns.

That’s the data the Google guys and Facebook guys and LinkedIn guys and all the others sell to advertisers.

The data itself then permits the advertiser or platform itself to make suggestions (or essentially an educated guess, based on patterns) on items or spots you might want to search, buy from, review, etc., etc.

In the same manner, artificial intelligence algorithmic models are watching you closely for your preference in buying and selling signals.

Back to Those Commissions....

The war on commissions seems innocent enough, right?

Come on guys.

The "commission war" on Wall Street attracts order flow. Think about it: Why on earth would ads for "500 free trades" be everywhere.

The small print tells you why - you gotta trade in the next 6 months, or about 4-5 times every trading day.

Not a great way to build wealth.

And the meat grinder reality is that some major brokerage firms have already admitted on CNBC that their firms would still make money if they did not charge commissions at all!

Why?

Because they make money by selling order flow data. And that is one of the big drivers for those who profess their love for ETF's.

In summary, the good news is that the financial markets are liquid and will do just fine a grand majority of the time as history has proven for decades.

There will be interruptions, there will be bad news (often), there will be bear markets, and there will be disasters.

It's been that way since the beginning of time.

And trying to run from it or miss it has proven far more costly than living through it.