Welcome to Trump’s World

The election dust is settling and a stunning set of events has unfolded since. I’ll look at these in more detail below.

But first there’s an interesting comparison to how much of the country felt towards President-Elect Ronald Reagan. There was a great deal of concern, layers of perceived risk, and the huge question as to how some guy from Hollywood could possibly run a country.

Reagan was spurned by his own Republican Party establishment when he ran for President because he was considered an outsider in many ways just like Trump.

But the people spoke then and now, and Republicans have captured majorities in Congress and state legislatures and represent the majority of governors as well.

Looking Back to Look Forward

The first 12 months were tough back then too; lots of chop, lots of anxiety and lots of second-guessing. I am nearly certain we can expect the same here - but that’s a good thing.

Either way the winner deserves our appreciation for the work that is required ahead. And there is a lot of work to be accomplished before the markets are ready to really begin acceleration into the new age we have been hinting at for months.

Let's Take a Stab at a Few Items

- We should expect quite a few speed bumps as the radically different economic and political consequences of Trump’s stunning victory come together.

- Like Reagan’s first 100 days, Trump is getting set to hit the ground running. Trump’s World is likely to be a brave new one in many ways. As the oft-referenced Dr Ed Yardeni comically points out: "It should be much more Reaganesque than the burlesque of the campaign season."

- Including the recent 60-Minutes interview, now that he is the President-elect Trump is already acting far more presidential. Yes, he is still tweeting but that may be a very effective way to tell his side of the story to counter the mostly anti-Trump mainstream media.

The New World:

Get a copy of the first 100-Days Plan here.

It’s entitled “Donald Trump’s Contract with the American Voter.”

In it he outlines three main areas of focus: Cleaning up Washington; Protecting American workers, and; Restoring the rule of law.

He also laid out his plan for working with Congress to introduce 10 pieces of legislation that would repeal Obamacare, construct a wall on the border with Mexico, boost infrastructure investment, rebuild the military, promote school choice, and more.

While almost no one expected Trump to win the Republican primaries or the presidential election, as well as confirming a Republican majority in both houses of Congress we should not underestimate his ability to fulfil his end of the deal: Trump intends to “Propose a constitutional amendment to impose term limits on all members of Congress.”

Keep a copy as a check list for the next four years:

- The Contract states that “More than two million criminal illegal immigrants” will be expelled from the US. That’s a big cut from the 11 million that Trump said would be deported during the campaign.

- On trade, NAFTA will be renegotiated, and China will be declared a “currency manipulator.”

- Payments to UN climate change programs will be used to fund water and infrastructure programs in the US instead.

- A $1 trillion infrastructure investment program over 10 years will be revenue-neutral.

- Childcare and eldercare expenses will be tax deductible.

- Repatriated earnings will be taxed at 10%.

Unified and Focused?

House Speaker Paul Ryan confirmed last Wednesday he would help lead a “Unified Republican government” with Donald Trump as President, promising Americans that the entire party can now work “hand in hand” to solve the country’s problems.

He also thanked Trump for pulling several House and Senate Republicans “Over the finish line” this election cycle to give the GOP control of the White House and both chambers. Ryan also said, “Donald Trump provided a lot of coattails.”

What a change a few weeks can make, huh?

Trump has single-handedly managed to bury the Bush and Clinton dynasties, and will soon do the same to the Obama legacy.

(Actually, the Obama legacy might very well be the Trump dynasty!)

Instead of triggering a widely predicted civil war in the Republican Party, Trump has recharged it while the Democratic Party has turned into a minority party at the federal and state levels, and is crippled by infighting.

The Big Surprise Waiting?

Experts en masse found their previous perspective of the future completely upended.

Weeks ago we were stuck in "stagflation fears" with rates that simply could not go up. Deflationary pressures were the concern of many. The US Fed was allegedly completely screwed.

As we stated just a week ago, "Whenever something becomes this obvious, well, it isn't."

Following Trump’s thumping victory on Tuesday, there was a significant overnight reversal of fortunes in the financial markets.

While I do think we should be prepared for choppy periods along the way (just like always), the Barbell Economy should be pushed even farther ahead given the latest data.

Last week’s developments might be just the start of unleashing new trends in the financial markets:

Bonds

The US Treasury 10-year bond yield jumped from 1.88% on Tuesday to 2.15% on Thursday. The spread between the nominal yield and the comparable 10-year TIPS yield implied that annual expected inflation over the next 10 years jumped from 1.73% on Tuesday to 1.88% on Thursday.

The bond market seems to be raising the odds of inflationary consequences. Given that the economy is arguably at full employment now, wages could rise if illegal immigrants are sent back home and the demand for labour is boosted by a federal infrastructure spending program.

Lower tax rates could also revive economic growth and inflation.

As a pushback, anything with a dividend and the word utility in its name got shellacked.

Look for value forming in those areas over the next few months - if not sooner.

Commodity Push?

Even before the election, we observed that the price of copper and base metals were remarkably subdued given the rebound in other commodity prices since the start of the year.

They were overdue for a jump, which is what copper did last week when it rose 10.9%.

On the other hand, OPEC and other oil exporters cannot stick to any agreement on production quotas which continues to weigh on the price of a barrel of crude.

It closed at $44.75 on Friday, the lowest since 10th August.

We have stated consistently for 18 months now: Expensive crude oil is unlikely to be a fear for us again for many, many years.

You can thank Generation Y for that too.

Small Gets a Boost?

Trump’s proposal to finally cut the corporate tax rate from 35% to 15% might have the biggest positive impact on smaller companies that don’t have as many ways to reduce their taxes as do large companies.

That could explain why the Russell 2000 SmallCap stock price index jumped 10.2% last week, far outpacing the 3.9% gain of the Russell 1000 LargeCap index.

The Bottom Line?

There is much more to cover in the coming days as more elements come into focus on many fronts.

But let's not get ahead of ourselves. After all, the eight years ahead don’t even start until January.

From the view at 50,000 feet in the first week, reactions from the financial markets suggest investors generally believe Trump’s economic policies will be much more stimulative than protectionist.

Protectionism would depress the global economy, which would be bearish for commodities and stocks and bullish for bonds.

The post-election vote in the financial markets is for tax cuts and less regulation, with a focus on making free trade fairer, which should be bullish for commodities and stocks but bearish for bonds.

We said much the same in the months leading up to the election.

Rates will rise, but oddly enough I suspect we’ll find we can all stand a 2.00% Fed Funds rate in the next 18 months. Markets are already approaching that level for them.

We may also all be pleased to find that Trump's tough talk during the campaign on an aggressive protectionist stance was more likely just setting the stage for negotiations.

The chatter over the weekend from Mexico on NAFTA talks could already be a sign it is bearing fruit for US workers.

Remember, if you are negotiating, you always start high to end up where you want to be.

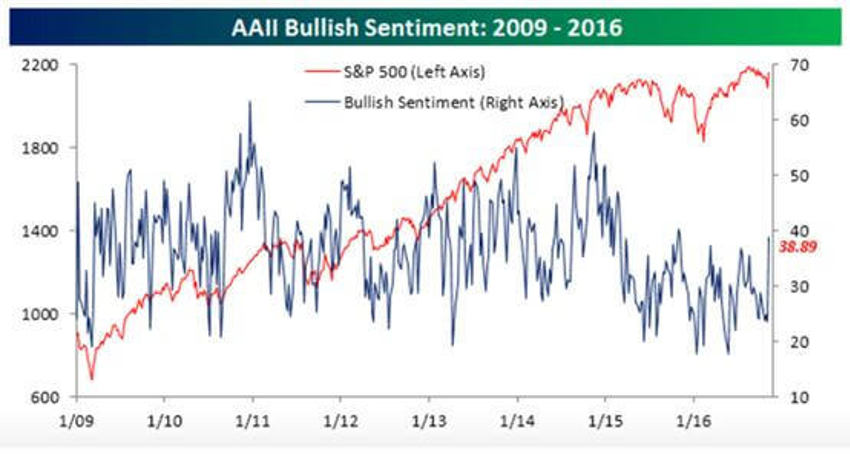

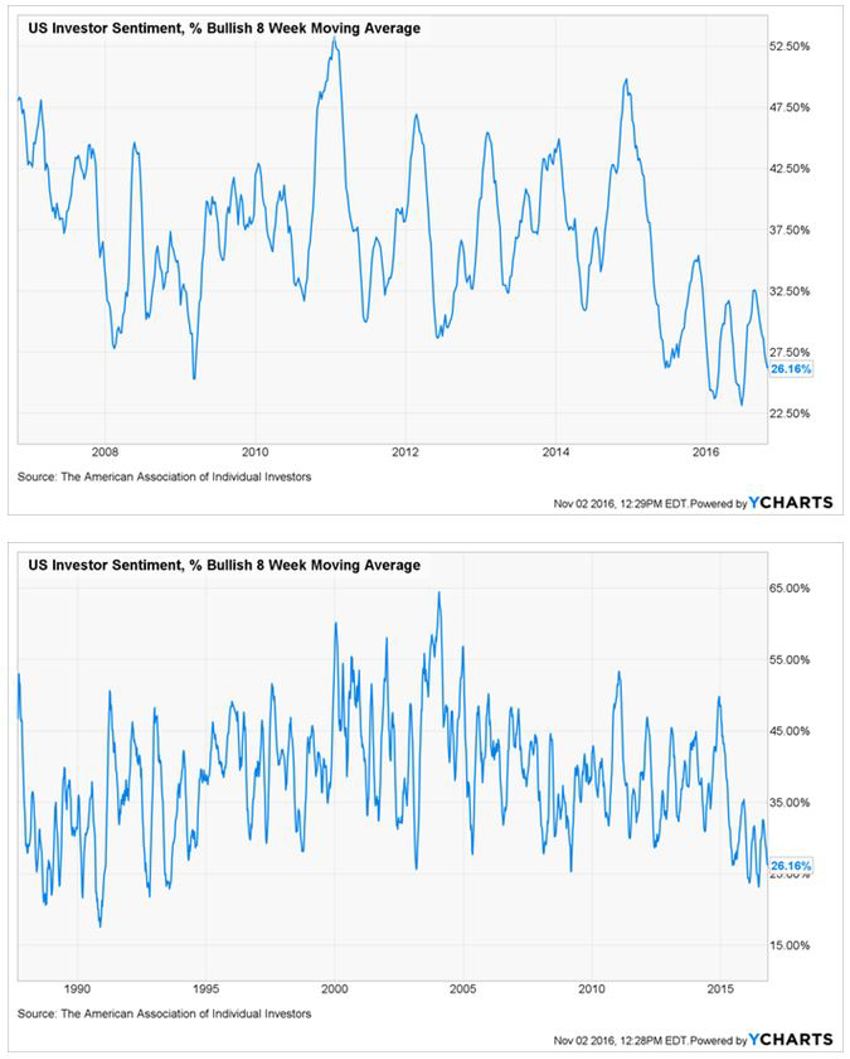

I have kept in a few charts from before the election to give you a sense of how dynamically wrong sentiment can be at times (below).

Note the eight-week moving average charts take months to shift. And look how long they have been sitting at the bottom of sentiment history even while we’re just points away from new all-time highs.