Watching Out for “What Isn’t Happening”

We’re just past the post on the end of Q3, 2017 and…crickets.

Sure, the problems seem to be endless. And if there weren’t such ample supplies of garbage in the headlines then I’m sure they would invent some.

But maybe we should be asking ourselves: "What isn't happening?"

Think about it. We have a host of risks to focus on – interest rate decisions from the US Federal Reserve, the record-breaking indexes, the possibility of a crash / recession, North Korea, Brexit, hurricane destruction, Washington DC problems, acrimonies political relationships, a President who still has access to Twitter – but the market is not selling off.

It’s certainly choppy, has internal churn, makes lots of noise and creates the often very expensive knee-jerk reactions over earnings seasons, but no real sell-off.

No correction either. Not even a mild one.

In fact, if you’re watching the breadcrumbs on this the trail looks crystal clear. The market is staying steady and the economy is continuing to expand.

The storms did not decimate the GDP, or even a region yet. And we are not being inundated with warnings of earnings misses due to those storms.

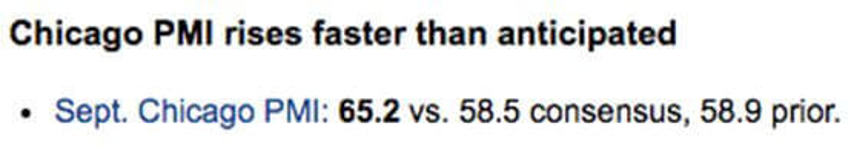

Heck, even the Chicago PMI just came out with huge numbers, well beyond estimates.

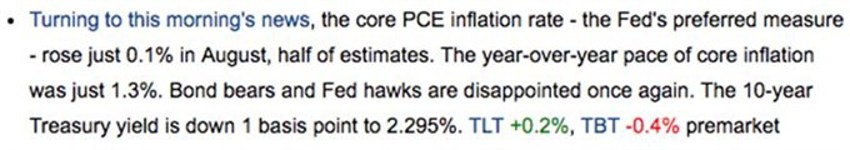

And inflation continues to not raise its ugly head either, even if that flusters those waiting for it for all the wrong reasons:

Vanished Again

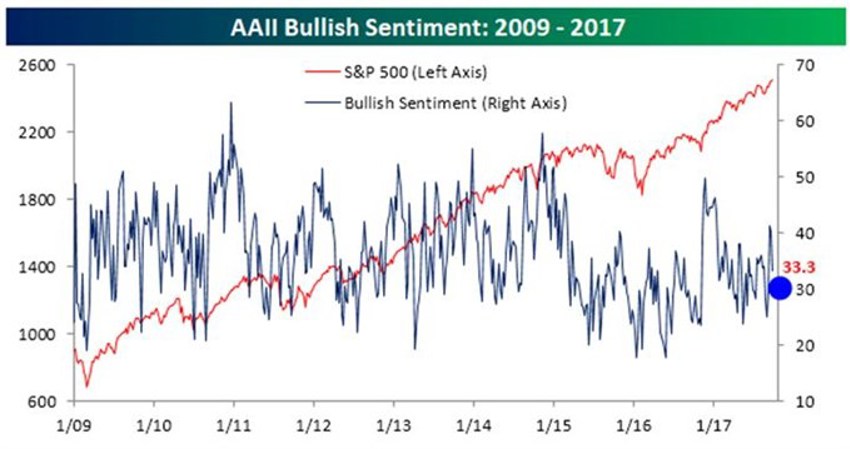

We noted the loss of bullish sentiment again even as the financial backdrop remains positive.

The contrarians of the world are still pinching themselves.

Note in the chart above how bullish the audience was back in 2011 and late 2014, far more so than they are today - at much lower prices.

Fear is the most expensive cost in market history.

In Summary

As we head into the beginning of Q4 pray for a correction.

It would only take a short space of time thereafter, and at the end of it no one would be bullish and the world would keep on ticking.

(Yawn.)

Remember, slow and steady still wins the race.