Wall Street’s Three Dirty Little Secrets

Many investors will assume the most important event on this week’s calendar is the meeting between Trump and China.

The media will drive this one into the ground. They’ll analyse every breath, syllable and body movement and focus on risks and mistakes; the new journalistic norm it seems.

But the big reality break at the end of the day here is that China needs the US far more than is readily apparent to most.

Corporate Earnings

As we kick off Q2, make sure to prepare yourself for the coming earnings parade. It’ll be here before you know it; complete with its calls of hits and misses, overreactions, knee-jerk impressions and short-term thinking haze.

And competing for your eyeballs and eardrums will be the ‘Sell in May’ crowd. They’re sure to have a heyday this year as markets tread water just below all-time highs.

Do as you must, folks. But we’ll stay focused on the long-term, and on the Barbell Economy investment process – where the Baby Boomers are handing over the economic reins to the Millennials of Generation Y.

To that end, several items this week are helpful in keeping that focus intact.

Dirty Little Secret #1

There’s a dirty little secret that’s rarely revealed on Wall Street.

The media, the hype, the fear and emotion, and the short-term thinking - alongside a constant effort to miss setbacks and try to time the markets - usually leads to a terribly discouraging result.

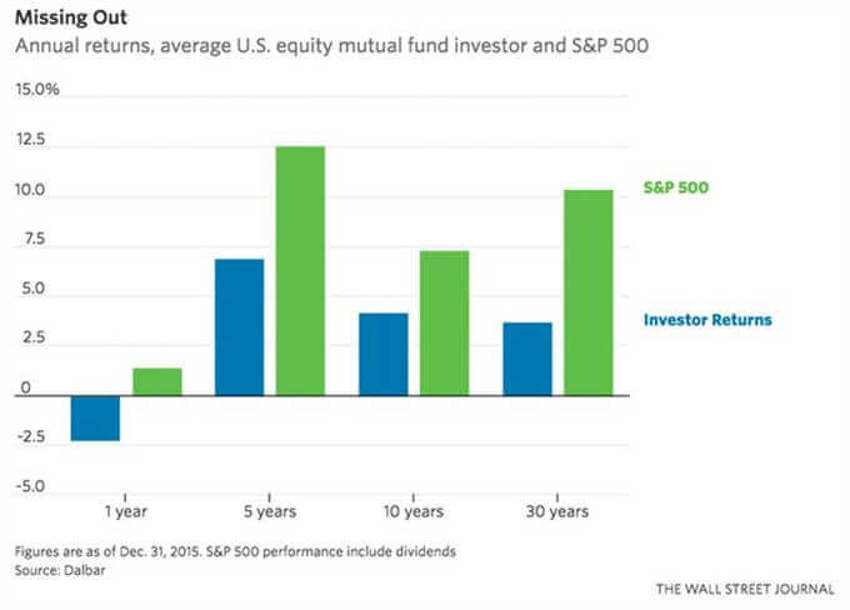

Let me share the following chart from DalBar with you and then explain what it means below:

The DalBar study (noted in the WSJ) has been a long running event.

When I started in this business back in 1982, I saw my first chart like this within the first 5 years. It was right after the panic of October 1987 had erased itself within just five months.

The sad news is that the results for this are consistent over the short-term and the long-term.

The average investor rarely sees results even remotely close to what the market actually delivers. As above, the percentage of market result the average investor receives over time runs between 31% and 35% of what is produced if you just sit there and stay invested for a long period of time.

But the problem is the ‘long-term’ part of the deal.

Time eventually heals the fear of volatility. Since the beginning of market measurements, investors have feared unpredictability. And their actions by way of response to it lead to the very same results they were afraid of in the first place.

Examples of thoughts or processes which create the very events we fear:

Thought: "I'll wait until the future looks clearer."

Reality: The future is never clear.

Thought: "The horizon is too cloudy to be safe."

Reality: The markets are always cloudy

Thought: "Sell ‘XYZ’ because it’s not working."

Reality: You’re selling low.

Thought: "Buy ‘ABC’ because it’s working"

Reality: You’re buying high.

Thought: "It’s never been this bad."

Reality: Every panic brings this feeling, as will every panic in the future.

Dirty Little Secret #2

Left to their own devices, far more often than not investors systematically underperform their own investments by acting emotionally, over-trading and making poor timing decisions.

All of these actions reflect and trigger our emotional responses and our fears of a bad outcome. And then they try to navigate volatility, always looking for ways to miss it.

But you cannot accomplish this feat over time. And if you’ve been taught that you can then you’re better off ridding your mind of that as fast as you can.

Dirty Little Secret #3

The further problem here is that brokerages often don’t care if you believe this and act on it. In fact, some of them actively encourage that sort off behaviour given the fact that they get paid on the trading you do, and not the sitting.

Why else would the ads say "500 free trades" with the fine print suggesting that offer only applies to the first 90-days.

How can you action five hundred free trades in 90 days and think for even a second that you’re going to make any money?

But here’s the light at the end of the multi-decade tunnel that seems to plunder the results for most:

The effort to avoid near-term volatility is the monster that crushes long-term returns.

Yes, I know, - it does seem very counterintuitive. But here is the flip-side of that statement:

Volatility is not your enemy because it causes fluctuations. Volatility is your enemy because it drives emotions and bad decisions.

Look, there will always be gaps between the performance available from measured indices and the performance an individual receives.

But that is driven by things like taxes, some fees, trading costs and the ever-present cash emergencies that will come up from time to time.

It’s the minimizing of the emotionally-driven on-going detractors from long-term returns that form the bedrock of a solid financial planning framework.

That is why we constantly focus on the long-term horizon - where your future lies.

All serious financial advisors strive hard to undertake this effort for clients.

The Bottom Line?

Effective financial planning strives to accomplish this for clients: Help them capture more of the results their investments offer over time.

This is extremely worthwhile, as the chart above shows.

The toughest part is in teaching investors to focus their attention on avoiding drawdowns and learning to tolerate volatility in order to profit from it over time.