Time Controls Risk, Everything Else is Marketing

"The human element in the investment game is unchanged throughout history....it remains fundamentally elusive to those who would seek to quantify it or predict its next bout of caprice."

– Jeremy Grantham

Jeremy Grantham has been around for a long, long time, and his firm (GMO) manages billions and billions of client dollars.

What he writes normally receives a great deal of coverage – his copy is intriguing, enlightening, clear and sharp as a tack.

And it’s the norm as regards his future market projections that they arrive as quite ominous.

As this year began Grantham warned "a horrendous bear market was in the offing."

His further comments are below:

"It suggests to me that I have in general been over-intellectualizing the working of the market for a few decades. I have had too strong a belief that investors would at least be influenced by past data in a sensible way. The market, however, appears not to care at all about the past or to learn much from it. This model for sure seems to say that for 92 years, at least, the market has with remarkable consistency been a coincident indicator of superficially appealing variables that in a strict economic sense have been inappropriate, and that have caused spectacular and unnecessary market volatility. The model is apparently a reflection of human nature and, of all factors influencing the market, human nature, as economically inefficient and unsophisticated it may be, seems the least likely to change."

The lesson?

The view from one very experienced guy is that there’s no palm reading and no crystal ball, and no unique choice to be made to eliminate risk.

Time is the controller of risk. Everything else is marketing.

Simple, right?

Not really.

Here’s Another Take On It...

I’ve often said that any market chart, whether it’s showing an index, sector or stock is much like an EEG - an emotional summation of all feelings.

It’s not the rational understanding of all known economic data as the efficient market theory portrays in school.

Not at all.

Why else would the same stock sell for 14 times earnings at certain periods and then, for example, 70 times at others?

Same stock, same business, right?

The difference?

The emotional perception of value.

Per·cep·tion: "a way of regarding, understanding, or interpreting something; a mental impression"

Risk is a moving target. It always has been and always will be.

And your emotions tend to trample your brain in its presence.

The human element of investing has been this way since the beginning of time. Warren Buffett said recently that "if we absolutely knew interest rates would stay at 2.00% forever, then stocks would be priced at much higher levels. The Dow would be 100,000."

The Premium for Risk?

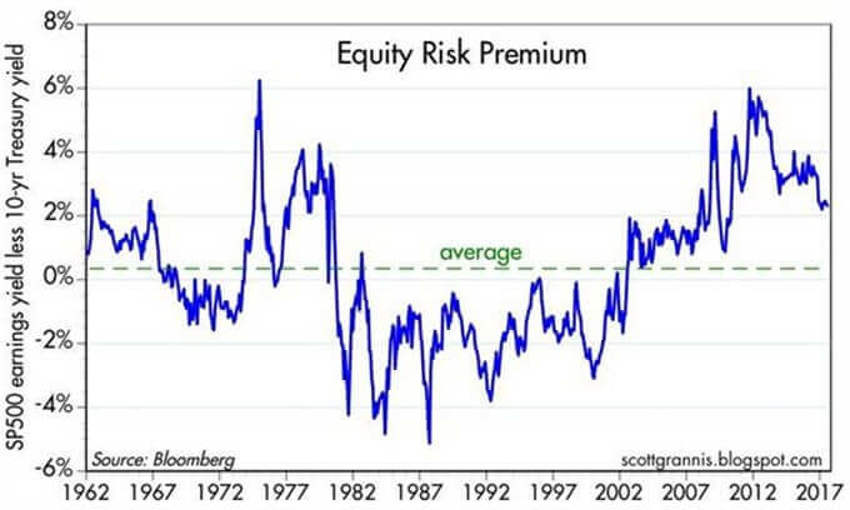

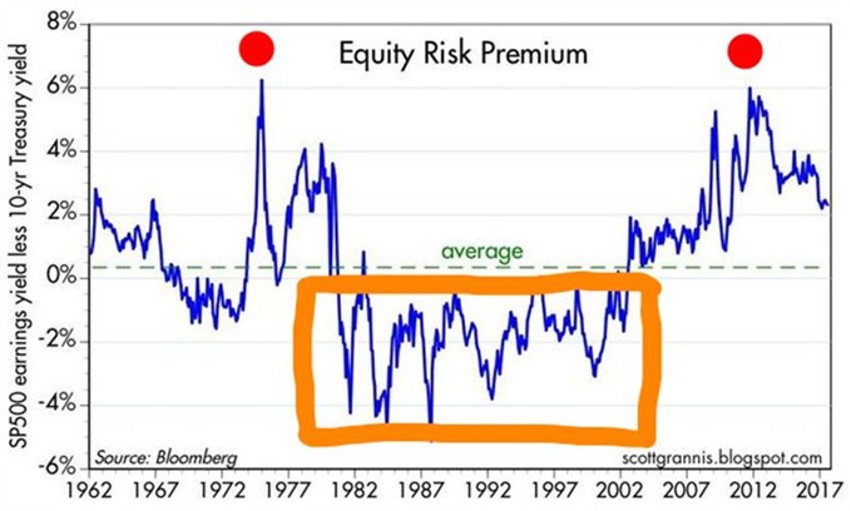

Check out the "risk premium" chart below that denotes earnings levels as a rate of return on the price of the S&P 500, just as you would earn interest on a 10-year treasury.

The "difference" between the two is called the risk premium – it’s the "extra" amount you are being paid to take on the risk of stocks.

Now, as I’ve just said, you take on risk no matter what you invest in.

It’s your perception of risk that changes.

Note the orange box (the charts are the same – a big thanks to Scott Grannis at the Calafia Beach Pundit for them).

Basically, from about 1980 until about 2002, you got paid less to own stocks than bonds.

An entire secular bull market covering almost two decades unfolded - which included two bear market periods (maybe three depending on your definition) – and all the while the risk premium was below zero!

My point is that the perception of stocks being overpriced to bonds simply holds no water in historical terms.

Now, back to Jeremy's point…

Humans are the drivers of markets. Their movement, their actions, their habits, their needs, their stages of life; they all drive the markets and the economy.

Sure, that can be very tough to grasp sometimes because it takes us to a scary place:

- We want to "know" exactly what causes something.

- We want to "know" why things happen.

An entire media industry has been built because we demand a reason for things.

But those reasons only ever seem to become clear afterwards, right?

Not before.

So, why then do we need a reason if it doesn’t help us to know what’s going to happen next?

Maybe that’s because floating on the winds of time is considered a terrible thing.

Just like demanding patience of ourselves in the wealth-building arena - and then forsaking the emotional pitfalls and knee-jerk reactions for the required discipline over time - is a very, very uncomfortable feeling.

But you have to get comfortable with it, because time is your risk defining vehicle (not guessing highs and lows), and people and behaviours are your roadmap.

Mathematical formulas based on historical norms will always have to adapt to the new normal; itself defined by the EEG reference above.

It will only take us so far in our understanding of the markets.