This Is Your Brain on Investing

You know that feeling...the sweaty palms, light-headed, like you’re on top of the roller-coaster right before you drop off a cliff.

(Or maybe had one too many of those summer cocktails with the coloured umbrella drinks.)

It’s the feeling that floods into your mind during moments like, "Oh My Gosh, the market did what?”

This is usually followed quickly by "I wonder if these office windows open up?"

Those “fight or flight” thoughts just seem to be able to flush everything out of your logical thinking system.

And it happens quickly, sometimes in just seconds, allowing you no real time to reflect before your heart-beat has increased by something north of 100%.

That, my friends, is your brain on investing.

The Change Formula

History shows us that successful investors, over time, have figured out how to change the message that these types of events send to their brains.

In fact, the most successful of these people have found a way to create nearly the exact opposite response to this type of stimuli.

In the vast sea of investors of all shapes and sizes, when trouble hits (as it always will), some twitch, some gasp, some reach for their inhaler, some instantly hit their sell buttons, some pick up the red phone and flush it all with their brokers…and some even call their advisors and scream something about being prudent, risk management and then "get me the f*** out of the markets right now."

And some don’t.

Bu the there’s a simple question you need to ask yourself to kick of the change formula and create better investor reactions to these types of events – the kind successful investors have come to control.

You need to ask yourself: “Am I an investor or a trader?”

These two perspectives are very different monsters indeed, the psychological makeup of which would take lots of pages to explain.

Traders who call themselves investors will sit still just until the news gets too hyper and the market movements become somewhat volatile.

These days, volatile could be a "Dow Jones down movement of over 200 points on the open" headline - which means less than 1%.

But those 200 points seem like a much bigger problem, right?

The investor will go into the summer haze looking for the opportunity to take advantage of historically poor reactions. In fact, their plan will have effectively positioned them so that capital at risk in the markets can afford to be at risk in the markets.

That’s because their short-term cash needs, on-going income generators and family protection have been handled via other effective tools.

Investors are in it for the long-term.

And these two perspectives offer a vast difference on how you feel about the all-too-dreaded "summer market swoon" that is right on our doorsteps…yet again.

A Pause?

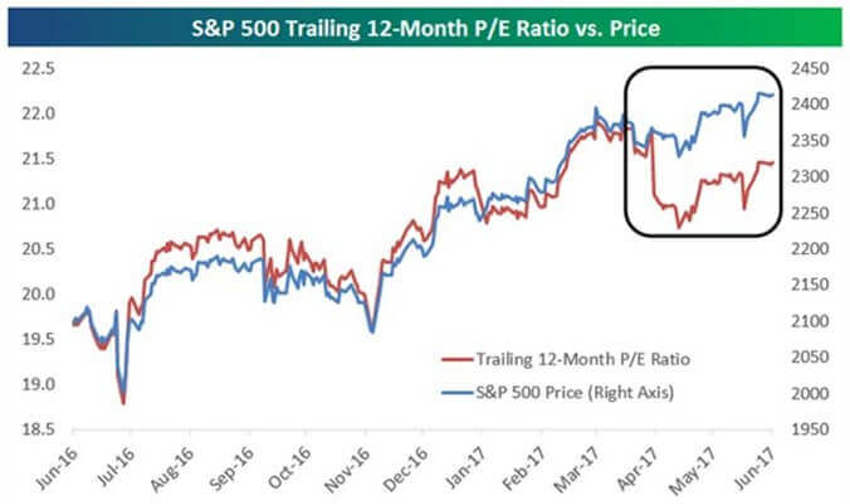

I thought you might enjoy this little snippet on price earning (P/E) ratios, a topic many of the bears like to pounce on when prices are at highs.

Granted it is just a 12-month snapshot but it is still interesting.

The chart below shows the S&P 500's price versus its trailing 12-month P/E ratio.

Note that up until the March 1st high, the S&P's P/E ratio was trending right along with it. It is interesting that since then, a P/E contraction has unfolded (black box) - even as price has gone on to make a new high.

The lesson? Well, maybe it’s more like just a good piece of information to tuck away in the back of your mind.

Earnings growth has outpaced price over the last couple of months while everyone chose instead to focus on politics. That's a good thing, particularly for anyone worried about valuations.

Remember, group think may feel good. It may even give you a sense of not being alone in the world. But history tells it more clearly in real quantifiable terms: "Group think" is a crappy way to guide your wealth building plans over time.”

Fund Flows

The exodus from managed equity funds into ETF and the "passive" game continues.

Remember what I have always said - movement of money is required to punch your ticket on Wall Street.

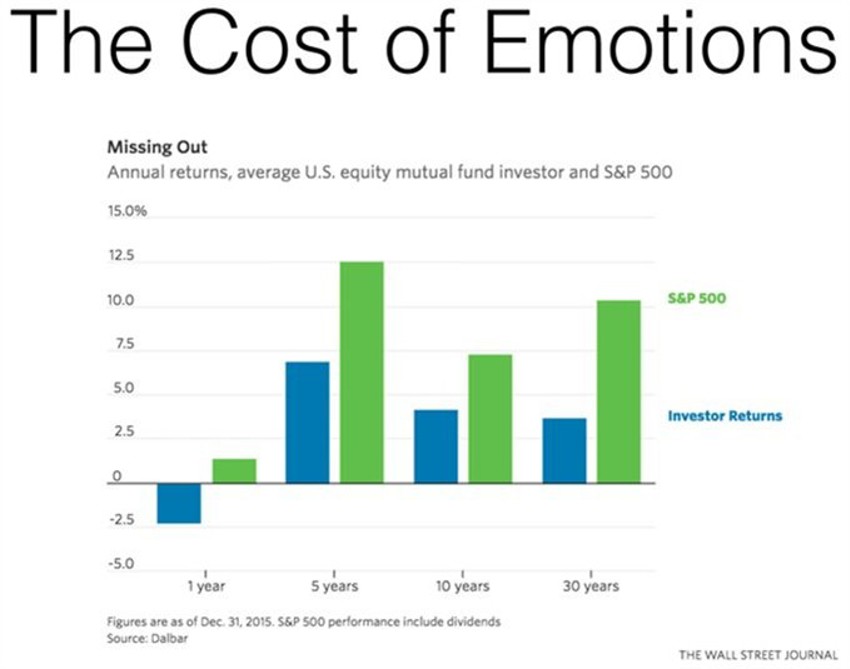

If we were all patient and let things unfold, history says it would work out better for us, as the Dalbar chart below shows.

However, the good news for the patient investor with a long-term focus is this: It does not look like there is any risk ahead of the market becoming overwhelmed by patient, long-term investors.

Dr Ed Yardeni updates the flow numbers over the past 12 months:

"The net fund flows into US equity ETFs certainly confirms that a melt-up might be underway. Over the past 12 months through April, a record $314.8 billion has poured into these funds. That was led by funds that invest only in US equities, with net inflows of $236.4 billion, while US-based ETFs that invest in equities around the world attracted $78.4 billion in net new money over the 12 months through April.

“Over the past 12 months through April, net outflows from all US-based equity mutual funds totalled $155.3 billion, with $163.7 billion coming out of US mutual funds that invest just in the US and $8.4 billion going into those that invest worldwide.

“So the net inflows into all US-based equity mutual and indexed funds totalled $159.4 billion over the past 12 months, $72.7 billion going into domestic funds and $86.7 billion into global ones."

My added thoughts are these: These are relatively small totals in the grand scheme of things, buybacks have spent more, and stocks available to buy are shrinking; which also helps the "melt-up process" over time.

The shift from actively managed funds to passive index funds is significant and could be contributing to the skewed melt-up of the FAANG group.

That’s especially likely since money is pouring into S&P 500 index funds, which are market-cap weighted and helps to explain why Large Cap stocks are outperforming.

Make no mistake - there will be a day when the masses will scratch their heads collectively and wonder aloud, "we did all these ETF things for what?"

Speaking of Robots

For one thing, we’d better bring them into the system faster than is currently happening.

Instead of fearing robots, remember they will take lower-skilled jobs and permit others who are replaced to learn more and move up the skills ladder. Think of it like when computers first hit the scene and we were told the job of the secretary was finished and we would never need paper again.

Sure....

Now, while may cause you to cringe, don't get too carried away by the "weakness" in May’s payrolls.

The Friday report showed they were up just 138,000, and the previous two months were revised down by 66,000 in total. Private-sector payrolls are up only 126,300 per month on average from March through May.

Yet over this same period, the ADP measure of private-sector payrolls is up 227,300 per month on average - and remember that their software actually writes all the paycheques and reports to the tax people.

Which data stream do you think is more productive?

And don't overlook that private-sector wages and salaries / personal income, rose 0.3% m/m during May to a new record high! It’s up solidly by 4.3% y/y, auguring well for consumer spending.

So, on second thought, bring on the robots and the summer swoon.

The Bottom Line

Ignore Politics - Focus on People.

Slowdowns and hiccups in the "monthly data" are dead ahead because everyone will be at the beach and spending time with kids....something I promise to do this year.

Expect it instead of fearing it.

Just take a look at every other summer swoon in history. They were all at lower prices than where we are now.

The dreaded summer haze will roll in slowly, and hidden in the chatter, hype and angst opportunities will arise.