There Are No Short Sellers on the Long-Term Rich List

Sometimes taking a break from stats and figures pays dividends, particularly when it involves absorbing some old school advice from arguably the greatest investor in history, Warren Buffett.

I’ve included a few excerpts from Warren’s recent NYC event celebrating the 100th anniversary of Forbes magazine. He happens to be on the cover, at age 87, in an issue that features 100 of the world's greatest living "business minds."

And it’s interesting (and very telling) to hear how the current waves of uncertainty coming from all corners of the globe have not dampened the Sage of Omaha’s optimism.

In fact, he went way out on a limb by projecting a century forward - based on the last 100 years – about America’s positive prospects over the long term, even after all the near-term concerns.

Mr Buffett said:

"Whenever I hear people talk pessimistically about this country, I think they're out of their mind" and that he “expects the Dow Jones Industrial Average to be over 1 million in 100 years."

(And you thought we were being too optimistic!)

Now, a prediction of Dow Jones 1,000,000 is quite a jump from Tuesday's close of 22,370.80, but the the Coca Cola swilling multi-billionaire octogenarian thinks "it's not unreasonable, given the index was roughly 81 a century ago."

Simple maths, eh?

Only One Way to Wealth

Mr Buffett, while mysteriously continuing to plug index trackers for the masses remains devout on patience and discipline as the key to wealth, suggesting that "long-term investing remains the way to go."

And I especially liked the point that he made about the Forbes 400, where he that since Forbes created its first list of the 400 richest Americans in 1982 (Buffett was worth just $250 million then), some 1,500 different people have been on and off the list.

All with one thing in common.

"You don't see any short sellers." said Warren.

"It’s been 241 years since Thomas Jefferson wrote the Declaration of Independence. Being short America has been a loser's game. I predict to you it will continue to be a loser's game."

Speaking of Slow and Steady

Now, one last little item for the day.

Obviously, strong economic data is a positive for the US economy.

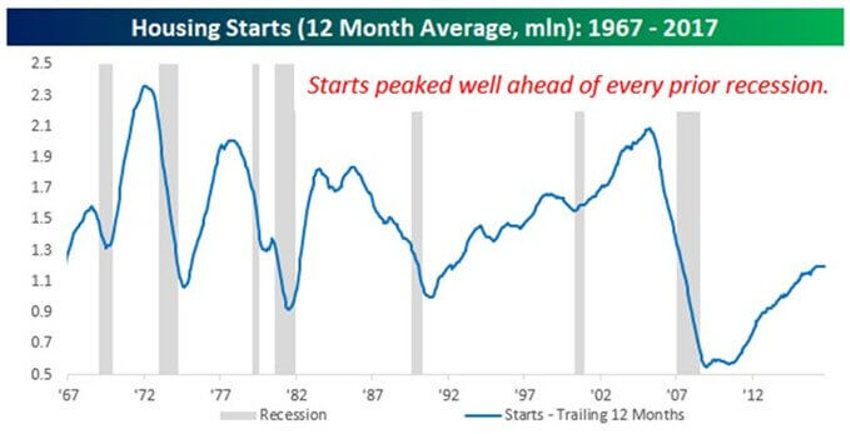

Note in the chart above however, how housing data and the economic cycle have interacted with each other over time.

The chart shows historical levels of Housing Starts (on a 12-month average basis) going back to 1967 with economic recessions shaded in grey.

For me a couple things stand out.

First, even after more than eight years of recovery, current levels of Housing Starts are closer to levels seen at the depth of recessions rather than late in an economic cycle.

The second is that ahead of every prior recession since 1967, Housing Starts peaked and began to roll over well in advance of the economy's peak.

In Summary

The global economy is changing faster than most can perceive at this stage.

And don't look for that pace to slow anytime soon.

Even during a correction - which is sure to come - that pace of change is set to continue. I suggest we all become more accustom to letting go of "what things were like before."

The US looks set for surprisingly steady growth ahead with stunning opportunities to unfold for the patient, long-term investor.

Remember that when the annual October crash remarks begin next month, and the strong economic data and steady earnings growth we’re seeing all around us.