There Are No Clear Futures, Only Perspectives…

“You will find only what you bring in.”

– Yoda

Markets, investing, and planning are unruly beasts.

Done improperly, they merely reflect what investors already feel and what is already in their thoughts.

And if they feel constrained, concerned worried, or weak about the future then that is what they tend to see when peering into the maze.

Thus, the Yoda quote above.

That’s the way it’s worked since the beginning of markets. There is always a buyer and a seller. Both see the future differently, otherwise they likely wouldn’t be at the bargaining table.

Just keep in mind that there is no such thing as a clear future, only perspective.

So, the next time you hear something like "I’ll invest when the future is clearer” or "Once we get a few more data points, we’ll know what’s going to happen next," you’ll know the fantasists are holding the microphone.

We only have control over our own emotions, reactions, planning and discipline.

Exit the Haze

The summer haze is clearing away, yet you’d think Armageddon was upon us after 5 minutes of listening to anything on financial channels.

In reality, very little has changed since we began to travel down the rabbit hole of Summer 2019.

There’s lots of chop, plenty of points covered, and all sorts of stress layered into the minds of those listening.

But there’s been little headway made in terms of price - good or bad.

And all of this is great if you’re a long-term investor.

- The Daily High in Price of the S&P 500 June 20 - after the bounce back from the May Panic: 2,958.00.

- The Closing Price on Monday after the summer haze and panics of 2019: 2,978.43.

- The Change in Price? Roughly 2/3's of 1 percent.

And yet…

The crowd is nervous again. Capital has vacated stocks by the tens of billions. Hundreds of billions have flooded into bonds. And all the while GDP has been positive, earnings have been up, and cash is seemingly everywhere.

And yet…

So, let’s pray for a continuation of the "sluggish" 1.5% - 2.0% growth curve.

Not too fast, not too slow is almost perfect for those focused on the steadily rising tide ahead.

The Facts

- Generation Y is the most powerful force to ever hit our economy.

- Baby Boomers created more wealth than any generation in history.

- That wealth will drive changes we cannot even fathom at this stage.

- There is no money heaven.

Sure, Gen Y waited a little longer to do some things…because they were going to school instead.

But late is not never. And in this sense, massive demand in many areas seen as "dormant" are most assuredly headed our way.

And when it does the patient and disciplined will be in a position to capture these gains as the new decade ahead is set to be like the 1980s, but on steroids.

The Headlines Ahead

Slowly but surely - only after prices have risen substantially - the headlines you are reading will shift.

They did the same in the 1980s and 1990s as the Baby Boomer freight train rolled through the US economy.

And they will again in the 2020s and 2030s ahead as Generation Y - with the Boomers' money in tow - changes the entire landscape.

Things will get better, faster, clearer, cleaner everywhere.

And what doesn’t adapt to those changes will get eaten alive.

We must rise to the 50,000-foot level to gain a clearer sense of this massive shift on all fronts. From interest rates to company operations - our rendition of what we refer to as "normal" will change...and not just by a little.

For now, let's just read 'em and reap:

The chart above could explain the appearance of "slowing jobs growth,” as we are indeed running out of people to fill job openings in the US.

In fact, there are nearly 2MM more jobs open than there are people to fill them.

And yet we complain and live in fear?

That’s nuts.

Back to the point: Let’s get those robots here - and fast. Some of the stress will end as our now "bursting at the seams" college kids will be graduating soon to lots of job offers.

Hence, when you hear the negative chatter about "slowing jobs" take it with a boatload of salt:

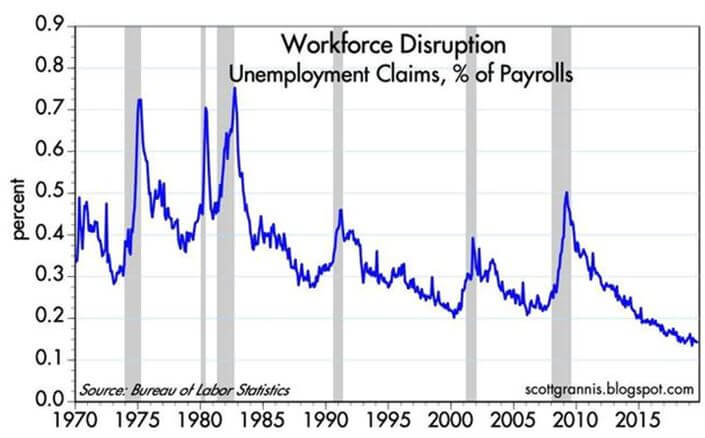

The chart above gives you another perspective of just how solid the jobs market really is in the US today, even as other parts of the world feel their collective demographic pressures.

It goes all the way back to 1970.

Unemployment claims as a percentage of the workforce provide a clearer view of the powerful underpinnings in the consumer market for the US.

Folks, don't fear robots. Welcome them, embrace them; their creation helps all those employed to rise further up, not down.

And by the way - a message to all the Baby Boomers: Tell your kids to have kids : )