The World of Uncertainty

Yep, this is one of those times when that feeling in your gut starts to get heavy – like standing way out over your skis before you plunge down a sheer snowy mountain face.

I call it altitude sickness, and it happens when the markets keep ticking up through one new high after another.

And what I repeat about these events time and time again is to pray for a correction.

Now, we have covered off on sentiment, earnings and PMI data. The new highs continue to be drowned out by more pressing issues, apparently (hey, who made what phone call and when? Seriously?).

Do investors really think there is a single company operating today, which is attempting to build long-term value that will suddenly begin to function differently because someone may have called the Russians early?

Uncertainty is a Constant

As long-term investors there are several very uneasy thoughts (facts) we must accept over time.

- The world is always based on uncertainty

- Nothing is assured when investing - ever

- The future is always "cloudy"

- Projection is a fancy term for guessing (educated one hopes, but guessing nonetheless)

And what makes these rather disquieting facts (above) seem more reasonable is that they have existed in the investing world since data began being kept.

It has always been this way in the process of building wealth over time.

And fear has always been expensive.

Back to the Real-time Data

I'd like to step back in time to about a year ago today – February 2016.

While many may have already forgotten this, it was just about then that we completed the WORST start to a year in the markets in eight decades.

Not a single human cared about who was making phone calls to Russia.

But here’s what they did care about:

- Cheap oil was the end of the world

- Oil was the new real estate

- The bankruptcy process coming in the oil world was going to take down the entire global economy

- Deflation was assured and no one doubted it

- Stocks were not going to recover anytime soon with the debt bomb in oil credits ready to explode

As oil dove below $30 a barrel, the media noise became deafening; the risk of a deflationary spiral became all the rage in the headlines.

What we wrote out to everyone was this:

"Patience will rule here as always. The more important thing you need to be aware of as an investors is this: with the entire world now locked in mortal fear of a deflationary end to life as we know it, expect inflation instead as the data pressures recede over the coming few quarters."

And now, here we are; thousands of points higher, with inflationary chatter building upwards ever so slowly and a new President in tow.

On Its Head?

What may be even more disconcerting for some is that we may be on the verge of a market that welcomes a rate hike with a rally afterward.

Yep, I did just type that; the market may be ready to embrace a rate hike as a sign that even more stability has returned.

Remember folks to think of low interest rates as a leftover indicator of deep-seeded fear and the demand for money.

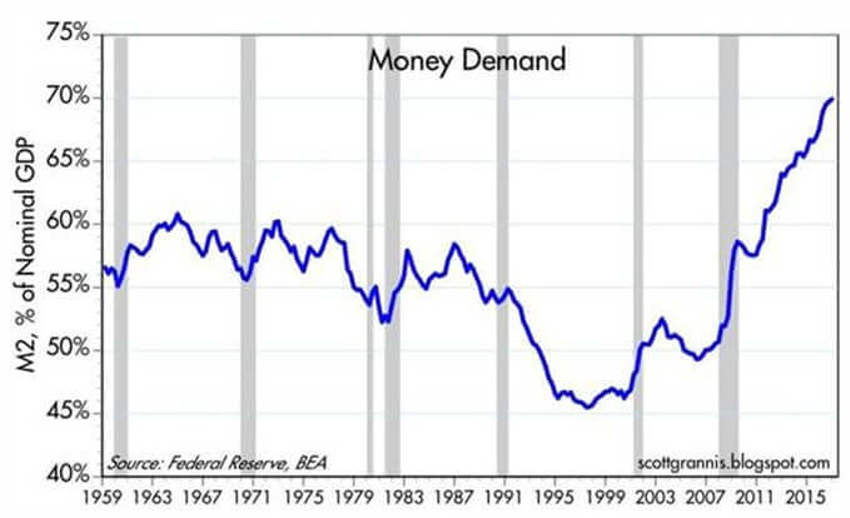

I’ve used the chart below before in order to illuminate a record demand for cash (which is likely why there is still over $9 Trillion of it sitting in bank accounts):

As rates rise due to better data and growth prospects, you would expect the demand for cash to fall.

We’ll keep you updated on that.

In the meantime, there has been a real sea change in the sentiment of small business.

As Dr Ed Yardeni highlights for us in a few great charts below, too many people often overlook just how much small and medium sized businesses drive America’s economy.

So let's review a little bit from the most recent surveys:

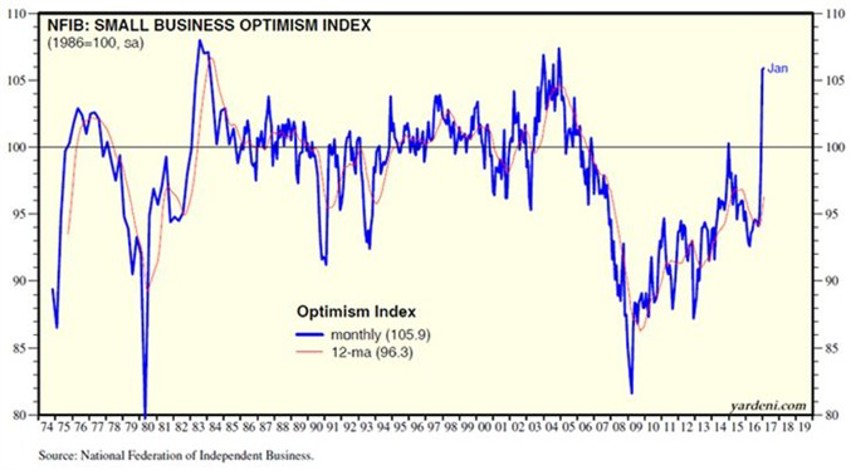

There has been a near vertical ascent in the Small Business Optimism Index over the past three months since the election.

The index (National Federation of Independent Business - NFIB), ramped up quickly after the election, surging from 94.9 during October to 105.9 during January.

Note this is the highest reading since December 2004.

Now let your mind wander back to the early 1980s to see how the 11-point rocket-shot looks oddly similar to the leap higher during 1980, when business owners started to anticipate that Ronald Reagan might beat Jimmy Carter in that year’s November presidential election.

You can see another similar increase during 1982 and 1983, when then Fed Chairman Volcker began to lower interest rates to revive the economy from a severe recession and a bitter effort to quell inflation at the time.

Odd that we now hope for the return of inflation, right?

Small is Big

So why is their confidence such an important element to be aware of?

Well, too many folks focus on the big jobs number at the start of each month.

What you really want to watch is what the small companies do.

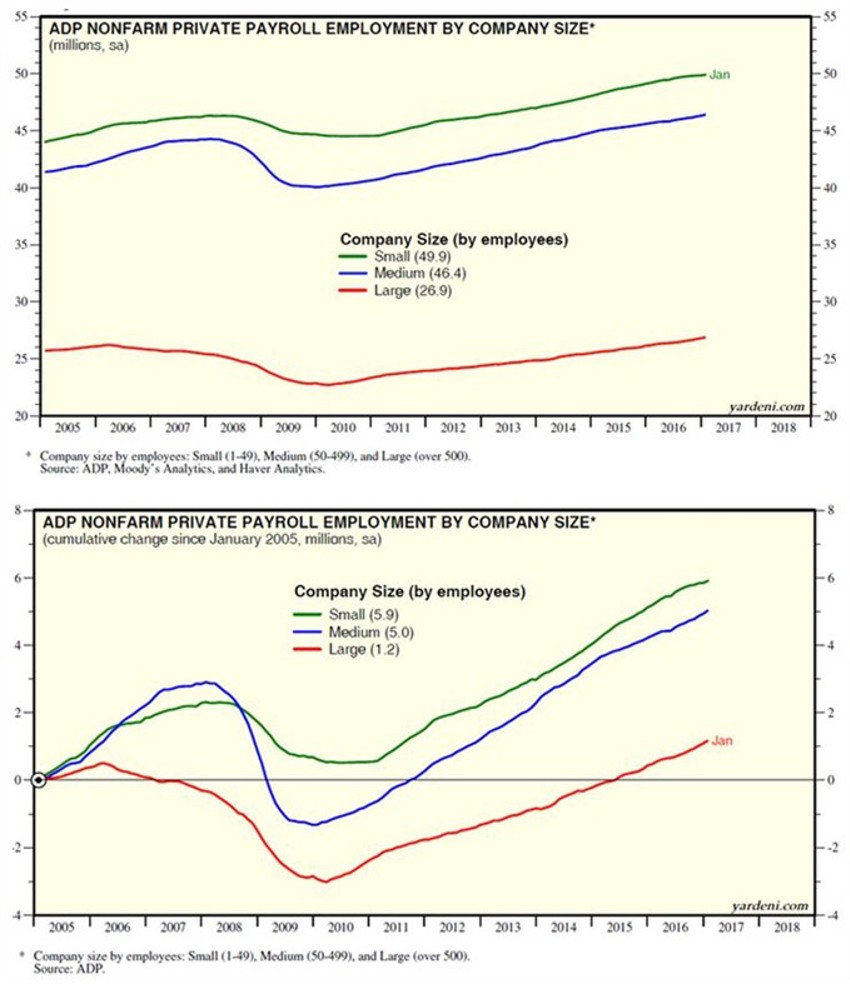

That’s because small businesses are a big part of our economy. In the chart below you will note they employ about 49.9 million workers, accounting for 40.5% of private-sector payrolls, according to data compiled by ADP.

Dr Ed also reminds us that since the start of the data during January 2005, small business payrolls have increased by 5.9 million, beating the gains driven by medium-sized (5.0) and large (1.2) companies over the same period.

NFIB’s internal chief economist noted that the very positive expectations seen in the data have already begun translating into hiring and spending in the small business sector.

Job openings have climbed to their highest readings since 2006.

Small businesses’ capital-spending plans dipped slightly last month, but are still close to the highest readings of the recovery.

And to top that off, small businesses who are saying now is a good time to expand has shot up from 9% in October to 25% in January; the highest reading since the end of 2004

The New Problem?

First of all, the new problem we’re now facing is a good problem to have.

The NFIB survey includes a question on the most important problem faced by small businesses. We have noted for the better part of the last four years that taxes and government regulation have been alternating between first and second place on the “concerns” list.

Obviously, the small business world loves that Trump has pledged to lower both of these things.

Now all he has to do is deliver on that promise.

During January though, nearly 30% of respondents stated they have job openings that they aren’t able to fill right now. To give you a sense of what is building in America’s long-lasting pipeline of demand, that is the highest reading since February 2001.

It continues to suggest that the economy is nearing full employment, and hints that further news down the road could show inflationary pressure building to compete for jobs.

All those kids going through college are going to be sorely needed. So let's embrace it, not fear it.

Back to That "World of Uncertainty..."

Something many may not recognize is that we have spent the better part of the last decade shrinking our thinking.

We have shrunk our expectations, our view of the world, the definition of opportunity, our exposures to risk, our money being invested and our view of what's coming at us.

And after a while that mindset, coupled with fear, can be a dangerous blinder.

We have FedEx'd our economy and keep very low supplies on hand anywhere.

It’s really, really tough to get a recession rolling in when there’s little supply of anything extra.

The Millennials Cometh

The one thing we most folks do not think about is that giant egg about to start running into our economic system called: Generation Y.

We have a hunch that the reason we are starting to see a lot of data looking like the early 1980s again is because we have almost the same demographic picture unfolding in front of us as we speak.

And while we don’t expect a straight line up the chart, those movements along the way offer opportunities for long-term investors.

Think demographics, not economics.

We are in much better shape than many realise. And the good news on the long-term investor front is that if you scratch the surface just a tiny bit, you’ll quickly find fear of risk just beneath the surface.

If you need proof, just watch what a two week stock correction does to a crowd of investors as afraid as they were back in March of 2009.

Until we see you again, may your journey be grand and your legacy significant.