The Wizard Behind the Curtain

Markets continue to churn through earnings as the annual August doldrums lie dead ahead.

That feeling of walking in quicksand may be with us for the next several weeks as the summer ebbs into history.

We just keep hoping that the market swoon is out there somewhere!

On that note, Goldman Sachs sent out a pretty interesting piece that hit all the major headlines and likely even convinced a large swathe of investors that they knew something others did not.

But it all sounds kind of like the namesake character in The Wizard of Oz; the reality is always quite bit different than the mirage. Here’s an excerpt from their report:

"Our risk appetite indicator is near neutral levels and its positive momentum has faded, suggesting positioning will give less support and we will need better macro fundamentals or stimulus to keep the risk rally going, but market expectations are already dovish and growth pick-up should take time.

“As a result, we downgrade equities tactically to Underweight over 3 months, but remain Neutral over 12 months. We remain Overweight cash and would look for resets lower in equities to add positions."

Seriously? An entire Special Report to say: "Folks, stocks may or may not go down over the next few months. And if they do then buy some."

I’m speechless.

And what’s a "risk appetite indicator"? Is that a real thing or something cooked up by marketing?

First of all, try reading that again and tell me this: What on earth are they trying to say that is of any value whatsoever?

It’s the same old marketing potion: Talk down to the reader, mix in a few vague and important-sounding comments, sprinkle in a bit of concern and angst and then tell them if they stick with you, then you’ll get them to the other side of this make-believe valley.

So is it any wonder that the public investor audience is turning its back on traditional Wall Street?

It's August and Earnings Are Improving

While prices stay mushy above breakout levels and the earnings data continues to pour in the results are slowly arriving as better than expected.

Yes, when all is totalled up we’ll still see a mild negative earnings year-over-year growth rate. But that rate of decline is falling quickly and it’s still carrying the headwind of energy.

Without the latter, earnings are up over last year at this time, along with revenues.

Forward Earnings New Record Highs

The good news hidden by all the headline stress is that forward earnings rose for all three indexes last week to new record highs for MidCap and SmallCap.

LargeCaps were up for a 12th straight week and SmallCaps for a tenth, and all three have risen since mid-March, which makes the best multi-week streak since August 2014.

Don't forget that when and if a summer swoon arrives.

Important note: LargeCap forward earnings are the highest since October 2015 and are now just a small margin (1.5%) below their record high back in October 2014; when the energy decline began to set in.

MidCap new record highs make for the seventh record of the past nine weeks; these recent highs are its first since January 2015. Finally, the SmallCap sector’s new record is the seventh weekly record high in a row.

Speaking of a Summer Swoon: Maybe Later?

One thought may be that we don't get our normal summer swoon pattern this year with the election just a few months away.

Let's just patiently be aware of this and not be too surprised if we see some sort of shock wave roil through the markets later in Sept/October time instead, as the nastiness of the campaign may worsen before it is over.

There is likely to be much chatter about rigged campaigns, and we may even see a few global leaders get involved with the process as the media looks for more angst.

I do not point this out as if it’s some major worry but merely as an alternative to the now assumed August-rooted summer swoon.

Remember the patterns way back in the early 1980s generational shift showed a major breakout as well, and it lasted forever.

Back then, within a few months of the move to new highs, markets did retest the breakout zone by falling back a bit over a few week’s time. It led to much chatter about how the breakout had failed and momentum simply was not there (Sound familiar?).

I would not be at all surprised to see the same type of set-up unfold again over the ensuing months.

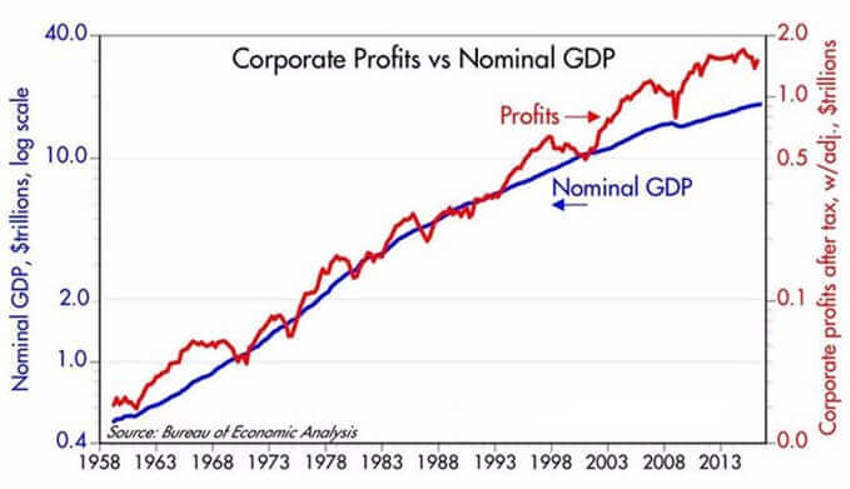

The chart above from Scott Grannis at the Calafia Beach Pundit blog shows us that corporate profits have thankfully been on a different trajectory than GDP growth for some time now.

The strength of corporate profits over the last 20 years has been steady and strong given conditions that were less than ideal.

Note in the chart from 1958 through the mid-1990s how after-tax corporate profits averaged about 5% of GDP (note that the right y-axis - corporate profits - is 5% of the left y-axis of nominal GDP).

However, it’s also vital to note that while corporations have generated about $1.5 trillion in after-tax profits on average over the past seven years (about $10.5 trillion in total), federal government debt held by the public has increased by about $6.8 trillion according to public data.

The Real Net Effect?

Sadly, our government has effectively borrowed 2 out of every 3 dollars of corporate profits for the past seven years. That capital has been handed out to favoured constituencies. And you cannot expect an economy to grow well if you are scraping off so much from the top.

Of course it will then appear as a "worst recovery on record." Expecting anything else in that set of facts as completely moronic.

In taking advantage of all the fear, the government has, in return, enjoyed the lowest borrowing costs in history. But by doing this the economy has squandered much of its hard-earned resources in the process of "change coming to America."

Never forget the true intent of Rahm's now infamous remark back in the Great Recession fog when he stated, "Never let a good panic go to waste."

Fact

We've ploughed two-thirds of the profits of the most valuable companies in the world into (mostly) transfer payments that have generated zero net growth.

This recovery, which has been deemed paltry by officials, has, at the very same time, funded a massive asset redistribution and huge debt increase that has turned out to be a historic waste of money.

Another way to see this is to look at business investment, which has been miserable for many years.

Businesses have been very profitable. But for whatever reason (e.g., the highest corporate tax rate in the developed world that has discouraged businesses from repatriating trillions of dollars of overseas profits) they have been extraordinarily reluctant to reinvest those profits.

It’s just another example of deep-seeded fears and risk aversion; the hallmarks of this recovery.

The good news? It’s all about to change.

Take Notice Hillary and Donald…

If either one of the candidates would instead focus on taking away these burdens accumulated over the last 7.75 years we would likely be utterly amazed at how well the economy could/would do thereafter. It would reward and help all concerned in the process.

The trickle-down effect could be surprisingly significant.

So, be patient and look out for a summer stock market swoon. Whether it happens now or later is just fine.

The Barbell Economy remains the focus.