The Wall Street Hammer Horror Show

"Well alas we've seen it all before, Knights in armour, days for yore, The same old fears and the same old crimes, We haven't changed since ancient times" - Dire Straits, Iron Hand

I always think of the lyric when I see extremes in investor sentiment.

It seems so fitting for this current bull market; the bears have howled at the moon on every corner for years and years, monsters have lurked, ghosts have spooked us and the goblins, as we we’ve been warned, will take us in our sleep.

In simplest terms, confidence has been lacking and fear has run rampant, and no news seemed to be the only good news.

And even as last week's Dow Jones bell rang to the tune of 25,000 plus, alongside a number of other market breakouts around the globe, headlines like this were mostly what readers and investors were met with:

STOCKS

Investors should be 'terrified' about the 'exponential' risk associated with Dow 25,000, analyst says

But let’s not stop there, the Hammer Horror style waves of terror just keeps coming, like these more recent options:

- a large meteor striking Earth and extinguishing all life forms

- a large explosion on the sun, providing a few weeks warning before our atmosphere is totally fried and us along with it

- a dirty nuclear bomb going off in downtown New York City, completely erasing one of the global financial centre points

- being struck by lightning, eaten by a shark, (insert your favourite fear meme here), and

- anything related to a 60 Minutes reporter showing up at your office unannounced.

The Point?

These risks, along with all market risks, have existed forever.

And they will exist for all time going forward.

Nothing you will ever read in these notes or any others, hear on TV, see on the Internet or buy in a newsletter will ever change that fact, nor provide any logical way out.

So, if you’re focused on the potential bad news then you’re just looking at “the same old fears and same old crimes,” in the immortal words of Mark Knopfler.

Sentiment Has Changed?

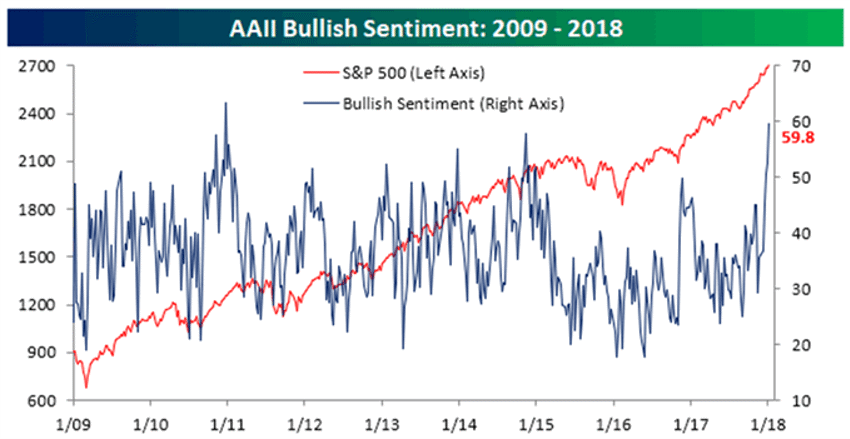

You will note that the latest AAII weekly individual investor sentiment report has changed dramatically from its former 3-year record of remaining below the majority.

Maybe the bulls out there had finally had it and decided to step up and end the year with a bang.

Too bad they waited eight years and a rise of 17,000 plus Dow Jones points before they got excited:

Personally, I was far happier when the AAII bullish numbers were in the 20s and 30s for months on end. And seeing them now just a few clicks away from their highs makes me, well, twitch a little and want to grab an extra handful of fruit-flavoured TUMS.

The Good News?

What remains, however, is the nearly $11 Trillion of money that now needs to follow those "bullish feelings" into the markets.

And we’re nowhere close to that happening.

From the long-term investor point of few, what you’re ideally looking for in the face of the sentiment turn-around is a correction.

Sounds loony, right? But watch what happens when those daisy fresh bulls that’ve just emerged from hibernation and are taking in this latest breath of record setting air see a few hundred points suddenly drop off their favourite index.

You’ll see those 59.8% of bulls drop like flies. And it will be thousands more points moving back upwards before they re-merge from their near nine year slumber.