The Value of Market Panic

What a difference 10 days make, eh?

Investors have certainly ridden a market sentiment rollercoaster of late.

And, it seems, the moment they began to re-emerge from their 2008/09 bomb-shelters, where they’ve sat huddled and worried for about eight years now, and started piling into those wonderful, passive, fix-all-ills ETF channels: BANG!

It took three years for the AAII individual investor bullish sentiment barometer to breach a majority of 50% of the crowd.

And it took a grand total of 10-days for most of that positive sentiment to disappear.

It’s as ugly in the short-term, as it is spectacular for long-term investors.

Exchange Traded Funds (ETFs)

ETF's were certainly the thing.

They were the latest tool created to appear to promise the average investor that somehow this was all easy…that somehow Wall Street, of all places, was going to provide you a tool that would permit you to stand tall through the inevitable storms.

The ETF was going to eliminate the weakest link for all investors - their emotional response to unsettling stimuli.

And it was deemed "passive" investing.

Passive my a**.

Folks, money floods out of ETF's just as fast - if not faster - than it does from mutual funds.

The dirty little secrets of Wall Street abound; from selling order flow to hedge funds, all the way to creating algorithms to pounce on that order flow when it erupts from the ETF world.

The public, in my humblest of opinions, still does not understand what at ETF does and does not do for them.

And everything looks ugly when panic ensues – good news now doesn’t appear good, and these past ten days will memory-wipe all the of gains from public perception:

- “Dividend increases? Ignore them. Give me my cash, man…”

- “Buybacks? A further shrinking of the stocks you can invest in? Are you nuts, man? Send me my cash…”

- “Earnings are going to be up 20% this year? Screw that! Sell my stuff and don't call me about stocks again…”

- “Wait. My bonds are hurting me too?!”

Can we just take a brief timeout, please?

First, some pictures:

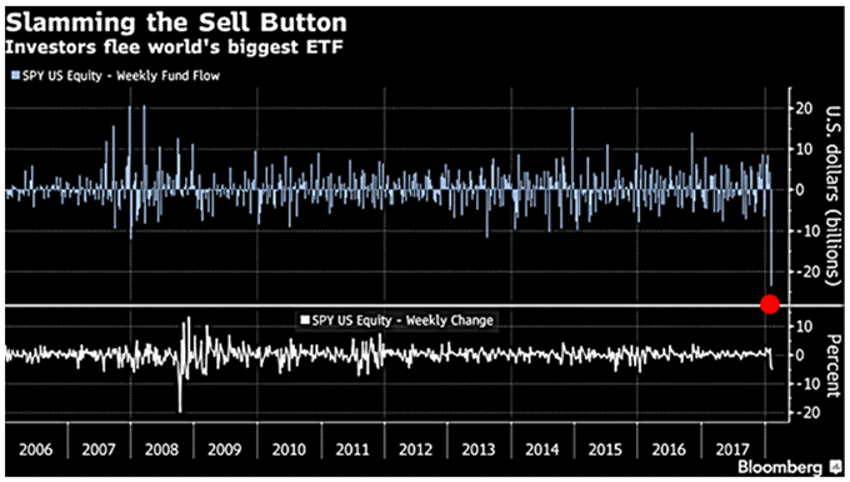

Now, you call it what you like, but that red dot shows what everyone did with their largest ETF in the business (the SPY).

Can you say "self-fulfilling prophecy?"

When you sell a SPY, you sell a piece of all 500 stocks in the S&P 500.

And since your order flow is being sold to all the big boys, they know when you are selling your SPY.

Since the SPY is a known element, they not only know when you’re hitting the panic button but they know precisely what you’re selling.

It does not take a rocket-scientist to figure out what happens next; ETF's did not change the reaction of investors. It only focused their reactions and threw gas on the fire at a concentrated pace.

The Proof?

Well, have a look at that red dot again. It far surpassed the panicked selling of the same largest ETF in the business seen in the '08-'09 Armageddon, by a magnitude of more than 2x.

There's more...

Now this week’s AAII stuff isn’t out at the time of writing, but the CNN sentiment data is clear.

Just remember: “It’s not about what's now, it's about what's next..."

With that perspective in mind, consider the red dots on the second chart (above) showing the Greed and Fear readings over the last four years.

They mark in order:

- "The worst start to markets in 85 years as 2016 dawned"

- "The pre-Election Fears of Trump"

- "Last summer's summer swoon"

As you can see the current levels of fear surpass all of those events.

In fact, we’re back to the Brexit global Armageddon lows of late summer 2015!

So, here’s what a long-term investor should be asking themselves: Did ANY of those previous fears prove legit? Was it wise, looking forward at any of those times, to be a seller of the stock market long-term? Did the world end?

Eh, no.

Still More...

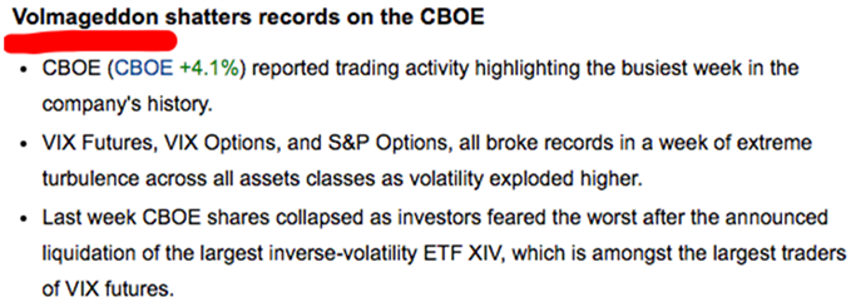

You gotta give it to the press; they can fit Armageddon into anything, right?

The "short vol" trade blows up and they have a word for it "Volmageddon."

I have another word: Moronic.

But it sure does sell a lot of newsletters, books and trading systems.

Here is another dirty-little secret:

I don't know how to "trade." I have only ever learned how to invest. And I only know how to perceive a long-term pathway through patience and the ability to see beyond unavoidable, emotional churn, reaction and panic.

Now, Just One More....

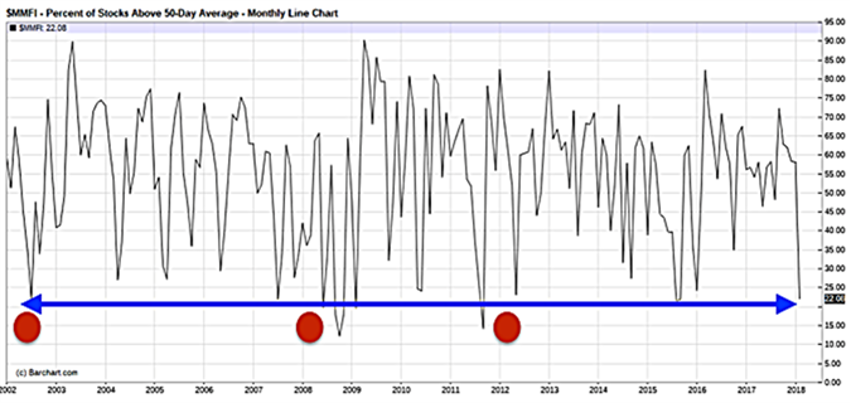

This one is fascinating to me, and growing even more so as we wash out the latest panic.

The waves of ETF-forced selling shown above have pushed a massive number of stocks down below their 50-day moving average.

The red dots now show we’re at levels seen only a few times before, like at the end of the tech bubble, at the pit of the 2008/2009 Great Recession and during election fears in 2016.

And when you look forward from those points do you remember if it was a good time or a bad time to own equities?

OK, OK, One More

Folks, earnings are through the roof. In fact, note the ratios forming during the selling wave even as earnings rise:

In a market trailing and very conservative way, looking at things after a US tax act that will drive earnings at least 20% higher, the value in the market is cheaper than seen in years.

On top of that, here is the latest from Thomson Reuters from the earnings season:

- Fwd 4-qtr est: $157.28

- P/E ratio: 16.4x

- PEG ratio: 0.84x

- S&P 500 earnings yield: 6.1% vs. last week's 5.62%

Year-over-year growth of forward estimates is now +19.6%.

That is the highest since the late 1990s, when Tech was growing at 35%-40% per quarter.

So while panic was bleeding into the market, earnings were rising. As such, the S&P 500 earnings yield has jumped because the forward estimate (numerator) rose this week, while the S&P 500 (denominator) fell hard.

The S&P 500 earnings yield is now at its highest point since the China devaluation and crude oil correction ended in February 2016!

I do not recall seeing this level of consistent upward revisions to weekly data, but I know that it’s good news.

And, yes, rates will rise. But that’s not a surprise. We’ve been saying it and expecting it for years now.

Panic is a valuable thing, but only for long-term investors focused on the Barbell Economy and the demographics being overlooked and totally misunderstood by most.