The Upside of Down

The summer haze has simply not (yet) uncorked a stock market swoon.

But you’d never know that by looking at investor sentiment.

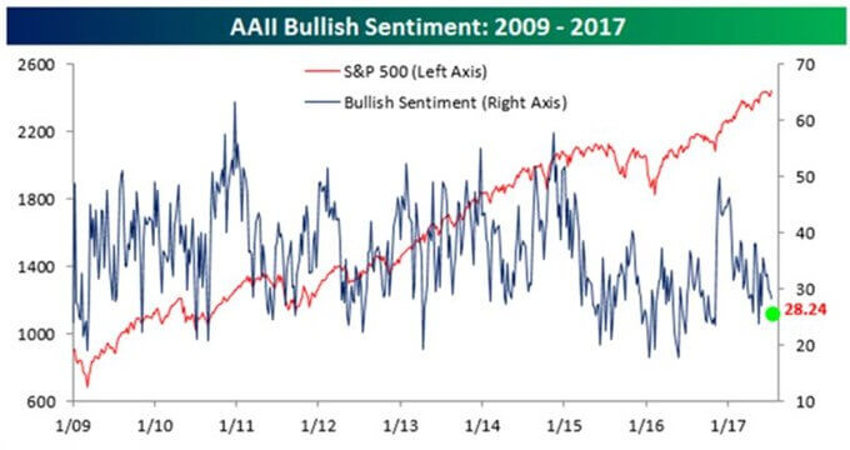

The latest from AAII shows not only the 132nd week in a row where bulls made up less than half the marketplace, but we now stand just eight percentage points above where we stood in this same survey during the week of March 9, 2009.

That date is important because back then we were 15,000 Dow Jones points lower:

Have a look at the green dot on the chart above.

Now check the blue line.

The basement level of "bullishness" is closing in on the same as those post-recession.

And I have just one word for that: Fabulous!

Theses sentiment levels are unfolding in the same exact week as new all-time highs in markets - and a new long-term buy signal from the old Dow Theory.

What an incredibly contrarian read. Find me a time on that chart above where being in the low bullish camp that we have now was a good thing as an investor.

It does not exist.

Scared Money Indeed

Years ago the big worry was the "perilously low consumer savings rate" that was sure to destroy mankind.

It went on for years and years.

Back then we said, "If you want a high savings rate just bring on a recession, and you’ll get it. So you get to pick: a) high savings rates or b) a steady, solid growth economy."

Today, the bold, leading-edge projections tell us that we’re stuck in a terminally slow-growth, secular stagnation economy that’s sure to imperil the very future that was previously imperilled by the low savings rate.

Why?

You guessed it: Because we now have a staggeringly good savings rate.

Excuse me while I laugh my ass off…

Hoarding Money

When we started the year, I noted America had a record level of savings – some $9.2 Trillion in consumer savings accounts, earning zilch.

The goal was simple: Keep it safe from that ugly old volatile stock market which sadly, for those in the bank, has once again proven scared money loses long-term.

But that fear is still expanding, and so is that mountain of cash.

That tidy little sum has grown from $9.2 trillion to $10.7 trillion as of June 30.

Folks, you can always smell fear. It has footprints and it leaves a mark.

And the bogeyman can seem real to even the sanest amongst us.

The Great Recession will reverberate in the psyche of America for decades to come. It changed everything related to investing.

The really, really sad part about investing is that the market does not care.

While the US is enjoying the best job market it has ever seen, consumers are frozen in time, and are reluctant to spend freely due to…what exactly…?

Apparently is because of "economic uncertainty."

Liquidity remains the key: Of that $10.7 Trillion in the bank, a full $2 trillion of it is sitting in checking accounts!

A Lesson on Movement

Make no mistake. We are the cause of our "slow economy.” It is our collective fears about a slow economy that are causing the slow economy.

The average dollar spent moves roughly 6 times in the US Economy. Meaning you spend a dollar today and it moves around to six other spots and produces a result - an impact. The money moves - it does not sit idle. Think of it like a little robot that keeps moving through the economic landscape.

And due to our fear of "economic uncertainty" we have removed 10.7 trillion of those little robots from our economic machine. They are all sitting idle in the bank doing nothing.

Yet, if that fear were to thaw just a tiny bit, or even reduce itself, America’s economy would instantly explode.

In other words, if we all collectively decided tomorrow that we were going to only be $9.7 Trillion worth of "scared to death" versus the current $10.7 Trillion worth, our GDP would expand by roughly 5% - 6% a quarter for the next 18-24 months, minimum.

You flush a trillion dollars of new capital for investment, small business, technology, corporate expansion, jobs and non-scared spending into our economy and it will grow.

Guess what? We have all the expansion capital we need. It is literally sitting in the bank.

And when that finally does happen someone will be there to tell you, a) what's wrong with it and b) why you should be terrified of it.

By The Way...

For those who may have missed it during a busy summer week, I prepped another short video review for you here as we edge into the second half of the summer haze.

Make sure you click and check the data here.

It only takes a few minutes and it should provide some calm as the rest of the summer haze unfolds.