The Trump Market Transformation

In the early morning hours, just as the world was beginning to recognize the tectonic shift unfolding on Election night, the Dow Jones futures were down almost 900 points.

While it somehow now feels like that event happened years ago, a fascinating change began to unfold before our eyes; President-Elect Trump completely transformed.

As he stood at the podium while many were still numbed by the result, he was soft-spoken, caring, and even respectful towards Hillary; whose efforts during the campaign he praised from a perspective of genuine sincerity.

And in that moment he revealed the Presidential persona that everyone had been waiting for; and as if on cue, the Dow Jones futures began to recover.

Within minutes it was only 700 down…then 500…then 300…and before the day was over, the most well-known market index on the planet was up by about 300 points.

Now, just in case we feared it was a one-time deal, President-Elect Trump just finished a planned 15-minute meeting with President Obama which turned into an hour and a half session.

The live shot of them together in the Oval Office for the first time in history was chilling - in a very positive way. In that meeting the personal transformation continued as Trump once again showed his good side, speaking eloquently about President Obama, his accomplishments and the coming transition…and get this: Working together.

Markets again reacted positively.

After dipping into the red intra-day, a side-by-side view of the market and their live Oval office shot showed a quick turn back to the green.

Yes, these are short-term events but after a long battle there seems to be a message.

What could it be?

I’ll take a stab at it: The market healing has begun.

Just like the early 1980s all over again

Back in the early 1980s, the country's political stresses were quite significant as the Carter years came to a close.

The Baby Boomers were just entering the workforce and a guy from Hollywood – via a California governorship – was about to become President. There was much doubt in all channels.

The many experts of the day told anyone who would listen that they should be fearful. At the time there were only really three mainstream TV channels that played those messages.

Today, we have just closed the books on another very stressful period politically. Generation Y is hitting the bricks and entering our economy on the leading edge of change. And yes, another guy from the TV has just become President.

The great thing about America is that once we have gone through something tough, generally speaking we get better at it than we were before. Sure, we get bruised and knocked down sometimes but then we get up, shake the dust off and fight back by building solutions and improving things together.

We are repeating that cycle all over again.

Finally, a sentiment shift?

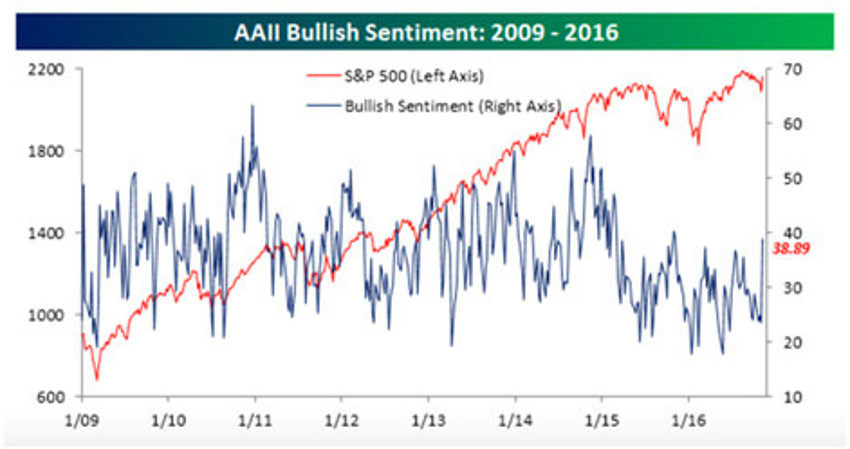

Here’s one for you: Check the latest bullish sentiment chart above from AAII at the top of these three charts.

Remember, the top chart shows the weekly reading; the freshest data out at the time.

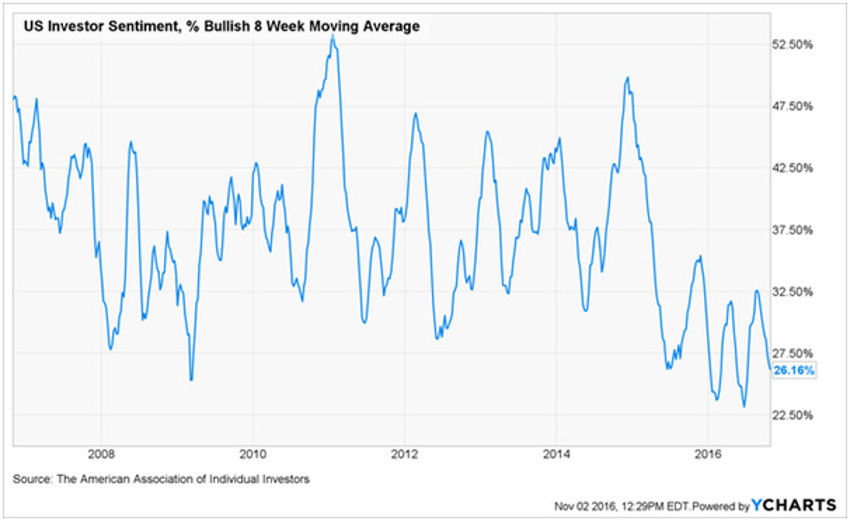

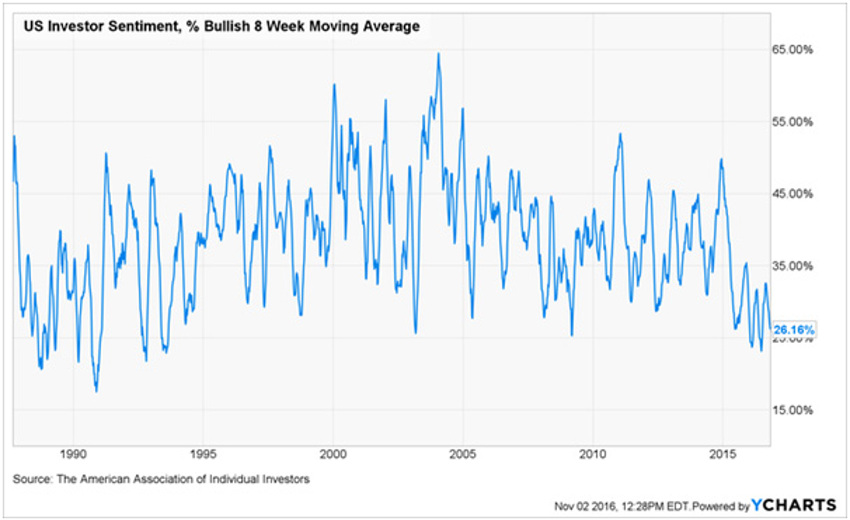

It will take some time before the 8-week moving averages begin to budge – from the bottom two charts above.

(Did President-Elect Trump just do what record highs in the S&P 500 couldn't?)

For months, consumer and investor sentiment has been collectively clobbered by the uncertainty regarding the election, and especially over the media-driven fear surrounding the possibilities of what a Trump Presidency would mean for the markets and the economy.

This can be seen in the weekly sentiment poll from the AAII, a chart you have seen here often.

And remember just a week ago that the S&P 500 closed at the same price as April 14, 2015!

Further, even though the S&P 500 has essentially been at, near or just below all-time highs for much of 2015/2016, bullish sentiment on the part of individual investors has been stuck below 40% for a record 54 straight weeks and 88 of the last 89 weeks.

This week’s AAII's bullish sentiment reading still came in below 40%, but it has come closer to that level than at any other point in the last year.

According to this week's survey, bullish sentiment surged from 23.64% to 38.89%, representing the largest one-week increase since July 2010. That's six years!

So let’s keep in mind that AAII's weekly poll is conducted from Thursday through Wednesday, so the bulk of this week's responses were more than likely tabulated prior to the election, and possibly even prior to the Comey letter saying that nothing had changed in the FBI's decision not to recommend indicting Clinton.

That being said, in a year where the so-called establishment has been proven to be so disconnected with the views and opinions of the overall population, it is only fitting that a survey of bullish sentiment among individual investors surged the most in six years at the same time as the biggest US political upset in at least a generation, if not in history.

Needless to say, it will be really interesting to see where this reading stands next week at this time.

What it says so far is that we should be praying for one more correction or a retracement of this knee-jerk reaction over the last 48 hours.

The Latest?

From the most foolish reporting item of the day column comes this little ditty: It seems the press would like us to believe that there will be some "payback" against tech stocks from Trump's White House because their CEOs did not support him during the campaign.

Really? Payback? What, are we 6 years old here or adults?

Take one lesson from this week: How many other times do you think the press has led you the wrong way?

Think about that the next time your heart-rate increases on some fearful headline and then begin to embrace setbacks in markets as a window of value.

Something else to keep in mind is that each time we hear the term "record high" moving forward, repeat to yourself the following: that means every setback I was fearful of before now was really a good deal after all, if I have a solid plan and a long-term view.

What's Next?

The better part of valour here hints that these knee-jerk, volatile reactions of the last two days are likely to feel a bit overdone, so don't be surprised to see it retraced.

The media will tell us much needs to be done and not to get too excited; many sectors have made huge moves in 48 hours, some in the opposite direction.

Bonds have been clobbered and that will hurt bond holders near-term. Anything rate-related is being politely "re-priced." Dividend stocks have become hated sectors in hours. This too will likely set the stage for more value.

It remains our view than Gen Y is a major deflationary force. So a little inflationary pressure in other areas of the economy is a good offset and not something to be nervous about.

Check this: We are just 150 points from 19,000 on the Dow Jones but the overall markets are churning a bit.

Don't be surprised if we chop around some as the digestion continues. Heavy volume suggests a whole pack of investors were betting on a down move instead - and maybe even a different winner.

The comical part about all of this? Many experts had nearly assured all of us that a Trump win would result in a 10% correction.

That should let you know it is time we stop worrying about who can predict the future and who can't.

The answer is no one can.

Keep it simple here: Stay focused on the Barbell Economy and be patient and remain focused on long-term improvement.

Required Disclaimers on all videos and content