The Summer’s Slow Moving Market Waves

The Q2 growth we’re seeing, confirmed in earnings, is broad-based and not dependent on one or two sectors.

This year, over 75% of the major sectors of the economy are on track to produce more earnings than in the corresponding period last year.

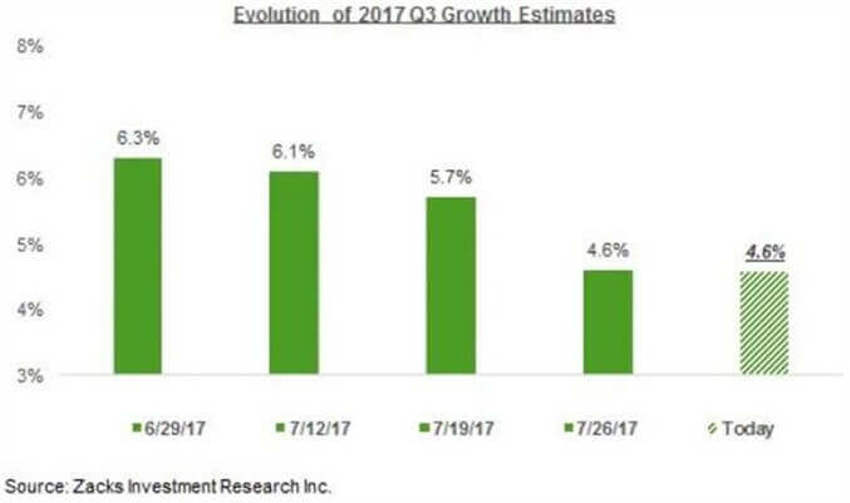

The chart below shows that estimates for the September quarter have started coming down, as is normal.

Remember how analysts have reacted "with caution" since 2008-2009, and do not want to be "caught" being overly optimistic?

Well, the pace and magnitude of negative revisions by said analysts compares favourably to other comparable periods.

See the evolution of Q3 growth expectations since the start of the Q2 earnings parade below:

The Positives?

This pathway, and the demographic shifts unfolding for the US, are slow moving waves.

They last a very long time, but they demand we remain patient and disciplined, even as near-term events like the annual summer market choppiness unfolds.

We are hitting that stretch of the summer haze where this will get thicker. In about another week or so, most of the important slice of the earnings data will be done, and volumes will fall even further as third-string managers exit for the last weeks of summer.

Shrinking crowds and attention spans can surely lead to the risk of more internal chop masked by the indices and ETF/robot algorithm activity.

Let's Stay Focused...

In the latest data, real GDP rose 2.6% during Q2, up from 1.2% during Q1 (itself revised up from the original 0.7% report).

Imagine if all projections were only 70% off target?

The YOY growth rate of our real GDP has been remarkably steady since 2010, sitting right around 2.0%. Yet too many refer to this as "secular stagnation."

Sounds scary but it misses the market, don't you think?

I stand by the idea still that what we’re likely to find in the future is how badly previous years of GDP have been under-reported. We simply cannot keep assuming that the way we reported growth 60 years ago is still the best way to report it today.

Yes, I get the idea that the stagnation reference sells more attention, but in reality it’s likely much healthier to see this instead as "secular stability."

Note this helpful item as well from Dr Ed Yardeni that, "the growth of the economy during the latest expansion looks better using the real output of the non-farm business (NFB) sector, which is essentially the same as real GDP excluding government. It’s been hovering around 3.0% since the start of the current expansion."

In Closing...

Robert Schiller was interviewed the other day about "things that concern him" as it relates to the future of the market.

At the end of the piece, the financial channel doing the piece had a survey.

Over 11,000 answered (see below), and I’ve pasted in the question and the series of survey results:

In answering the question "Is the stock market about to suffer an epic crash?" there were 150% more answers of "Yes" than "No".

This meshes well with the continued poor AAII investor sentiment data.

And you can bet that the "Not Sure" answers came from those who were not invested either.

The Contrast?

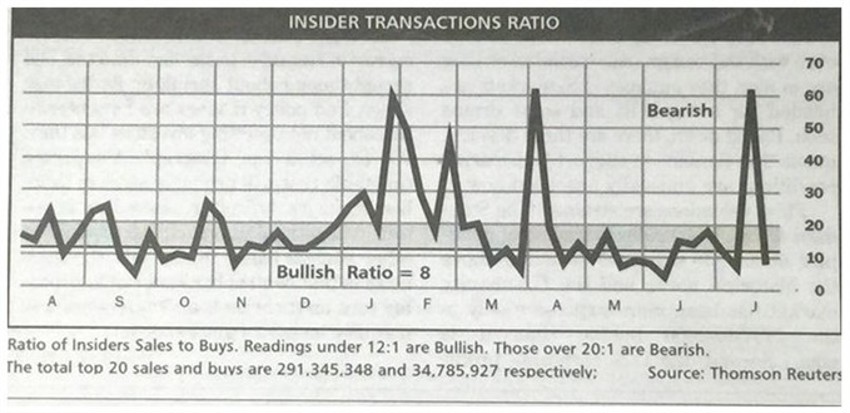

Check out the little snippet (below) from the weekend issue of Barron's, showing insider buy and sell activity.

The earnings season may be causing lots of reasons for knee-jerk reactions in the minds of short-term algorithm traders, but the insiders seem to see deals on the horizon:

As always, think demographics not economics.

We’re in great shape.