The Robots Are Coming (No, Not Hillary & Donald)

Here are the financial highlights:

- Net worth records.

- Debt/asset % back to late 1980s levels.

- Oil draws - supplies still bloated - with more to come.

- Housing dwindling.

- "The Robots Are Coming."

- Comedy Break.

We’ve now passed the much feared US Federal Reserve meeting on interest rates and it was as big of a non-event as you can imagine.

The “experts" who were positing endless streams of fearful statements about the impact of a rate hike have awoken this morning with a brand new set of so-called “facts" to scare you in the near-term.

So, when does the insanity end?

Honestly, let's hope it never does.

Sentiment stinks, mountains of cash lay idle, fretting over something (anything, in fact) is at a record tilt, data points are being dissected beyond any meaning whatsoever, and despite all that the markets keep fighting onward and upward.

As long as you can stomach it these are great things for those with a long-term focus.

New Stats

A quick summary:

- Housing inventory is down to 4 months - six months is deemed as balanced.

- New home sales were down slightly in the latest data. That’s because realtors tell us there is not enough supply, which is causing prices to rise. That said it's never cost less to own a home.

- Midwest business stats are steady: September Kansas City Fed Composite Index is +6 now versus -4 in August. The manufacturing index is +15 versus -7 in the same period. A spokesperson said, “For the second time in four months we had a positive reading on our composite index. This followed 15 straight months of contraction and suggests regional factory activity may be stabilizing.”

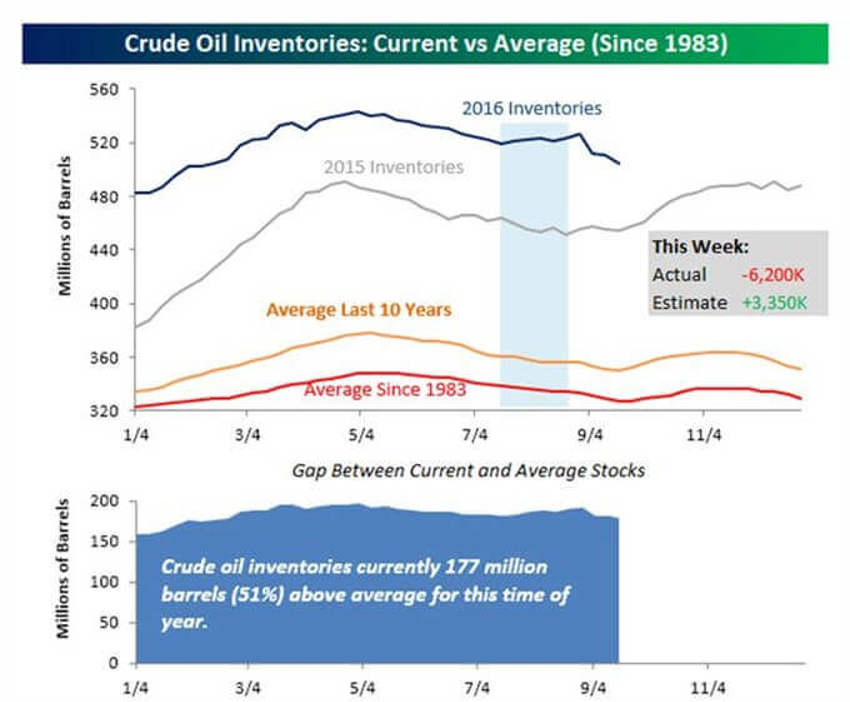

- Oil inventories continue to creep downward as the bloat wears off.

Don't fool yourself. Those oil patch guys are sharp and likely got the hang of this pretty quickly; if you stand idle long enough the price of oil will rise in the near-term.

The spigots will be turned on again, with more force than ever before thanks to the ever-increasing benefits of technology. Higher prices are then locked in via futures and they pump as much as they can. Then prices fall again.

Net-net, this is a long and winding path downwards in the way we see oil in the future. Already, the cost of energy in the average per capita budget across the land is at record low percentage levels.

On that point; do not let cheap prices cause your brain to forget what the experts terrified you with back in the summer of 2008; that $148 per barrel crude oil is the end of the world…

Speaking of the end of the world....

The emotional scars of the Great Recession run deep.

Investors now look to cash, massive bond buying, mountains of money flowing out of equities and into bonds and the debt levels of households.

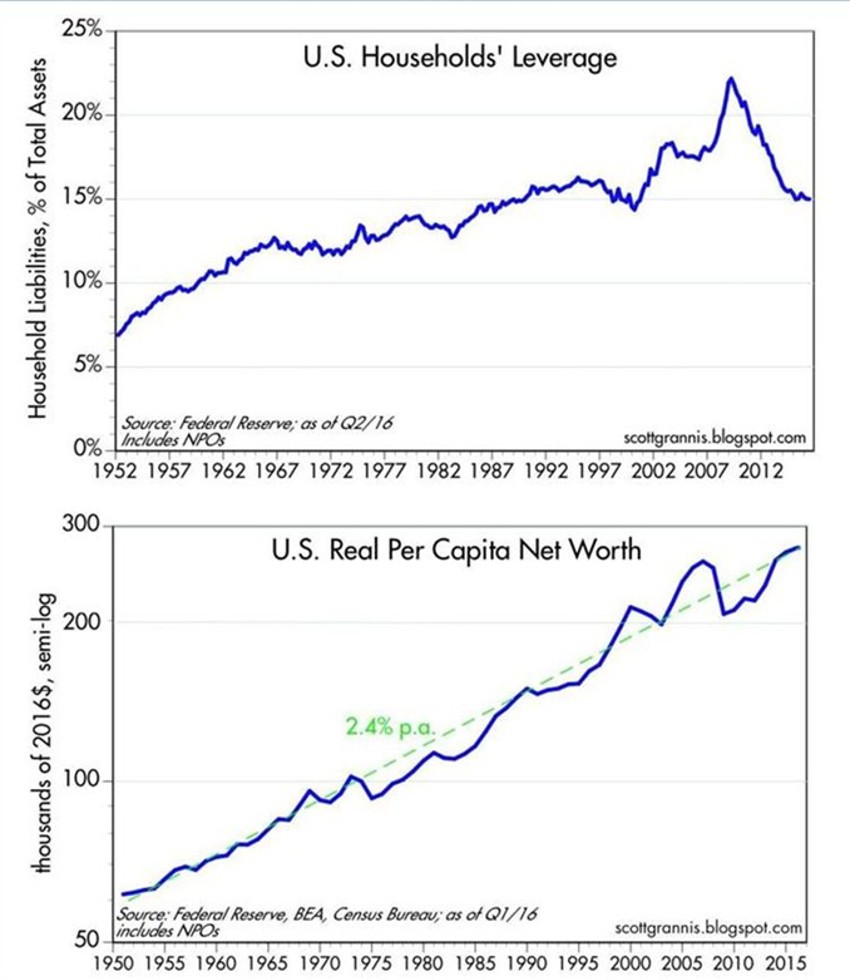

These two charts above harken us back to the basics: Debt and assets.

While all the fear-mongering attention getters would lead you to believe all is lost on this front, the facts, as usual, are a bit different. Household debt as a per cent of assets is now back to levels not seen since the late 1980s.

The second chart shows you the per capital net worth levels. Note the pace. Since the 1950s, per capital net worth has been expanding at around 2.4% per annum. And it’s still going.

I’ve added red lines in three periods on the chart above to show where growth fell below trend. Those were great years in the markets and lengthy periods of time.

So the "bad news" we get drowned with by the media is actually good news if you’re a long-term investor willing to look beyond the garbage.

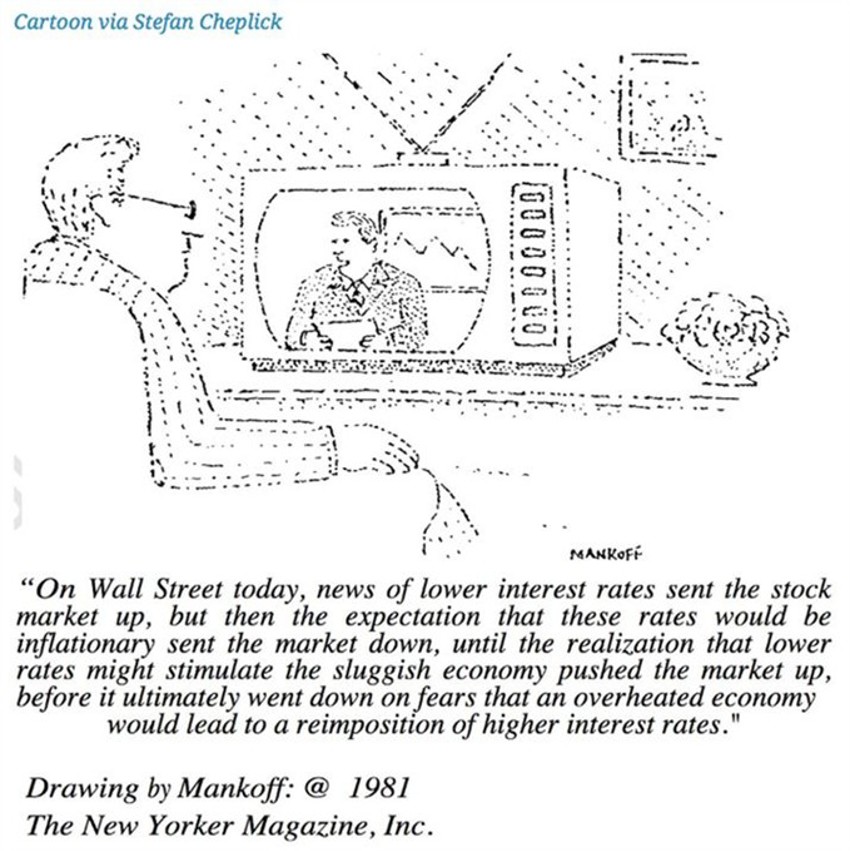

A Comedy Break

I saw the below on an email from Josh Brown of The Reformed Broker site. It’s a terrifically funny cartoon and speaks so well to recent events.

I had to include it for a chuckle:

Now look at the date that it was originally posted by the cartoonist: 1981!

One More Thing - Robots

There’s a lot of chatter about robots and artificial intelligence now that’s leading some commentators to the conclusion that we humans will soon become like house cats of sorts.

In the long-run, robots are good. They have helped change productivity in manufacturing and permitted millions of workers to move on to higher education, more productive employment, new training and a better standard of living.

Try finding someone to build a home these days. National builders say they could build more if they had more workers. We all know the demand is there.

Robots fill voids and permit people to do things better and do better things. By example, IBM’s Watson is being used to monitor patients’ vital signs in a hospital’s intensive-care unit, a job that normally would fall to nurses. A Pizza Hut in Asia will use Pepper the Robot to take some orders and process credit card payments.

Warehouses are next. As we Fed-Ex more of our economy, storage points become vital for efficiencies. Symbotic has developed robots that travel through a warehouse untethered to stack and retrieve cases of goods. “Symbotic said its system allows food retailers and wholesalers to cut distribution-centre labour costs by 80% and operate warehouses that are 25% to 40% smaller,” as reported in the Wall Street Journal on 20 September.

The article goes on to say, “Unlike in conventional warehouses, where cases of a given product tend to be stored in the same section so humans can find them, Symbotic’s robots can put any product in any spot on the racks--mayonnaise rubs elbows with peanut butter and coffee--allowing for denser storage. Each of Symbotic’s autonomous robots can drop off and retrieve one case of products a minute, about five times as fast as a human can on foot. The robots are 28 inches wide and the aisles they travel only slightly wider, compared with the 10-to-12-foot aisles of a conventional warehouse.”

There is something of a limit though until technology advances and price falls. The equipment for one system can cost $40 million to $80 million.

Now I assure you that if you tell that to the press the bears will immediately warn you that warehouses are in trouble because robots need less space since the aisles will be smaller.

Rounding out the latest data, more than a third of new robots went to the auto industry, and the next biggest users of robots were electrical and electronics producers.

The Final Countdown

Next up: The criminal versus the nut in the Presidential debate.

And we have to pick?

The media clearly does not want Trump as they pander to Clinton and write over her past; one littered with reasons to have her in jail.

Grab your popcorn because this should be interesting. I think Obama and his policies have divided this country so badly that neither candidate gets the 270 votes needed.

After all that updating - we find ourselves back to the boring but stable foundation of the US economy. The Baby Boomers will explode demand in many sectors while the Generation Y cohort will launch massive waves of demand on the other end of the Barbell Economy. Gen Z is backing them up with more records to come.

And that’s all good news for the long-term investor.