The “Pile On” Effect

I must admit, the stockmarket's activities over the last few weeks would suggest that any move towards mustering a positive view point would seem a bit foolish.

The good news in all this however, is that we've gotten exactly that for which we've prayed.

As stated here for months, we were becoming perplexed with the idea that our ability to take advantage of mini panics may have disappeared into the morass of a bull market.

History will show that once a secular bull (read: a lengthy upswing) begins, there are very, very few periods over the ensuing years where real opportunity exists, other than simply paying more for an asset next week.

Fear of Deflation

Our "rescue" from that concern has come via a barrage of new worries; as if they were all sitting on a ship somewhere in the middle of the ocean, waiting for a breeze to blow them in.

Suddenly, Ukraine and Syria seem a fair distance off the bow even as we run bombing missions against ISIS as we speak.

Young men and women are in harm's way, risking their lives so we can sit back here and worry about the end of the world, this time at the hands of deflation fears and the "outbreak" of Ebola. It did not help that a second person in DC has been diagnosed. In fact it has only added to the "pile on effect" to which we are now witness.

Mind you, piling on is a normal stage in the process of ratcheting fear up to crescendo levels. Can we stomach it? Can we steadily pass through it? Can we recall bird flu, H1N1 or any of the other various viruses that have sprung up in recent years?

They too had an impact, but all rather chaotic and relatively short-lived.

Now, that's easy to point out in the rear view mirror. I get that. And I fully understand how the fears start playing with our minds, reminding us all too well of the '08-'09 collapse and darker times.

The Fear Cocktail

And, as if all those meaty headlines weren't enough to spark the Apocalypse, earnings season is upon us and the natural knee-jerk reaction is to now view every release through the following (and rather absurd) analytical lens:

"Yes, those numbers are fine but what will happen to them once Ebola kicks in, travel stops, planes don't leave the ground, business slows, deflation rears its ugly head, ISIS wins, IRAQ implodes again, Russia takes half of eastern Europe, the other half of Europe collapses, the Euro goes to parity with the dollar and crude falls below $60 a barrel?"

Get it? It's the pile on effect.

So If We Can Stay Focused...

Let's come to terms with the idea that the cash we had outside the market was to take advantage of these types of setbacks when they arrive.

Now comes the tough part; overcoming the fear that keeps too many from taking up this advantage.

Case in point is the wholesale selling, massive fund liquidations and assuredly far lower levels of sentiment when all the newest surveys come out tomorrow.

Their collective readings should be a doozy indeed.

But there are positives...

Earnings season has started off very well and as Dr. Ed Yardeni effectively summaries for us, valuations have, well, come down as well:

"The forward P/E of the S&P 500 rose from 12.6 at the start of 2013 to peak at 15.7 during July 3 of this year. It is now down 1.2 points to 14.5. That's a walk in the park compared to the 2.3- and 3.3-point drops in the forward P/E's of the S&P 400 MidCaps and S&P 600 SmallCaps. The former's P/E rose from 14.3 at the start of 2013 to peak this year at 17.7 on March 4, and is down to 15.4 now. The latter's P/E rose from 15.2 to 19.3 (on March 18 of this year), and is down to 16.0 now.

On Monday, the forward P/E of the S&P 500 was the lowest since February 5, 2014. The forward P/E of the S&P 400 was the lowest since June 25, 2013. The forward P/E of the S&P 600 was the lowest since April 18, 2013."

Yes, I know, data doesn't help much when your TUMS bottle is empty.

But it should remind us that we have seen all of this before and we have a solid amount of cash to take advantage of the overdue - yet surely to be overdone - setbacks in the near-term.

Right Now?

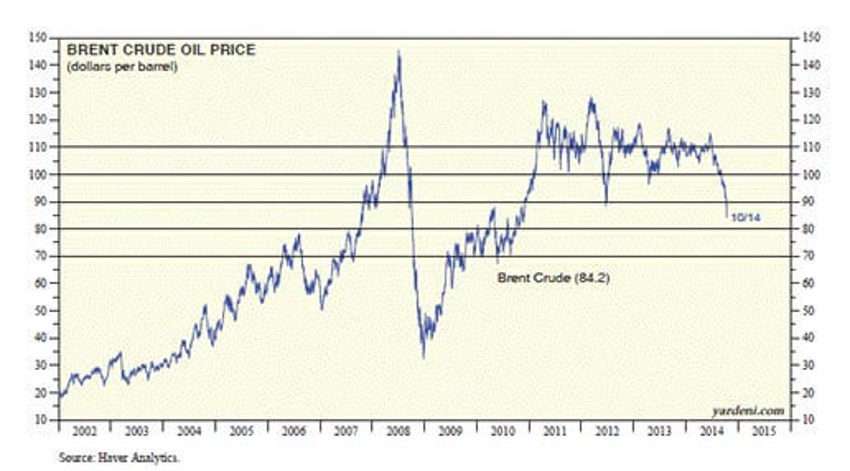

"Slippery when gushing...." is the new term for the US oil field.

Our over-abundance of supply is cratering prices. That should prove a painful fix to some of the oversupply.....but remains excellent for us all in the long-run.

This is how these new technologies work:

They create too much of something as they are unleashed. The unleashing causes a glut, prices fall, high costs producers cannot survive, supply gets controlled, prices bounce/rise/stabilize, the rising price supports yet even more advanced, newer/cheaper technologies and the process repeats itself....until oil prices look like grain prices.

We thought $80 was good a year ago. Oil in the $60's may be coming soon.

After the naysayers realize that this is not bad for us, unless we are the Middle East, consumers will buy like its 1999.