The Path Behind Us

I was thinking about how 2016 has rolled out thus far in market and economic terms.

Remember where we began? A bear market had arrived with that old ditty, "How goes January, so goes the year." Then the media and pundits sang “Sell in May, Go Away” song. September mourning has followed and October is the anniversary of the crash. Now bring on more Zika, China, Brexit, Greece, Brazil, crude oil...it all blends into a grinding noise after a while and serves no purpose at all.

In short, it’s been a mind-bender; with the media and experts telling us about one disaster after the next.

And on that front… this news just in from CNN: Apparently the Zika virus spray being used in Miami is killing bees.

The headline: "Millions of Bees Die in the Fight Against Zika"

I kid you not.

Onward Brexit Ho…

Yesterday's gauge of U.K. services surged!

The latest data show it jumped the most ever on record in August. This is a far cry from what was "expected by experts" following the so-called “shock" inflicted on the world by the UK’s decision to leave the EU.

The IHS Markit's Purchasing Managers Index surged to 52.9 from a seven-year low of 47.4 in July.

Again, that's the biggest monthly gain since the survey began two decades ago.

Wait for “Italexit” and “Un-Bee-Leave-A-Bull.”

Sentiment Paradigm

Pick any news page, news site, financial or otherwise. Scan the headlines.

Tell me what you see.

Is it any wonder the average investor is petrified and would prefer a ton of cash, and maybe a few bonds?

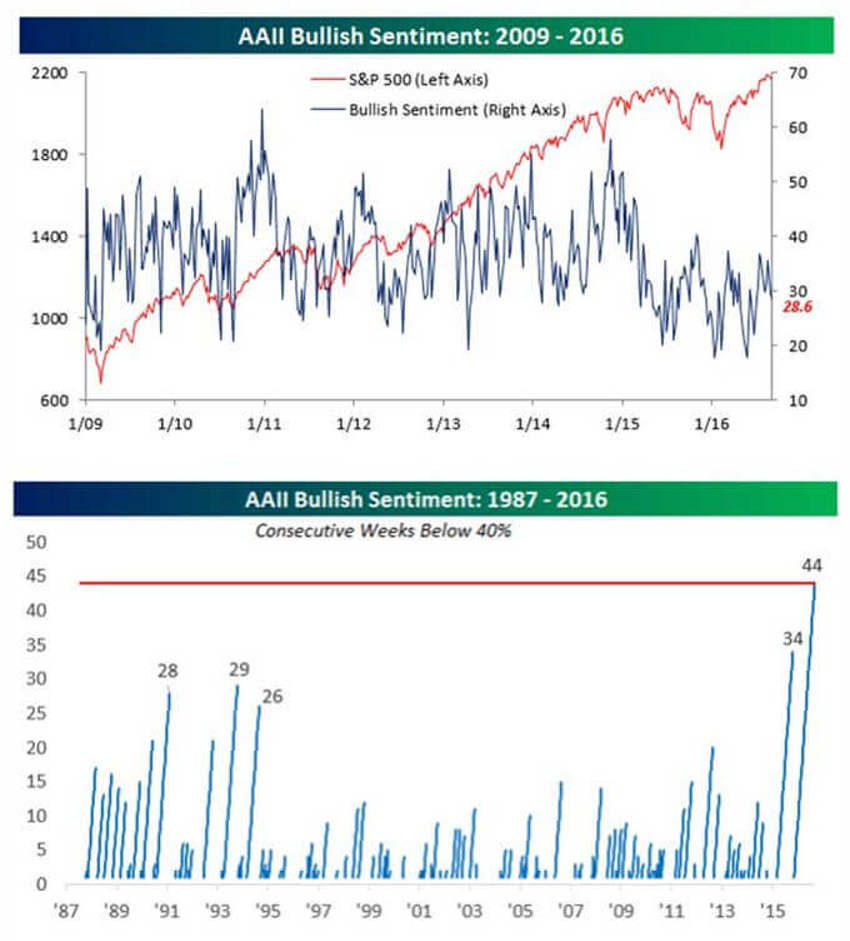

Never in the history of markets have we been at all-time highs while 72% of surveyed investors didn't "feel bullish".

We noted last week this was the 44th consecutive week that bullish sentiment was below 40%.

It's the longest streak of sub-40% weekly readings since 1987!

This is a long-term investors dream, even if it means we struggle through flat spots and corrective action at times ahead.

And if you are concerned that we are even remotely close to dangerous greed in the market or a frenzy to buy stocks then think again.

Better yet, if we get a two or three-week pullback you’ll see investor fear like we haven’t recorded since March of 2009…and that was 11,900 Dow Jones points ago.

The Big Bad Wolf (Part 87)

There is a piece making the rounds from a group chanting about the end of the world for as long as I can recall.

Here is some of the art from their latest video clip:

Scary right? Got your attention? That's the purpose.

You can even buy a newsletter at the end of the movie.

China Syndromes

In the last 30 months, we have gone from China will rule the world, to China will replace our currency, they’ll devalue their currency three times in a year, and they keep loaning money to keep dead companies alive.

China has cities they built that no one has ever lived in. And these now need to be rebuilt because they’re rotting in places.

The bottom line is that they have gutted their demographic power, and their struggles are set to be long-lasting because of it.

Meanwhile, Back at the Ranch…

As we slowly all get back into the mind-set of work and pass through summer 2016, remind yourself of a few records that we can feel good about during the next market correction:

- There’s record cash on hand; over $9 Trillion in the bank and a few more $Trillions in corporate coffers.

- Cash flows are at record highs.

- Margins are flat-lining at record highs.

- Forward earnings and revenues are at new record highs.

- Markets are near record highs.

- Industrial production is set to turn.

- Inventories are becoming very lean (a good foundation for GDP growth later).

- Housing demand is rising quickly.

- Chemical demand is at a new record high (which usually leads production).

Having faith in all this is a scary thing. And we can all be sure there will be many scary things to come.

But investors are paid a rate of return to accept risk as part of it all.

So stay patient and stand firm.