The Old Measures Hiding New Growth

A lot of people feel the need to always have a sense of fear about what's next when it comes to markets and money.

And there’s no shortage of outlets to feed that compulsion.

But forewarned is forearmed, at least for the sake of perspective, so there are a couple of things I suspect will slowly seep into the media coverage window over the next few months, and likely well past the suffocating coverage that’s expected on the election ahead.

Here are two things to keep in mind:

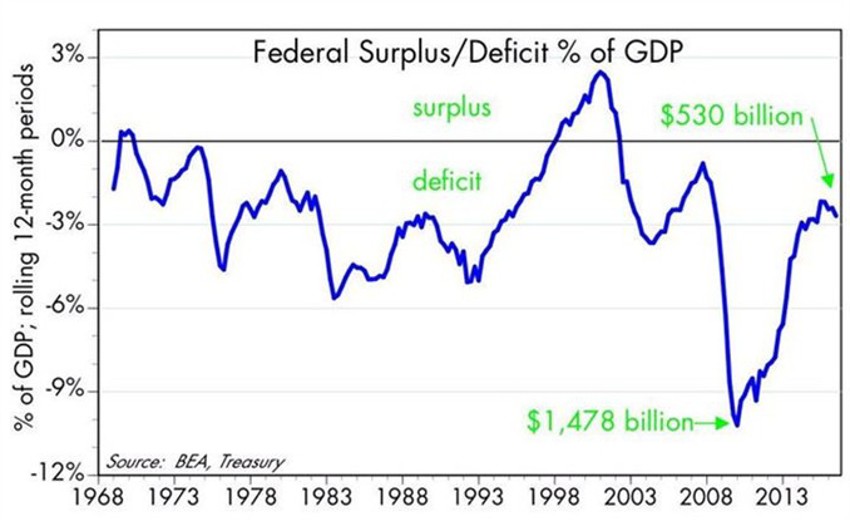

1. Mr Obama's administration has done a good job on timing and accounting. And, he has been blessed with a great economy from which to extract revenues for his chosen programs. Increasing budget deficits may now indeed come into focus almost precisely when he is leaving office. The social programs created from record tax receipts for years will begin to weigh heavily on the numbers as ways to hide their accumulation will fade.

2. Fretting over deflation is a process that should stick with us for many years to come. It’s a good thing, and clearly brought on by the massive productivity shift of the Generation Y wave ahead. That’s because Gen Y does much more with far less. The endless apps, cloud tools, free services, internet power/reach, supercomputers in everyone's hand and the like; expect costs to continue to be wrung out of the systems that we once considered as new and established. Add that to their insistence on multi-tasking at all levels and you can see why the current government reporting capabilities on new growth are so very far behind in this "new world economy."

Old World Reporting

I hope we can all agree that we’re missing out on a full sense of everything being produced by Gen Y because of old world government reporting. Deflationary pressure (and our awareness of it strength and where it’s coming from) offsets the internal pressures that are driving up employment costs across the board.

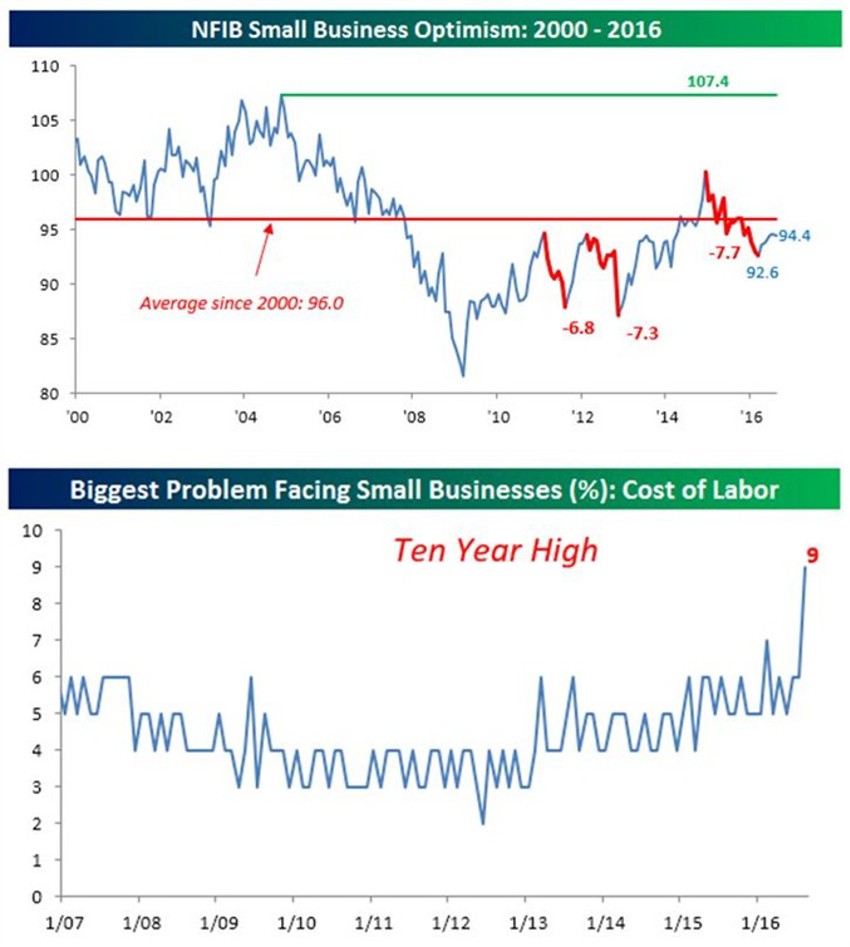

When we combine the massive debacle called Obamacare, and other things like regulation taxes, increased fee/licensing layers, legal battles and even the increasing pressures on minimum wages, we can see how small business is reaching a few choke points.

This is not terrible news, but we should all expect to see some inflationary pressures in a few areas.

And yes, I know; mentioning inflationary pressure in a world full of deflationary fears is somewhat odd...but “It is what it is” as the kids tell us.

Let's look at a few charts:

Let's Review

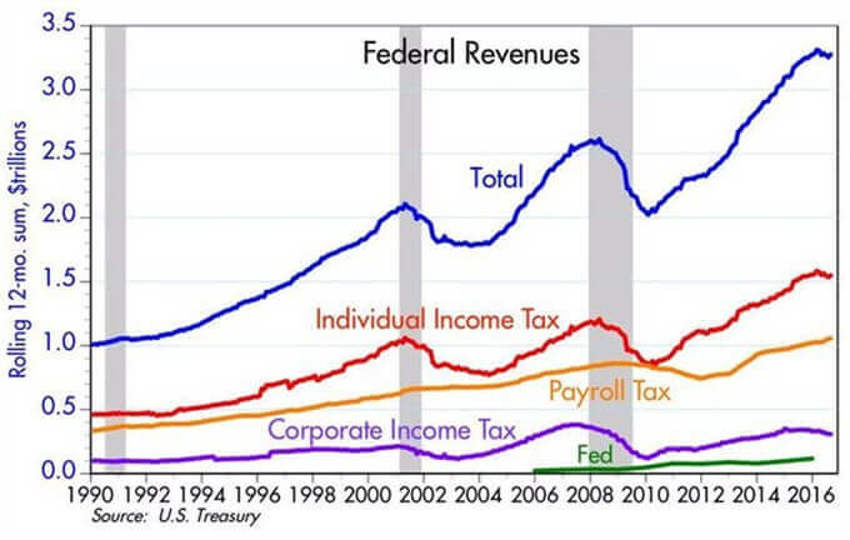

In chart 1 from Calafia Beach Pundit, Scott Grannis, we see a solid view of expanding government revenues.

We’ve been told that our economy was somehow subpar and living through the weakest recovery on record. But it's rather foolish to keep falling for that line as we can see the rapid acceleration in federal receipts over the last eight years.

The pace of change is the steepest ever seen in the data. Huge all-time records in income, payroll and corporate tax show us just how much of our growth has been raked off the top to keep deficits appearing in control while giving away trillions.

To then suggest a weakest recovery on record is sort of like biting the hand that feeds you....

We’re very lucky that the amazing growth of the economy has been able to fund that federal spending and pay those revenues to Washington DC. And the good news is that, thanks to the current budget deficit relative to the economy, we’re very much in line with the average over the post-war period.

The Larger Point?

We had better find some more productive fiscal policy coming out of Washington DC so that we can produce freer business growth and get investment capital moving again. As the curves show, capital will only stand so much taxation before it finally stalls, or worse, begins to reverse.

This can all be remedied to unleash massive benefits for all at the same time through better fiscal policy. It has zero to do with the US Fed or any rate hike on the horizon.

Treat the life-blood of business better and we will see explosive growth. And we’ll need it; the demand building in the pipeline will stress many areas of our current tightly-wound economy.

Small Business

The third and fourth charts above are for the latest small business surveys. What’s often overlooked for larger headline material is that small business impacts jobs far more than big ones do. And the data shows this group is now feeling a bit punk, with record pressures in the employment cost category.

The Culprits?

- Running out of employee choices as we use up current candidates

- Massive regulatory chains/costs for all new employees (a feeder of the revenue rake above)

- Extreme pressures brought on by Obamacare costs which, far from what we are told in the press, are now completely out of control

I repeat: Better fiscal policies will come under more and more scrutiny and we cannot expect capital to keep moving into new growth and expansion while seeing such heavy costs of deployment when risk is what we all live on.

Many tend to forget this: Risk taking capital built America.

Treat it poorly and money has a funny way of disappointing flows on a wide scale.

In Summary

The confusion in our midst continues to be the massive generational power-shift underway.

Seen one way, it appears messy, disjointed and feels like we are all walking in quicksand.

But looking at it from another perspective it’s actually relatively ordinary.

Demand is coming our way at levels that are vastly underestimated. The old reporting parameters just don’t suffice in showing that to us.

That's why they say patience and focus are so difficult to manage, and likely why so few accept it as a required set of traits for the long-term successes ahead.

Stay focused on the long-term growth demand ahead.