The Match That Lights the Market’s Fuse

The new administration is just days old and I'm already tired of hearing about all of its problems.

So if we’re going to get some sort of market setback then I suspect we’re now on the verge of seeing it unfold, unless of course earnings arrive in more robust than expected.

And as much as I would like to see some setbacks happen the upside remains the surprise here.

And if the first couple of days are any indication then it looks like we’re going to need to become more accustomed to the media process of attacking this President.

Sure, he may even like it. But this is different; nerves are already on high alert, a state that can cause investors to drive near-term events, and in doing so create opportunity for long-term investors.

The press may very well become the match which lights the fuse.

Look, long-term and wide portions of America’s economy, and the rest of the world, are slowly but surely mending.

The earnings reports have so far been solid. But these are getting very sparse attention.

After all, if you can spew more negatives about the incoming administration then why waste your airtime on positives?

The truth just doesn’t garner much attention these days.

That Noted...

And there is still plenty of temptation to link your investments to the electoral change.

My base position is that you should not regard it as important but, alternatively, see it as an adjustment over time.

When it comes to investing you’re better suited to make an effort at being politically agnostic.

And despite the uncertain environment, volatility has been a matter for individual stocks. The overall market forces seem to have found a bit of patience and stability.

By example, here are the stats from the early days, and those since the election in two charts:

This chart above covers the last several months of the SPY and is here to simply show reality.

As much as there has been never-ending chatter about the terrible things this President is setting the world up for, the markets do not seem to agree with this conclusion…at all.

A couple of highlights for you (from the above chart):

The red dot: This marks the day before election day - that close was the same price as was seen back in early April 2015; nearly 18 months of little more than moving sideways (even as things under the surface were improving).

The two purple dots: Note the recent overbought highs in the indicator (for technicians out there) and the paring down of that robustness even as the market (light blue box) has literally been in the same range.

And as you can see in this second chart (above), the stats prove the point.

By at least one measure, the Trump Administration's transition has been pretty smooth.

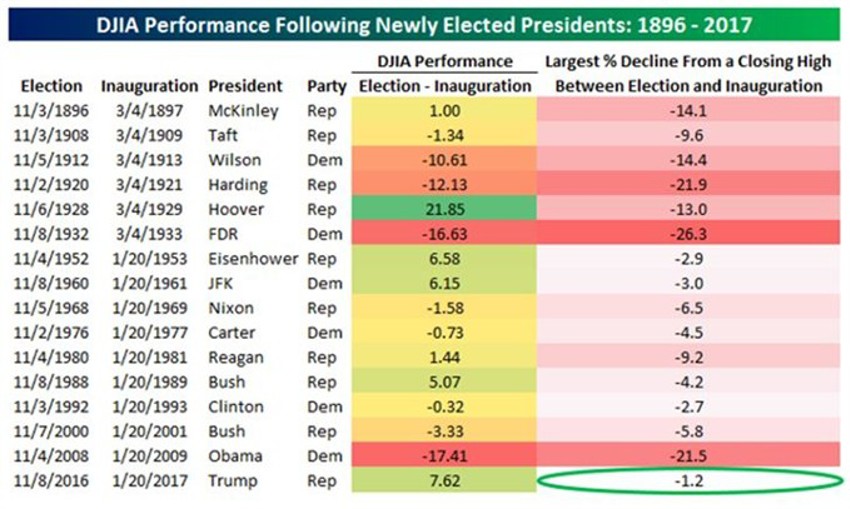

The table from Bespoke shows how the DJIA has performed from Election Day through Inauguration Day for each newly elected President since 1896.

Along with the DJIA's performance during each transition, we also show the maximum percentage decline the index saw from a closing high during each period.

With a gain of 7.62% during Trump's transition, the DJIA had its second best transition performance since 1896.

More importantly, with a maximum decline of 1.2% from a closing high, no other newly elected President has ever seen a less volatile transition period!

Call it whatever you want, but getting caught up the press hype is a real risk here. As noted earlier, from the stock market's perspective, the Trump transition seems to be moving along just fine.

As Always - A Choice

Whether we like it or not Trump is a deal-maker; he enjoys the ‘in-your-face’ style and verbal sparring, which has often been misinterpreted in the media.

And in the end he sets the stage to get what he wants. Hey, maybe we should consider being happy that he’s negotiating for us?

And oddly enough, while the press is doing all the complaining, early developments in this eight-year process to rebuild are, well, shall we say "already paying off?"

Let's take a look:

Late Friday, the headlines suggested (and later backed up over the weekend by Reuters) that Foxconn, the world’s largest contract electronics maker (thanks to Apple), is considering building a display-making plant in the US.

Note that the investment would exceed $7 billion and likely creates somewhere around 35,000-40,000 jobs.

Foxconn business partner Masayoshi Son (also head of Japan’s SoftBank Group), convened with Foxconn’s Chairman and Chief Executive Terry Gou before a December meeting with Trump.

Now note what drove the press coverage of that meeting: Son pledged a $50 billion of investment in the US.

Here’s another surprise:

After some very negative attacks on Germany's leadership in the post-election days, Reuters also noted on Saturday that Germany’s Chancellor Angela Merkel: “Vowed on Saturday to seek compromises on issues like trade and military spending with U.S. President Donald Trump,” adding she would work on preserving the important relationship between Europe and the United States.

“He made his convictions clear in his inauguration speech,” Merkel said in remarks that were broadcast live a day after Trump vowed to put ‘America first.’”

One has to admit this is a fairly gracious response to the position Trump is negotiating for us all.

And you just watch how Brexit unfolds as a positive for the US as well - just as we noted here the morning it unfolded last summer.