The Markets: Cloudy, with a Chance of Fatigue

There have been times in the past where "crowd fatigue" was itself a drag on markets in the near-term.

It seems pretty clear to me that we’re jogging through a period just like that now.

The combination of the feared earnings recession continuing, the interest rate hike media-mania and the election vitriol is more than enough to push anyone out of the markets. In fact, it’s creating a headwind in the business surveys.

Equities are clearly the loser in the risk profiles for so many today, and bonds remain the go-to leader as noted recently by the massive over-subscription figures for the Sprint and Saudi deals.

Speaking of angst toward equities, the latest sentiment stats are in from AAII and get this; the bulls are vanishing faster than a warm summer breeze.

This week's AAII Sentiment Survey results in summary:

- Bullish: 23.7%, down another 1.7 percentage points

- Neutral: 38.4%, down 2.4 percentage points

- Bearish: 37.8%, up 4.1 percentage points

To put this in some context, this latest reading tells us that over 90% of all other bullish readings in their 29-year history (over 1,500 surveys) were higher than we are now.

Still a different view suggests we have now gone a full year with bullish sentiment staying well below the historical averages noted for you here:

- Bullish: 38.5%

- Neutral: 31.0%

- Bearish: 30.5%

Fear is Clear?

Sentiment is not the only indicator of fear.

The demand for cash - the need to have liquidity - is a clear indication of fear. And that type of fear is unfortunately long-lasting and takes (usually) a very lengthy, slow jog upward in prices to restore confidence.

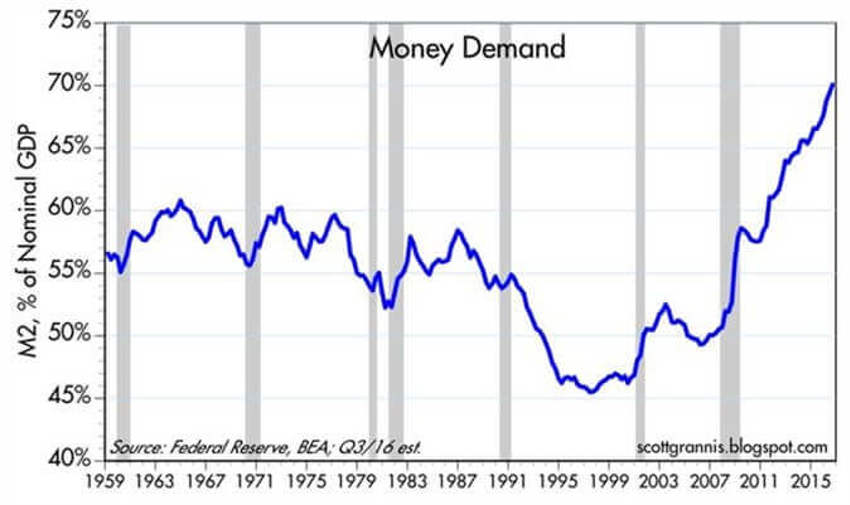

No doubt remains: all across the world, investors of all shapes and size have driven a soaring demand for money (using M2—currency, retail money market funds, time deposits, checking accounts and bank savings deposits—as a proxy) since 2008.

The chart above from Scott Grannis of the Calafia Beach Pundit blog makes this very clear: The world wants to hold more cash relative to nominal GDP than ever before.

I’m pretty sure these fears are deeply seeded and will not be dissipating anytime soon.

Nothing in the current news cycle is likely to do anything but make it worse; no matter the event, risk is all that is currently being focused upon.

People everywhere are more risk averse and caution permeates our daily lives.

People worry about QE, the risk of another financial collapse, the direction of politics, the rise of terrorism, instability in the Middle East, the proliferation of nuclear weapons, the elections, the Fed, crude oil…the list seems endless.

Many did not understand at the time the value that former US Federal Reserve Chairman Ben Bernanke placed on studying the forces of deflation.

In time, likely many years from now, we may begin to see that it was the public's insatiable demand for money that essentially drove the Fed to adopt Quantitative Easing (QE).

Bernanke understood the Fed needed to rapidly increase the supply of money in order to satisfy the world's huge demand for same. What most do not recognize is that if he had not driven these programs, we would have experienced significant deflation, which is what happens when there is a shortage of money.

While it does not help reduce the number of Black Swans telling their end-of-the-world stories, it does help explain why the massive fears about igniting skyrocketing inflation because of QE never even remotely materialized.

Indeed - every dollar of QE is in the $9 trillion++ pile of cash sitting idle in bank accounts.

More on Earnings and Value

Many stay focused on P/Es as though they have a consistent sign of security implied by their number.

This is a fallacy.

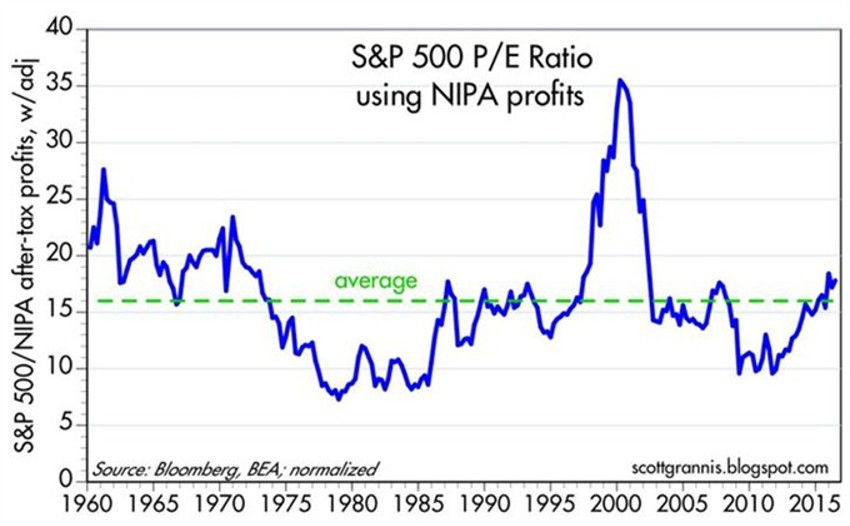

It also does not give anyone a real view of earnings. Standard measures of earnings which conform to FASB accounting standards are not necessarily the same as "economic profits," noted in a P/E over a trailing 12-month period.

This is especially true when that period covers a collapse in one specific sector.

The chart below helps us blend the picture better since it works directly from the estimate of economic profits found in the National Income and Product Account (NIPA).

This is right from tax returns.

In taking this different view we see that PE ratios today are only marginally higher than their long-term average and have been far higher in the past.

Considering the near-historical low interest rates and the discount rates the market continues to drive, you have to wonder aloud, "does it not make sense for PE ratios to be at least somewhat above average?"

One Last Item on Risk

I have written on the equity risk premium before. To get to the heart of the matter here is what it tells us today:

Today investors are showing a near insatiable willingness to pay what is now $57 for $1 of annual earnings in T-Bonds. However, they are only willing to pay about $19-$20 for $1 of annual earnings from equities.

Now seriously, if that is not a sign of some very significant, deeply-seeded risk aversion then I’m unsure how else it could be demonstrated.

Said another way, the market of investors are saying that it is extremely unlikely that we will see companies maintain their current earnings into the future.

...and this is happening even as we see the corporate earnings turn becoming more and more evident.

In Summary

While none of this takes away that "cloudy" feeling I noted above, it does tell long-term investors what we often see during periods of value.

You see, being bearish or concerned in a world that has been extremely risk averse and bearish for years has not usually been a winning long-term viewpoint.

Unfortunately, this is where patience and discipline arise as more valuable assets in your arsenal. It’s admittedly never fun to watch but historically valuable nonetheless.

I remain confident that a quarter or two into 2017, or maybe sooner, that we’ll find markets are not that over-valued after all, based on 2017/2018 earnings.

I say we pray for a correction or setback around the election. Be prepared to take advantage of same in your long-term planning - even when it hurts - while many will be focused instead on the short-term.

And, as always, think demographics not economics.