The Market Forecast: Partly Cloudy with Corrective Winds

Do you remember the scenario we suggested as these notes came to a close in 2016?

We said we could very well be setting up for a pause or some setbacks as Trump enters the White House, and that we would shortly see the initial friction points of the new administration's first 100 days.

Things would not go perfectly. They never do.

Now, as we stand on the edge of the Q4 earnings parade how can we measure the outlook of the next 100 days with any real accuracy?

Sure, we can be certain that taxes, regulations and other headwinds to business will abate but we can also be sure that CFO's will be conservative in their respective views of the impact of same.

The result?

The forecast could be partly cloudy with a bit of chop and corrective winds.

But this is not something to be worried about. In fact, it’s a good thing.

That’s because the bears will be quick to come out in force with a chorus of, "I told you it would never work" chatter that will reverberate through the headlines.

Market sentiment, which was thought to have been overdone of late, will be undone just as quickly.

Know this: Confidence in markets remains weak. And this too is a good thing.

A Couple of Highlights

Several nice items showed up under the haze setting in around the inauguration:

- US Mortgage applications were up 5.8% despite concerns that higher rates would hurt the market. This is a very nice surprise.

- US Jobless claims at 247K continue at an extremely low level.

- Michigan sentiment at 98.1 on the preliminary survey remains very strong (although a slight miss on expectations).

- Along with solid rail data and the already noted Small Business Sentiment increases, sea container counts also ended the year nicely in the latest data.

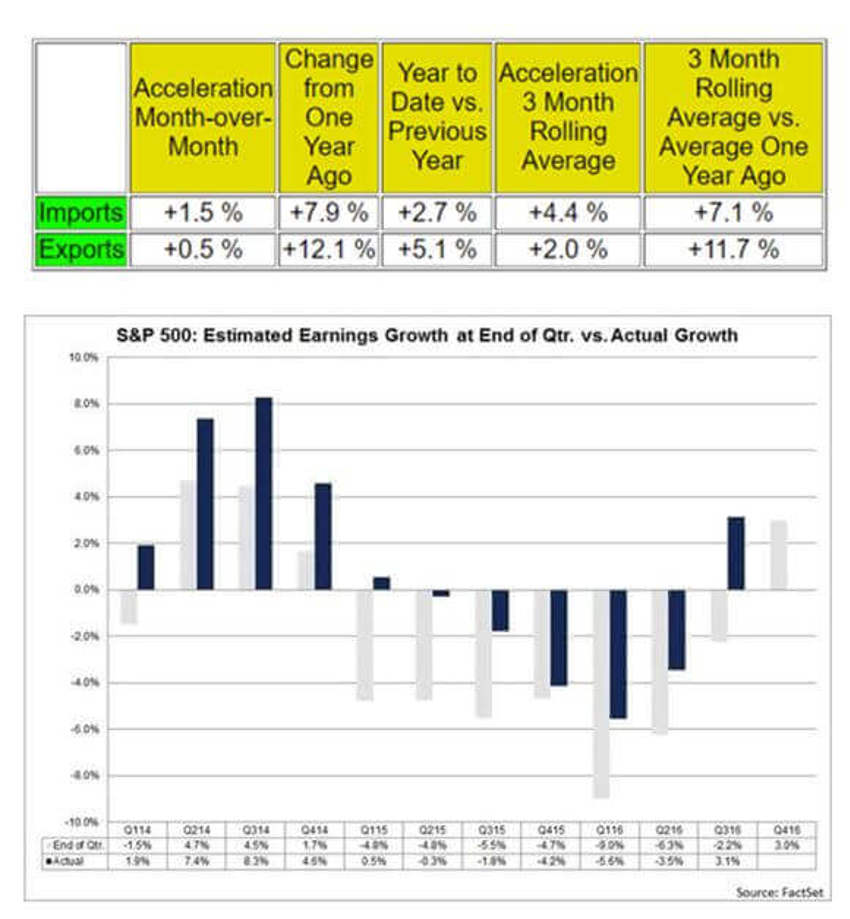

A little table helps:

Stats on Q4

While it is likely to be a little sloppy (another good thing for us long-term investors to take advantage of) during Q4 conference calls that try to predict events over the next quarter or two, the latest expectations data seems a solid foundation.

Long-time readers know how we have been able to count on the idea that analysts are light on projections, and the beats tend to show up better in actual results.

We already noted that we had one of the lighter Q4 warning periods in recent years and in the second chart above we should see some pretty good data in the final outcome.

Note the consistency: "Actual reporting" tends to solidly outweigh the estimates. And just as important is the solid end to the "earnings recession" that we can see in the data flow above.

Rounding Out

A couple more items from the US market help to fill out the picture here with retail sales and inventories, which are both pretty solid as well:

- Holiday retail sales rose 4% to beat even the NRF's expectations.

- Business inventories increased 0.7% as businesses are slowly rebuilding depleted supplies.(Remember that it’s very difficult to get a recession rolling with a supply pipeline already down to 35 days of sales. I would think at worst - this is neutral.)

- The latest data from Chemicals sales shows steady increases continue. These are typically early signs of a continued upturn in industrial production as well.

As a collection, the points above auger well for long-term confidence, even as the risk of a near-term corrective wave stand by for the reasons we’ve already noted.

Closing Out Some Details

US nominal business sales increased in November for the eighth time in nine months, while October real sales continued to set new record highs.

Dr Ed Yardeni fine tunes it even more for us here with this:

"November’s nominal inventories-to-sales ratio ticked up from a 15-month low of 1.37 in October to 1.38 in November, still below its cyclical high of 1.41 recorded during the first three months of the year."

Either way, be confident that it remains tough to build a recession with a lack of burdensome inventories in the larger picture - even though it sells press attention.

The Bottom Line

Pray for a correction.

The long-term drivers weaved into our Barbell economy is significant and is set to weather anything the media chatter about the first 100 days may throw at us.