The Market Footprints of Fear

Well, it’s never boring.

And I can tell you that, as I enter my 36th year in this business, the news rarely gets better than what we are seeing unfold for the years ahead.

Does that make me feel just a tad nervous saying that?

Yep.

Personally, I like it when we’re being told things look bad.

And you can rest assured that despite all the good stuff ahead there is a correction out there waiting.

I say, bring it on!

It will ultimately be a good thing, not a bad thing.

Sentiment Fuel

The AAII data shows bulls dropping like flies on any pause we experience to the upside.

And with that tidy sum of about $11 trillion worth of potential investor money still sitting in the bank, there is plenty of fuel to go before we can say the world is "all-in.”

Now, let's check the rear view mirror and then on the windshield ahead:

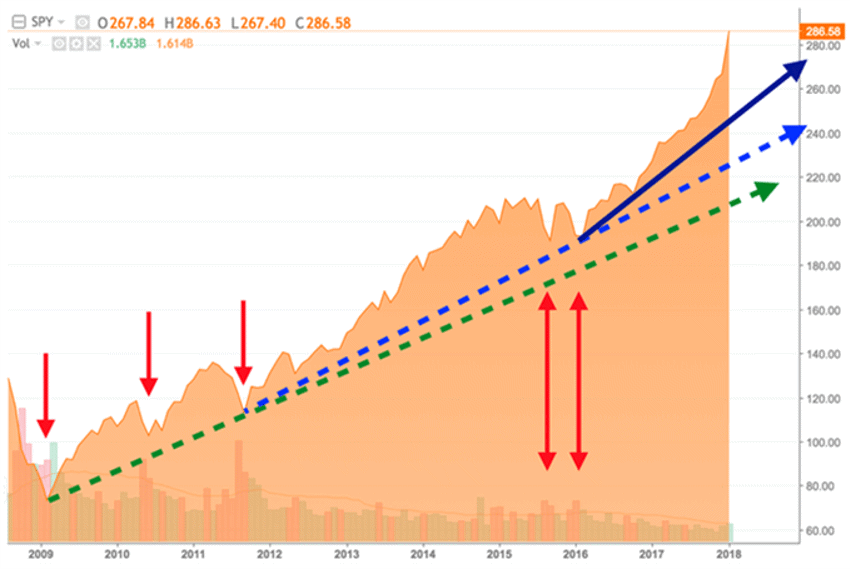

My Thinking About the Chart Above

First, this is the rally structure since the lows of the end of the world back in early 2009.

Second, watch the red arrows and learn from them. They connect lows in the market with the high volume red bars you can see through the image in the background. It's how we read panic in the market. We call them "the footprints of fear." The crowd consistently proves they will sell based on fear much faster than they will buy based on logic.

Third, you can look at the acceleration of improvement in the world of business going forward by noting the angle of the coloured trend lines; green is the base trend line, the dotted blue line is another gear higher, and the current acceleration is solid purple.

Fourth, markets are a buffet of human reactions; perceptions of the future, fear and comfort all blended together.

And finally, remember where your feelings were back in the lows of 2009? Take this as a lesson the next time they make an appearance.

We humans look at the market today and perceive it through the lens of past events, knowledge and emotions.

The market on the other hand tends to be a discounter of the future.

Meaning?

Business looks through the windshield, humans look in the rear view mirror, and history suggests that one approach is productive while the other is not so much.

Better News?

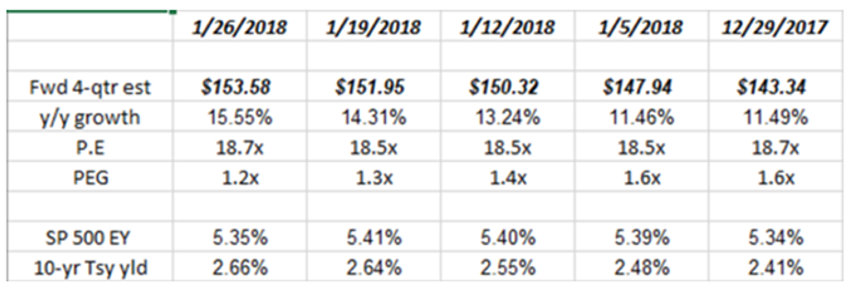

Earnings are continuing to accelerate, and there is still over half of the Q4, 2017 earnings season to go.

Let's check the stats:

A tremendous number of things are happening in the market’s favour.

- The S&P 500 earnings yield, when compared to the 10-year Treasury or "Fed Model" calculation (as Dr Ed Yardeni likes to call it) shows it’s still undervalued relative to the 10-year Treasury yield.

- Take note of the accelerating pace of growth in the forward four-quarter earnings estimates.

- There is still more acceleration ahead.

- And the price earnings (P/E) ratio as of Friday of last week was the same as the end of the year, suggesting this is on earnings increases and not the expansion of P/E multiples.

It was a big deal going over 10% growth as we noted back in the November/December notes.

But now, it is even more staggering to see that same forward earnings growth rate accelerate into and beyond the 15% range, which is something we’ve not seen from this large an earnings base, well, ever.

Mark Your Calendar

I don't want to cause concern - just make sure you put this next bit on your calendar.

We will likely hear all sorts of nasty "Armageddon-like" stuff at about this time next year, when the media hype will sound something like, "Markets are in trouble as the pace of growth slows..."

Just keep in mind that while it will be nonsensical for the most part, the lapping effect of these big surges cannot help but find a pause (in the pace of increases) for Q1 of next year.

It's just like then you hear we have terrible holiday sales, despite it almost always being a record year; they’re just throwing you off by referencing the pace of growth.

And That’s Not All Folks…

Yes, corporate earnings are increasing rapidly, the trickle-down effect of which is still being misunderstood.

But there is more happening in this larger market and economic event.

In fact, the game is just beginning:

- Global economic activity is accelerating across the board. Just last week, the IMF once again raised their growth forecast for both 2018 and 2019.

- Assume that, in order to be competitive, the fuse lit by the bold steps taken in the U.S. on the tax and regulatory front will be followed by other countries. And expect efforts to enact reform-boosting for growth benefits in other regions as well.

- The massive deflationary forces of Generation Y alongside inflationary pressures remaining low will confuse many experts looking at old tools.

- Held in check by globalization, rapid technological change drivers and the Gen Y disruption, it’s likely the Philips Curve and other historic measures of productivity may no longer be very effective indicators.

The bottom line here is that it’s foolish to think of our current economy as anything even remotely like that of 10, 20, 30 or 50 years ago.

And fears built on that perspective are like footprints travelling in the wrong direction.