The Lighter Side of Market Volatility

Office pools appear split on whether a 25-basis point hike in interest rates will kick-off Armageddon, or a yawn and then a nap.

And positive financial media coverage is like finding needles in hay stacks.

What’s important to keep in mind is that markets generally do not plummet when the entire planet is expecting them to do so.

So, while sentiment has, does and probably will continue to stink for the foreseeable future, the black swans will likely to continue to fly past a while longer.

Tightening

Since about six weeks ago markets have been doing the tightening for the US Fed.

Once again, if they finally pull the trigger today (21 September, 2016) they will be following the markets, not leading or controlling them.

And thinking that process works otherwise is a yet another example of why this year’s long effort to blame the Fed for low rates has been such a bunch of sh..., eh, hogwash.

(I would have used another word but I have promised to no longer speak that way.)

Review Stats

Markets continue to struggle far too much with concerns over interest rates. The US Fed may have put itself into a pickle, but not for the reasons so many assume.

Fear has been the driver of rates in our society for the better part of the last decade. An avalanche of money “seeking safety” has decided that bonds at near record low rates, or even negative rates in some places, are the answer.

But how such a vast crowd could get so twisted in their thinking to believe that’s true is still beyond me.

The issue the Fed is faced with now is how to unwind that fear in a manner where the short-end (typically the quickest to react to Fed rate hikes for example) can rise without triggering a negative yield curve, while the long-end is pressured to the downside via the fear-driven rampage of buying.

In recent weeks that adjusted only slightly, with the long-end rising ahead of a feared rate hike.

That noted, vast amounts of money continue to roll into bond funds at the expense of equity funds.

Volatility?

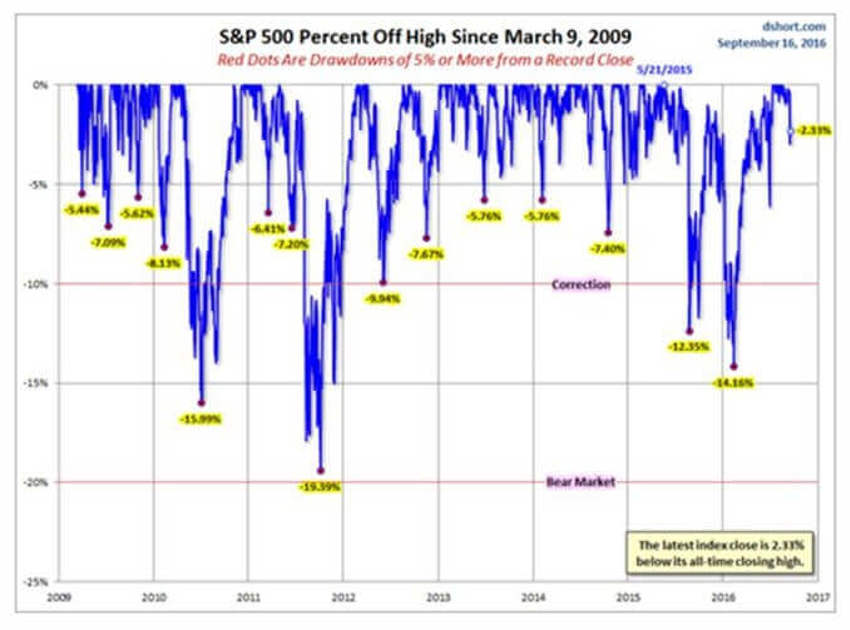

Are we really at the stage of underlying fear where a 3-5% fall-back in major averages is defined as “volatility?”

See the snapshot below for perspective on what these pullbacks from recent market highs really look like in percentage terms, back to the Great Recession lows of March 2009.

From this perspective, recent “volatility” seems, well, not very volatile at all.

Let’s see if we can continue to keep our wits about us as all the others lose theirs.

More Data - Solid Foundation

While way too much energy will be expended this week on the “will they or won’t they?” debate, regardless of the decision half of the audience will be disappointed.

If they hike, a rash of headlines will usher in terrible events coming our way due to 25 basis points more in interest costs.

If they don’t hike, a rash of headlines will flood our screens about how the Fed is stuck, has run out of tools, debt is out of control, QE is still haunting us and all that is left is to finish our underground shelters and buy more guns.

Builders Feeling Pretty Good

I still find it rather comical that the Great Recession we still fear a repeat of on any inkling of red ink, was wrapped around the real estate world and fraud in the debt markets.

While obvious to everyone now, the expert view back then was we would never use up the supply of homes available to live in.

The good news is we now know how long forever lasts: About 7 years.

Home supplies are wilting to levels not seen since the early 1980s, with population demand rising rapidly.

The NAHB just noted this morning that builders are feeling good and its index jumped six points to a new one-year high - leaping over expectations of just a marginal increase.

So here’s the deal: We are at a 50-year low on home ownership rates and we have the largest generation in the history of the US just beginning to buy homes; all in a vast landscape of depleted inventory.

Here in Chicago, buildings for condos and rentals are going up everywhere you look downtown.

With cap rates on most deals still ranging from six to eight, you can assume more and more capital will move into real estate as bonds begin to sting more, and rate-starved investors look for the next pool of investment capital to exploit.

The bottom line is that there are tens of millions of kids who will move out of mom and dad’s house over the next decade, and our shrink-wrapped, Fedex style economy with little supply in the pipeline is not ready for the housing demand wave that is coming with it.

Speaking of Money

More good news; we have more of it than ever before.

Even as asset managers and investors alike see their sentiment swoon as though a multi-year bear market has already unfolded, wealth has reached levels never before seen in the US on an overall and per-capita basis.

Keep in mind that well before all the ink dries on the various charts showing these new data points worldwide, rest assured we will be told it's all really bad news.

Enjoy it while you can.

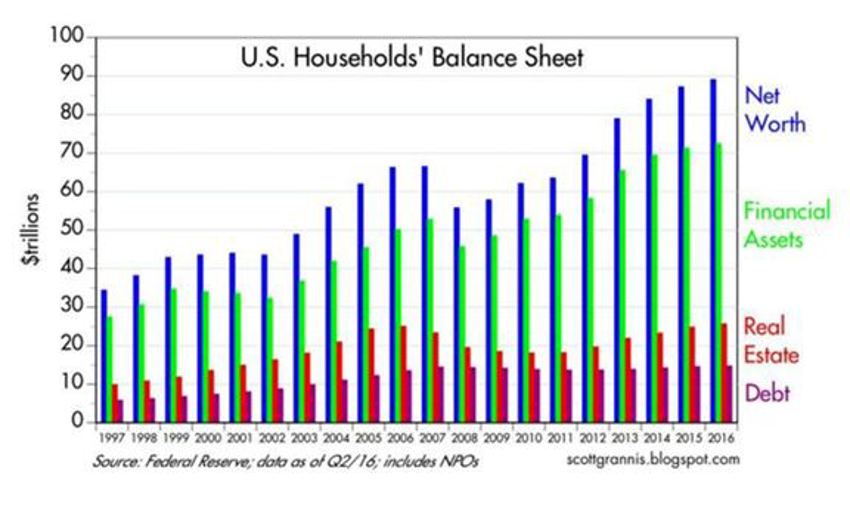

Scott Grannis of the Calafia Beach Pundit shows us that as of June 30, 2016, the net worth of US households (including that of Non-Profit Organizations, which exist for the benefit of all) reached a staggering $89.1 trillion.

And get this; that's about 40% more than the value of all global equity markets, which were worth $63 trillion at the end of June, according to the latest stats from Bloomberg.

Interestingly, household liabilities have not increased at all since their 2008 peak.

The value of real estate holdings now slightly exceeds that of the "bubble" high of 2006

And, obviously, financial asset holdings have risen since pre-crash levels, thanks to the $9 Trillion in savings deposits and gains in bonds and equities alike

One last thing. You may recall back in housing bubble days that we were told our real problem was that we were not saving enough.

Well guess what, we fixed that item.

And now? Well, now they’re telling us that consumers aren’t spending enough.

If this twisted process of media expertise was not so sad it would be funny.

Hard to Ignore

Life in the U.S. has been getting better and better for generations.

While the naysayers and those who prefer you remain afraid of the future will tell you it is all about debt and bubbles, the facts provide a far more productive view.

The typical household has cut its leverage by over 30% (from 22% to 15%) since early 2009.

Debt as a percentage of assets is back to levels seen in the late 1980s.

Households en masse have been the beneficiaries of strengthening balance sheets over the past seven years with a cushion of the previously noted $9 Trillion now sitting idle in the bank.

Unfortunately, as social programs have expanded under very poor fiscal policies, our Federal government has more than doubled its debt burden over that same period.

The Bottom Line

Finding and focusing on relevant data in a sea of negative, gut-churning, fear-mongering headlines is today’s more difficult emotional challenge.

Think I’m kidding? Check this graphic from CNBC over the weekend:

And yes, that train is headed towards you to make sure you get the point.

Closing Thought for the Day

Stay focused on the proper horizon and the growing portions of our economy.

This "weak recovery" is far stronger than most understand it to be. Even though it’s messy at times, we do continue to overcome many hurdles.

And remember that the momentum is being driven by a very significant and rare “economic baton shift” from the Baby Boomers to Generation Y in a very long race.

If we can focus upon the areas of the economy that are growing, and which have vast channels of demand in their pipelines, then we can begin to step back far enough from the markets to escape the emotional hand-wringing.

And keeping the Barbell Economy in mind helps simplify the noise and even work to eliminate some of it.