The Law of Large Numbers & Small Businesses

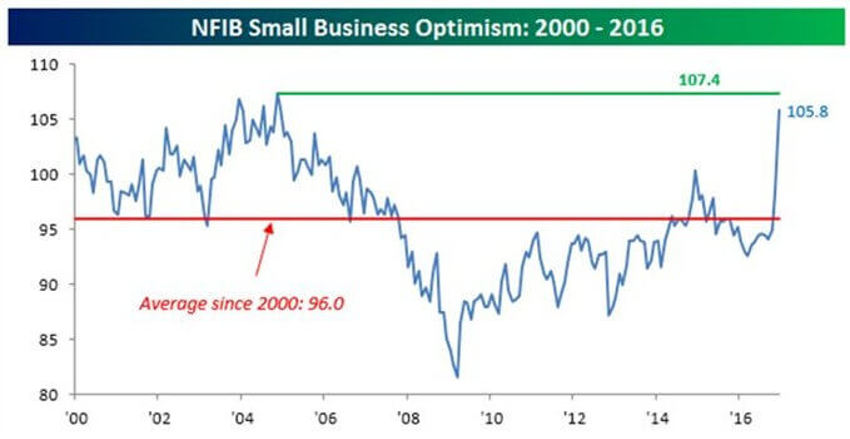

Beyond the political noise, one of the most important developments this week is the chart (above) on small business optimism in the US.

Granted some of this spike might be a bit premature but the value of this will likely be underestimated in our “bad news is more important" world.

We all know small business is the major driver of key economic activity.

We also know that the regulatory and Obamacare burdens of the last eight years have been especially hard on the smaller business community.

I have a hunch we can be confident that the newfound optimism beginning to show up in many places along the economic bell-curve of activity will not be a short-lived event.

Yes, there will be hiccups along the way - but this is looking more and more like the early 1980s as each day passes.

Correction in Time?

After two bear markets, several one day crashes, the Great Recession and the mind-splitting political shift, the last 15 years could quite easily be defined as, “An ugly set of downs,” like every time we hear the word "correction."

After all, a correction is what everyone seems to wait on anytime the market has more than a few weeks of uptrend in prices.

And it seems any movement above the centre line smacks of over-valuation, while many still remain foggy over the idea that the market has travelled upwards over 12,800 points since March of 2009.

Here’s the thing though: Corrections often arrive in a time perspective rather than price one.

And you could argue that this was the case for a greater part of 2015 and 2016.

While the year finished strong after the election, it’s easy to forget that just three days before the vote, the S&P 500 closed right where it stood in early April 2015!

Pretty shocking, but true.

And we may find that was our "correction."

Also, while I have made my hopes clear in that we do get some sort of shakeout before the effects of the new Trump promises begin to take shape, a pause and extended chop is just as likely.

Hence, we could flip a coin as to whether we get a correction in time - or in price - or maybe a blend of both.

Why think about this?

Well, because secular bull markets tend to be notorious for teaching us lessons about the most painful elements of the recent past.

In this case; what a "correction" looks like.

Markets will tend to do this until the next bear market when the investor audience will have long forgotten their fear of stocks; teaching us yet another new lesson about corrections.

Today might be the first day the bears can get a hold of something and move the ball back down the field a bit, which would be a healthy thing to happen.

The risk?

We may find emotional reactions will overlook this. The normal range over the years has been well over a 1% move from top to bottom on any one day. These days, this would imply 200-300 points on the Dow Jones.

So, the last mention here would be to not let the law of large numbers fool you.

For the advisor helping their client through this process as Inauguration Day approaches, it simply highlights again the purpose and value of patience and discipline.

Corrections will come and go. There will always be a few sectors in the market taking it on the chin more than they should – and quite importantly too – and a few sectors getting far more praise than they should as well.

I like to put it this way: It's never as bad as it looks or as good as it feels.

Patience and a focus on the long-term objectives help a client redefine their emotional concerns and perspectives about risk.

This is where their plan is vital.

Earnings Season Dead Ahead

Ok, so it’s good to see optimism perking up even as we stand by the idea that we need to assume all steps will not be perfect in the first 100 days. In the end, no matter who is President, businesses need to produce profits for growth and expansion.

On that front, before the election we had already highlighted the passing of the "energy correction cloud" that had masked so much of the internal growth for other sectors in 2015 and most of 2016.

It’s likely pretty safe to assume that the recovery continued into Q4-2016, as we should soon begin to see in the seasonal confessions.

Dr Ed Yardeni reminds us that analysts currently expect Q4 earnings to come in a little over 1% below those of Q3.

As is the case for most quarters in the last 5 years, analysts tend to downgrade prior to reporting only to see "surprises" at reporting.

While it appears on the surface to be a series of negative expectations, it does stand 4.5% above earnings from one year ago.

On the positive side, this would be a slight increase from the 4.1% YoY growth rate seen in Q3.

Keep in mind also that forward earnings and revenues for all cap levels are at record highs and have continued to inch into new, all-time highs for many weeks now.

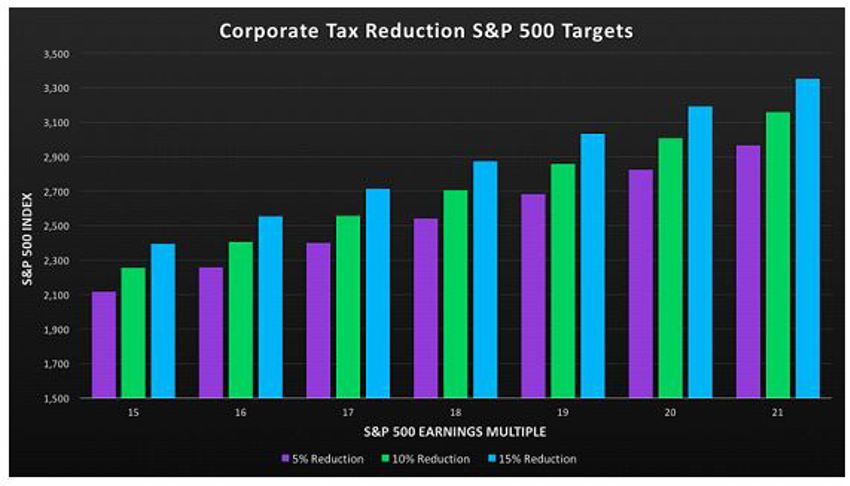

I would lastly remind you that most of these expectations currently do not bake in any improvement in tax rates, repatriations or the like as we still have to await what is real and what is not.

See the chart below to give you a sense of where S&P 500 earnings would go and what types of price targets would exist based on corporate tax reductions ranges on the horizon.

The hunch here is investors likely see this as more of a 2018 event for real bottom-line dollar improvements:

The Bottom Line

Let's remain focused on the larger picture at hand. Improvement is seeping into the picture from many channels now, and in time this will serve us well as positive reinforcement cycles can take hold.

Stay focused on the Barbell and America’s fantastic demographics (world-leading by developed-economy standards).

Its pace of growth should continue to surprise as we move forward into 2017 and beyond - but only for the patient investor.

And don't be afraid of setbacks. In fact, we should expect they will continue to be a part of the landscape.

We should pray for a correction. The stage is set to teach a new set of lessons.

Long-term investors might further want to be prepared to take advantage of the often emotional, short-term reactions as the upcoming Q4 earnings season begins.