The Largest Market Bubble Since 2009

We’ve been wrong.

Dead wrong.

The pace of earnings dropping to the bottom line is happening far faster than even we expected.

And I am pretty sure we had a fairly rosy view of things.

Now, some of you may think that’s bad. Just remember you heard it here first (about 6,712 times), that this game is just getting started.

And just because emotions can cloud memories, this does not mean that every week, month, quarter or year is going to be "better."

Long-term trends include bad windows, and sometimes many of them. So, I fully expect some ugliness will interrupt this party at some stage.

It will hurt, feel terrible, make you doubt all your impressions and then it will be over.

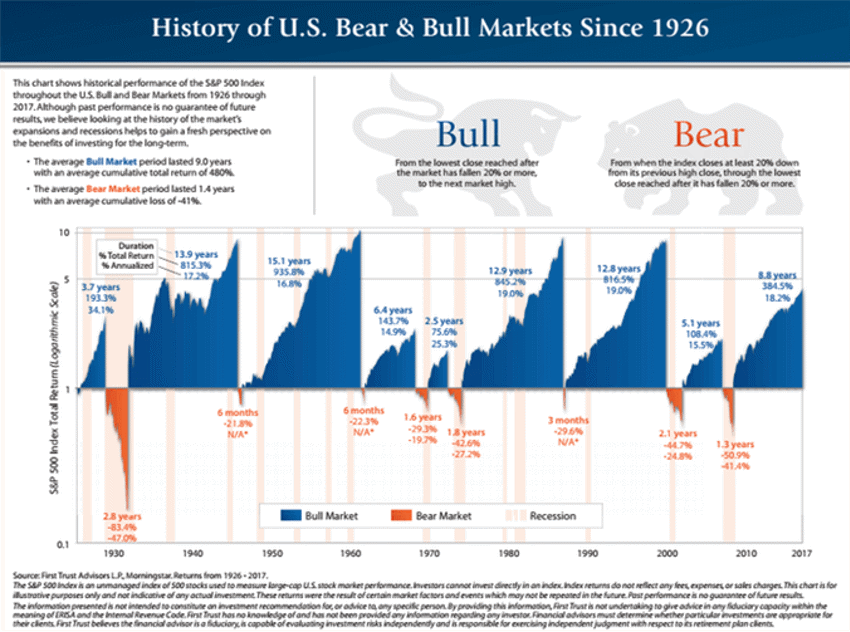

Simple rules for the chart above are:

1 - Blue is an image of bull market lengths and height of returns.

2 - Orange is for bear market lengths and depths of losses.

3 - Notice how much blue there has been since 1926.

4 - Now see how much orange there has been since 1926.

5 - Finally, ask yourself this question: "Why am I always worrying about the orange?"

But Mike, Rates Are Rising!

Yes, that’s true.

The economic patient is out of his coma and being weaned off all those meds. But that’s not a reference to “easing” or any other Federal Reserve-style actions. It’s the air in the bubble of fear slowly beginning to seep out.

In my opinion, the fear bubble since 2009 has been the largest bubble of all time.

Still, too many folks will assume it was QE or something of that sort that has led us to this point. It’s not. The easing process was totally misunderstood by 99% of investors and experts. It was never "keeping rates low" and it did not "ignite a firestorm of inflation."

And it was fear that caused “standing room only” at bond auctions all over the globe for years and years, and led people to horde nearly $11 Trillion in US bank accounts for a rainy day.

Everything that "works out" and everything that "doesn't work out" in the investing work always carries risk.

Period.

No amount of worry or fretting over it will change that fact.

But it’s those who get caught up in trying to avoid it altogether who end up losing out and stuck in a bubble that only usually bursts when the real opportunity has passed on by.