The Inflation Ghost

The US Federal Reserve just doesn't seem to get it.

The experts have missed it too.

And most of the financial talking heads are almost always behind the eight-ball.

So what is it that they miss?

Simples: Inflation being snuffed out.

History has taught us that a growing, fully-employed economy must end with out-sized inflation.

And I use the word "end" because what usually happens next is the Fed is forced to raise rates (the bond market always does it for them first) and subsequently "kill" the growth curve.

Then, a recession sets in and creates the base for a makeover and a fix.

Kind of like a 1,000,000 mile check up on your truck.

But here’s the thing:

- First, history never met Generation Y, and

- Second, the events during 2008-2009 created so much pain that success was nearly assured.

The Lesson?

Markets and economies are funny beasts. They’ll twist you and turn you until your brain is fried, causing you to chase ghosts down dark alleyways in your mind.

But only until you think you’ve found the reason, and then the problem no longer exists. Or it turns out never to have been a problem at all.

Case in point: The inflation ghost.

The US Fed is sure that it’s coming. The experts have chanted of its risk for years into this "weak, stagnating recovery."

But here’s the deal: They have misunderstood inflation and are unwilling to respect the idea than things change.

The tools being used to measure inflation today are (finally) beginning to just scratch the surface of the promises of the Internet that so many were feasting on in the late 1990s.

As such, their impact and long-term trajectories are most definitely being misunderstood.

Add the massive force of Generation Y as fully-tooled up and having been brought up on nothing but technology - and you can begin to get a sense of the forces pressing against the re-ignition of the inflation monster.

This is all capped off by the massive - and still growing - cash hoard sitting in bank accounts across the land that fears anything that moves in the market.

How Does One Know?

Look no further than the bond market for the answer.

Generation Y has set the stage for years of a fully-employed economy steaming forward on a steady clip, with rates staying far lower for far longer than currently perceived by many.

We are setting records in GDP output, manufacturing, finding oil, creating new tech and blasting into new highs in earnings.

Yet we still fear so many things.

And if you think I’m kidding then check the stats on bond rates below.

These bond folks are not fun guys to be around. When they sniff even the remotest chance of a whiff of inflation and rates move up, Fed hike or no Fed hike:

Want More?

Check the latest data on mortgages.

They just hit new yearly lows:

And this is all within hours of manufacturing data and ISM data reports showing we are hitting highs!

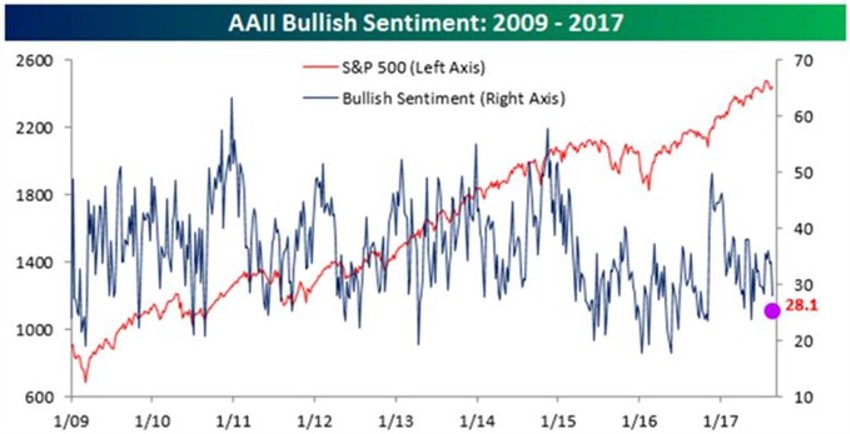

Then, right on right on cue, the AAII Bullish sentiment was toasted by the 2-days of selling in the last week.

Note in last week's reference to this data I hinted that a little bit of harsh selling should snuff out the bulls quickly and that the “20s” were right around the corner.

And then:

I hope you’re getting how good all of this really is for the long-term investor.

Once again there are more bears than bulls by a solid margin.

And to cap off the sentiment story we have 72% of the crowd either bearish or "confused."

And that is all good for summer swoons becoming valuable gems instead of mortally feared events.

Remember: People drive markets. Ignore the fear-mongering as much as you can.

And focus on demographics not economics.