The Ghosts of Debt Concerns Past

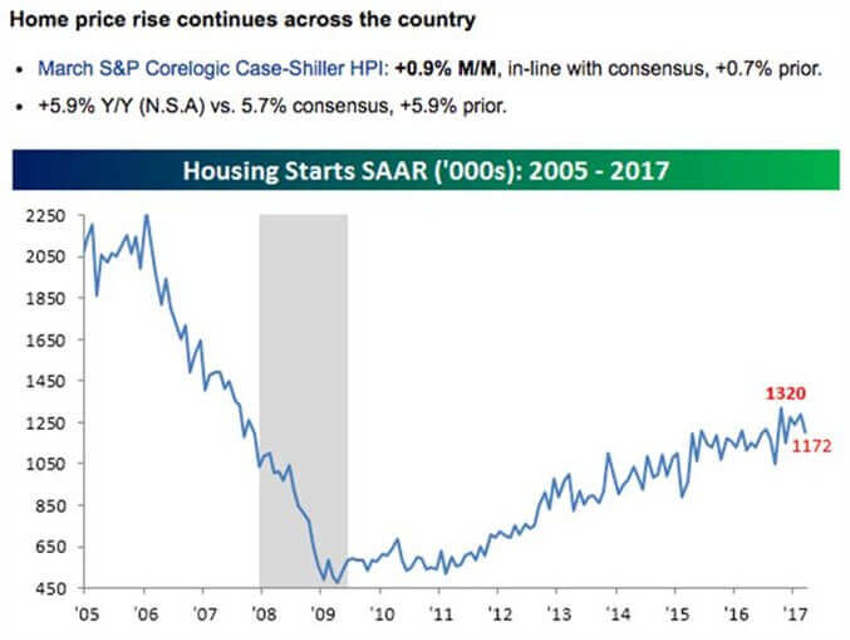

Have a look at the latest data on homes in America – we’re already running out of them:

Over the next 10 years or so, approximately 60 million “kids” in the US will be looking to make their first home / residence investment - whether it be renting an apartment or buying a condo or home.

Sure, styles will change but the logic doesn’t.

Prices are rising because we are already running out of inventory. Talk to a broker; we’re seeing depleted inventory levels like we’ve not seen in decades.

And the good news?

This new game has just started. In fact, we’re still a few years away from the really busy part, which itself is expected to last for 15 years or more.

By then we won’t have built new homes in appreciable numbers for 20 years or so, and a severe scarcity of housing is set to arrive.

Residential real estate prices will soar, and labour shortages will eventually force wage hikes even as we bring in the most deflationary force the world has ever known: The entirety of Generation Y!

In another few years, the "middle class" standard of living will soon begin to see a slow reverse from its perceived "decline."

It was always about people a demographics and never about politics.

Alongside housing, annual GDP growth is set to return from the current subdued 2% rate to near the torrid 4% seen during the 1990s.

And in case you’re wondering, we might safely assume the stock market will be set to surge in this scenario.

Share prices may rise very gradually for the rest of the 2010s as long as tepid 2% growth persists - but a three to four times multiple over the following decade is within reach - for the patient investor.

But as much as we focus on people, this is not just a demographic story.

The next 20 years is set to bring a fundamental restructuring to many sectors of our economic infrastructure as well.

Start with Energy

The latest data shows the US needs only produce another 150,000 to 200,000 barrels a day to take the lead over Saudi Arabia in global oil output.

Can you believe that?

The roughly 100-year supply of natural gas discovered through the newest "fracking" technologies will finally make it to end users, replacing coal and much of oil.

We already know that new (even cheaper) fracking technology applied to oilfields is unlocking vast new supplies. Since 1995 alone, the US Geological Survey estimate of recoverable reserves has ballooned from 150 million barrels to 8 billion.

And OPEC's share of global reserves is collapsing.

Meanwhile, as noted here many times before, Detroit is changing with Gen Y engineers flowing in - and automobile efficiencies are rapidly improving:

- Mileage for the average US car has jumped from 23 to 24.7 miles per gallon in the last couple of years with targets or 45 - 50 mpg by 2028.

- Total gasoline consumption is now at a five-year low.

- Alternative energy technologies are building their contribution in important but overlooked ways in states like California, accounting for 30% of total electric power generation by 2020.

Before we know it, all of this will build into its final stage: Shifting the US from a net importer to an exporter of energy!

This will have significant and hugely positive implications for America's balance of payments.

By eliminating America’s largest import and adding a vital export, we will all be surprised by how quickly some of the ghosts of debt concerns past will collapse into the dust bin of time.

Accelerating Technology

Generation Y kids and engineers will bring new and expansive tools.

And it’s feeling more and more like Star Trek as the years move ahead - new technologies at the enterprise level are already enabling speedy improvements in productivity that are filtering down to every business in the US, and lowering costs everywhere.

This is why corporate earnings have been outperforming the economy as a whole by a large margin, surprising many who are either still unaware of these shifts or unwilling to embrace them as real.

And profit margins are at all-time highs.

Even so, at lightning speed thousands of new technologies and business models that we cannot comprehend are under development.

When the winners emerge they will have a big cross leveraging effect on the US economy.

New health care breakthroughs will make serious disease a thing of the past - technology is leading the revolution in research – and in 20 years it’s likely that many types of cancer will be managed through a prescription you get at the pharmacy.

And the US is overwhelmingly in the driver's seat on these innovations.

More Political Change Ahead Too....

The political gridlock in Washington can't last forever.

Eventually, one side or another will prevail with a clear majority, allowing the government to push through those necessary long-term structural reforms - the solutions for which everyone agrees on now, but nobody wants to be blamed for in fear of votes.

Hopefully, the national debt then comes under control and we don't end up like Greece.

And the long awaited Treasury bond crash never happens as the Fed becomes more aware of crowd fears.

In Summary

There’s a great deal to take in right at the start of the market’s summer haze, and it’s well worth keeping yourself aware of what sits on the horizon.

And even though some of the main drivers of these events won't kick in for another five, seven or ten years, the markets will begin to discount them well in advance.

The risk now is the same as it was in the early 1980s.

But if you wait until it’s all crystal clear, the bulk of values will have already been built.

Perhaps this is what the essentially uninterrupted rally in stocks since 2009 has been trying to tell us?