The Ghosts in the Stock Market Machine

Halloween may still be several weeks away but there’s no shortage of ghost sightings out there amongst the investor herd.

Imagination is the enemy, and they’re clinging to theirs fear like it was a security blanket.

And it’s all being fed by the expectation that this is a time of year when we usually see sloppy, downward sloping activity in the market.

(But that’s bordering on the invisible as well.)

Sure, internal chop and some sector pushback has drifted in and out of our measures, but nothing to confirm the seemingly endless reasons things could have been worse.

Regardless, soon the calendar headwind will turn into a tailwind, and it’s pleasing that while as terrible as Harvey and Irma were, the economic impact in the warnings window still appears very light.

That could all change of course, but thus far we’re hearing few moans and groans.

In fact, in the last week we’ve seen trains, ports and truckers data as very positive. GDP moved higher on the latest read this morning, beating expectations. And alongside, profits for Q2 were also revised higher. Cap that off with a new all-time high in Transports, and even the Dow Theory has erased the 483rd fear about the two averages not confirming each other.

Now have a look at that last entry above.

It’s intriguing to see how multiple regional readings (post-hurricanes) have each added a note to acknowledge they’ve not seen pressures from the storms.

That’s all good news, by the way.

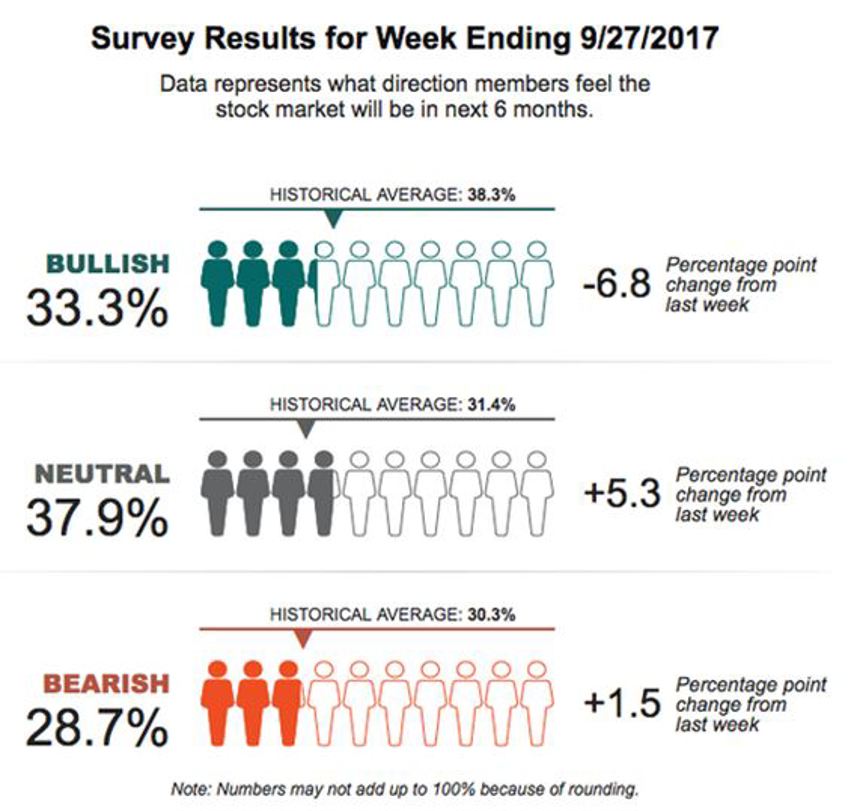

As such, you might expect all those AAII bullish sentiments to finally - after nearly 16,000 points of rally since March of 2009 – emerge from the darkness of long-term negative sentiment.

Buuuuuuuuuuuuuuttt no!

That bounce we saw last week evaporated quicker than rain drops on a hot summer day in Florida:

Contrarians of the world are still pinching themselves.

Here we are on the brink of yet another record setting quarterly earnings parade, record GDP output, record household net-worth and record cash flows, and still a full two-thirds of the investor audience is not bullish!

(Please give me a couple ugly days in the market.)

If we get that wish, my hunch is those bulls will be rampaging back into their foxholes at lightning speed - not to be seen or heard from again for another few thousand points.

Now, I jest (but only slightly).

We’re witnessing historic aging of the highest levels of remaining "economic uncertainty."

I love that phrase, by the way: “economic uncertainty" because it sounds smarter than “scared sh$$less.”

Folks, investing, the markets and our economy are always uncertain, and the future is always cloudy.

Think about it. A hundred years ago when the Dow Jones was 81, the future was just as cloudy as it is today.

And for anyone keeping records, seven more weeks of this and it will have been a full three years since the last time we saw bullish sentiment over 50%! And it’s all due to ghosts in the stock market machine.