The Ghost in the Bull Market Machine

There are literally hundreds of reasons that are now being created for why the market is falling back a bit.

My response to this, as I’ve noted many times before, is that we will all need to get accustomed to larger numbers, as four-digit daily stock market index moves are a “sooner rather than later” possibility.

I’ve also said repeatedly that this, unto itself, should not be cause concern, because while the numbers get bigger percentage falls do not.

So why is this happening?

Well, the simple answer is that things have gone up for a lengthy period of time. So, a rest is normal.

What is not normal is the emotional reaction of the crowd.

Consider it was only recently (3rd week of December 2017) that we broke a three-year record of not seeing a majority bullish reading (above 50%) in the AAII sentiment data.

That’s three years running, folks, during which the crowd just could not get bullish even as markets basically rose.

And now here we are, and the moment something goes “red” in a significant way, the crowd looks to exit very, very quickly.

Driven by?

Somewhere in all that mess is this mental suggestion that says: "Gosh, I waited for years to feel safe again and for the markets to go up. But when I finally decided to step back in, a month later and the markets are back in turmoil again! Get me out for good this time...."

Now, I am poking fun a little bit but the underlying theme is not too far off from what a whole bunch of latecomers are likely feeling of late.

And how do we know they were latecomers?

Well, it’s highly likely the final break to a majority of bullish sentiment, and the break of interest rates to the upside alongside a heavier flow (not seen in years) into equity funds, was not all an accident.

In simplest terms, they felt good again.

They had managed to chase away that emotional grim reaper of humiliation that comes with short-term stock market investing, and makes you imagine the worst possible outcomes.

For me, well, I’ve been praying for red ink like this for a long time.

Why?

That's because bull markets last longer when they are intermittently interrupted by emotional misperceptions of reality.

Ghosts are embedded in every bull. They serve a purpose, they create doubt, and they rebuild walls of worry.

As Warren Buffett says, "In the short-term, the market is a voting machine. In the long-term, it is a weighing machine."

We are now witnessing the emotional voting machine at work.

Make no mistake, for those of us old enough to tell you about portfolio insurance in 1987, the VIX, ETN, ETF influences today smell, sound and quack just like them.

The commonalities are very real.

Speaking of real, some of the VIX ETN "tools" are already blowing up.

Here’s the data:

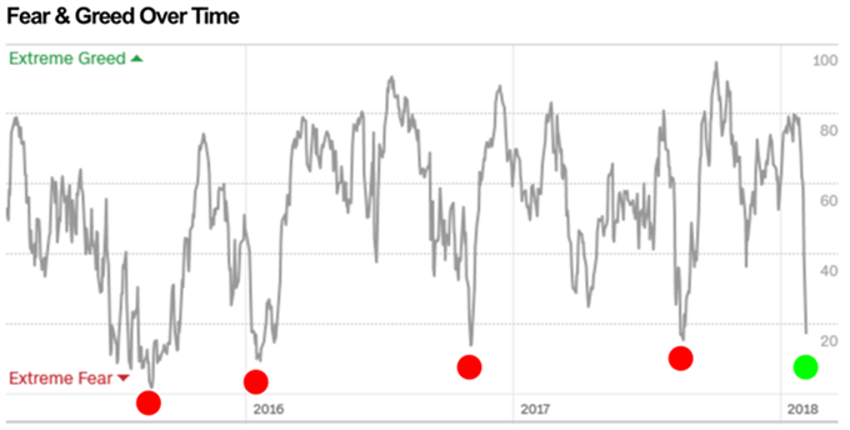

The first chart above is the CNN Sentiment Index again. Quite a near-term change towards extreme fear, eh?

In the second chart we gain more perspective. I’ve marked the last few lows in red. All of them were many, many market points lower than we stand now.

The green dot is marking our most reading (at the time of writing). That will soon become yet another low on this multi-year snapshot. And as the emotional surge of fear works through the system, its impact will burn off as well.

Keep in mind that a 1,000 point Dow Jones downward movement in a matter of less than an hour is not related to a fundamental issue with an economy.

We are very early in the Barbell Economy game, where the Baby Boomers are handing over the economic range to that much larger age cohort, Generation Y.

The overly-bullish crowd running on pure emotion will be pushed back by even a small dose of stock market red ink.

One More Note on Emotion

The VIX ETN's have caught too many newcomers off guard.

So, what is the VIX telling us now?

Going all the way back to 1990 in this data set, there is now only one reading of the VIX (fear index) which is higher. You guessed it: 2008-2009.

Folks, the emotional reality is this:

a) Sometimes there is no "reason" people get nutty and emotions skew way off course for a few weeks, and

b) Nothing that’s been going on in the voting machine atmosphere of the last 8 days has caused dire consequence for the more important long-term weighing machine factors in place for years to come.

Earnings, Orders and GDP

Despite the frantic calls the economic news continued to be very positive.

The tax reform package seems to be lifting consumer spirits, since the future expectations component rose to 105.5 in January, up from 100.8 in December.

How healthy the U.S. manufacturing sector is at the present time? For November, U.S. crude oil production rose above 10 million barrels per day (to 10.038 million barrels) for the first time in nearly 50 years.

Jobs are solid and above consensus estimates. The big news is that average hourly wages rose 0.34% (9 cents) to $26.74 per hour, the strongest monthly wage growth in more than eight years.

Unemployment remains at a 17-year low of 4.1%.

Finally, while I am sure it will be revised somewhat as the quarter proceeds, the Atlanta Fed upped its forecast of first-quarter 2018 GDP to +5.4%.

Remember, after big annual surges, it is not abnormal to go for months and months without making a lot of headway.

And as much as it might not feel good watching it, I would not be at all surprised if we find ourselves in a neutral-zone for a bit.

But here is what Bespoke shows us in a nice little piece from historical numbers after all the market panics:

So, what does the above data tell us?

Well, when the sell-off began last week it put an end to the S&P 500's longest-ever streak without a 3% decline from a closing high.

This latest streak ended at a mind-bending 448 calendar days on January 26, 2018, eclipsing the previous record of 370 days that ended on December 13, 1995.

There have been only eight times in market history in which the index went over 200 days without a 3%+ pullback.

In six of those eight times, the market was significantly higher a month, a quarter, six months, and a year later.

That’s what the numbers above tell you.

As such, maybe we should be thanking our lucky stars for this dip, and be grateful if we can get more of a corrective wave to drive away all the good feelings again.

The VIX tells us that the wall of worry is solidly in place...and that is good.

Let’s just hope the ghost in this bull market machine keeps scaring its way forward for the next few years.