The Game has Just Begun

Last Friday, right after the good news on the employment numbers arrived, the media spin turned almost immediately negative.

And that’s good news.

Along with the recent terrible investor sentiment numbers, following just a week of low percentage pullbacks from record highs, it makes you want to pray for the bad press to continue.

That’s because the odds and history suggest that by the time you finally see this negative sentiment tide turn, with both the investor audience and the media throwing caution to the wind by finally realizing things are better after all, markets could be so much higher that it will be scary.

Think about it for a moment; they were not even a tiny bit excited about the first 14,000 points up from the 2009 lows.

So how do you think they will feel about the next 14,000?

Like I’ve said in so many notes before; don't think old, think young. In fact, think of it like this is just the beginning of the game.

The Bad News

The reality is that the US employment figure was just “ok.” And then this headline popped up:

"Unemployment fell in February, but a more realistic rate remains much higher"

To that I would add: “You’d better hope so."

That’s because we have massive demand headed our way, and we’ve spent too long "becoming productive" and shrinking supplies in the pipeline (FedEx-ing our economy) that we are actually not ready right now for robust waves of demand. Just check the data on US housing if you think I’m off base.

As such, America also needs the employment base to expand. So we’d also better pray those kids get done with that expensive schooling they’re doing real fast.

If not, inflation will be the new chatter from the US Federal Reserve. The risk then will become that the Fed will overreact by instituting too many hikes, too quickly and unnecessarily choking the golden goose.

And the reason I say this will be unnecessarily is because it will all fix itself if we just let things roll forward. New bodies will enter the workforce at six-figure starts. Believe me, the Boomers never had it so good and look what we created?

The next time you hear all the garbage about student debt, think instead about the salaries being created from that "investment" in school. They are the smartest generation to ever hit the system.

By example, think of trying to explain an iPhone 8 to your buddy in 1982. Then think this: The next 10 years will bring change at such a pace that your head will spin.

So be ready, be prepared, plan effectively, and stay focused, patient and disciplined.

The Barbell Economy is just beginning to rev up.

Back to That Bad News

So here again was that headline from above:

"Unemployment fell in February, but a more realistic rate remains much higher"

That report goes on to conclude:

"...relying on that one headline number as an indicator for the economy as a whole ignores import information just below the surface.”

“Each month in America on ‘Jobs Friday,’ the US Bureau of Labor Statistics puts out a trove of economic data, each of which provides its own perspective on the labour market and the employment situation.

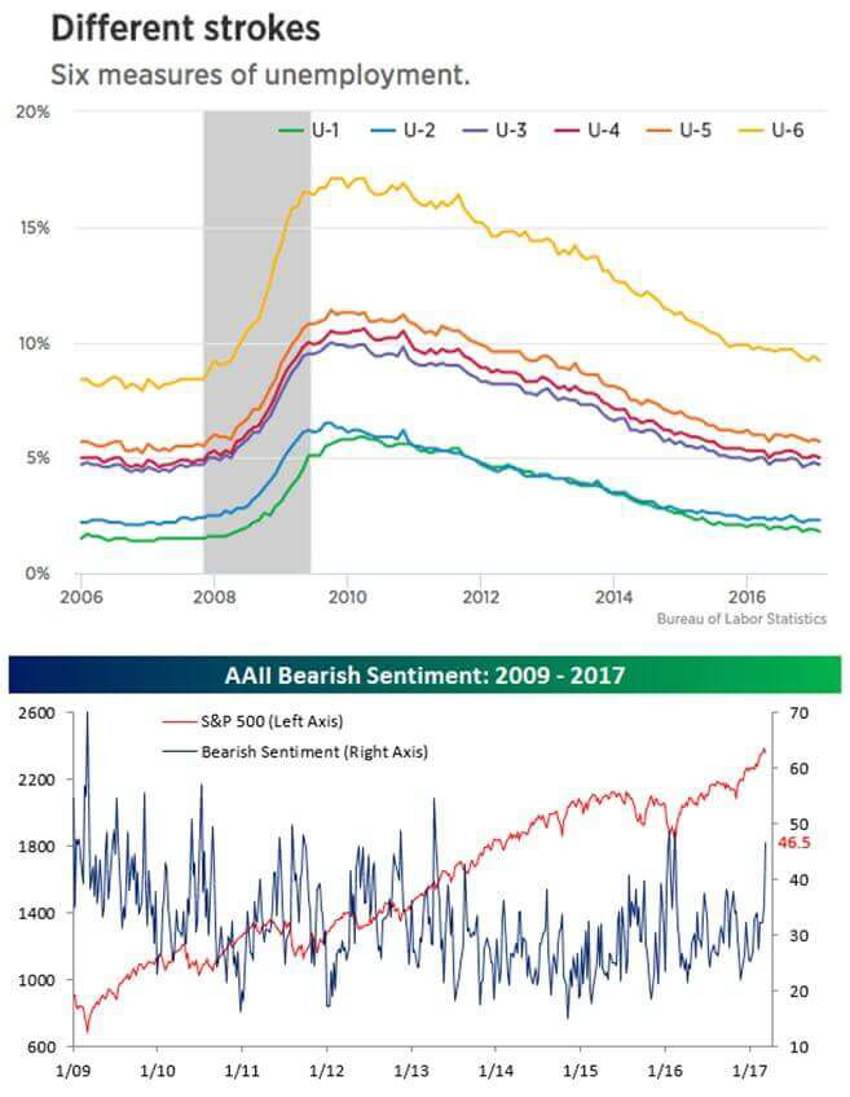

“Economists look past the official unemployment rate — that 4.7 per cent figure, also known as the ‘U-3’ — to other metrics that give their own view of jobs in the country.

“One of those figures is called the U-6 rate, which has a broader definition of unemployment than does the U-3. In February that number fell two-tenths of a per cent to 9.2 per cent."

But here’s what the constant effort to create fear leaves out:

It has been like this since the beginning of time. In other words: Today is no different than it’s ever been.

In fact, as the chart below shows you, today in nearly every level of the jobs data released is as good as it was BEFORE 2008-2009.

And no one was complaining then.

Companies have done a great job since 2009 in finding ways to grow more revenue without extra costs.

But while margins have expanded they now need new blood.

Think Generation Y…lots of them.

Yes, it is all those kids who we folks spoke of as lazy, staying in school too long, acquiring too much debt and living with their parents.

But all the pro-business plans and effects implemented now or in future are unleashing some 8 plus years of pent-up activity.

Don’t confuse politics and viewpoints with business issues. It will not serve you well. It’s not about Democrat or Republican. It is about bullish or bearish.

Look, we have two choices:

1. We can look at data through eyes of fear and react, or

2. We can look at data with logic, patience and discipline, and plan

The outcomes for each strategy will be dynamically different in most cases.

Always.....

It is always risky.

It is always scary for one reason or another. It is always dangerous, challenging and hard to read the future…that's why it's called "The future."

And if you’re sitting around waiting for these things to change, then I have two sad facts to share with you:

- You don’t understand the investing landscape, and

- You’re likely going to miss out on what’s coming.

The Big Picture

Sure, at times stocks will be in a soft spot. That shakes the loose hands from the tree and creates value opportunities for long-term investors with their eyes open.

As ugly as it feels listening to any press coverage, the United States is sitting in a wonderful spot. The fears of the past have all been birthed on the back of a market that has risen to new highs during all of this fear-mongering.

- The noise is getting louder and tensions are increasing

- Sentiment is falling quickly

- Stocks are pulling back slowly - but churning internally quite a bit more

And all of these are good things for patient investors who can discipline themselves to look beyond what’s currently being called a mess.

Our demographics are the most powerful on Earth for a developed nation. And the game has just begun.

Until we see you again, may your journey be grand and your legacy significant.