The Economic Eggshells Beneath our Feet

So here we are, less than a week from election day, and the eggshells are scattered everywhere beneath our feet.

It's hard to move forward without stepping on one, and it’s taken about 12 weeks but we are now between 3-4% off the all-time highs set in the summer.

FYI - We sent a video out back in September (you can view it here) to give everyone a sense of how the markets would chop around, and much of that has now unfolded.

And now the elections, US Fed policy, rate hike fears and an "extended election outcome battle" cloud the horizon ahead.

Investor nerves are shot, put-call ratios are weighted to the bear side, bullish sentiment has again disappeared, a wake-up call in the bond market has been issued and outflows from equity funds are setting recent records.

You can almost feel the tension and the sense of foreboding about bad things to come.

The Surprise?

My gut says the Fed will not raise rates in December.

Why? Well, the market has already done that for them.

Better yet, if they do and then send a message that "lower for longer" is the name of the game then I suspect a rally will ensue as the testing of support is already underway.

Earnings Turn Continues

The Q3 earnings data continues to support the idea that earnings are turning and growing again.

So far, so good. Let's look at the data:

- Almost 62% of S&P 500 companies have finished reporting Q3-2016 results. The data continues to show stronger output when compared to both Q2 of 2016 and a year over year comparison.

- Dr Ed Yardeni highlights that of the 308 companies in the S&P 500 that have reported, 73% exceeded industry analysts’ earnings estimates by an average of 6.7%. They have averaged a year-on-year earnings gain of 2.1%. At the same time period in Q2-2016, a slightly lower percentage of companies (72%) in the S&P 500 beat consensus earnings estimates by a smaller 4.8%, and earnings were down 2.1% year-on-year.

- On the revenue side, 55% beat sales estimates so far, with results coming in 0.1% above forecast and 1.7% higher than a year earlier. At the same point during Q2, a slightly higher 56% was above forecast, exceeding estimates by a greater 0.5%, but results were down year-on-year by 0.2% instead of up.

Obviously, more Q3 results are coming over the next few weeks and we can assume these numbers will adjust. But the on-going read on the earnings metrics is encouraging and suggests that Q2 was the bottom for year-on-year revenue and earnings comparisons.

More P in the PMI

The other factor where we should see improvement, as the energy bottom completes its round-trip, is the headwind against factory output and the idea that is should begin to subside a bit.

This meshes with the latest data from the ISM survey.

Manufacturing activity grew again in October after contracting in August for the first time since February. In fact, it expanded at its fastest pace in a year according, to Markit.

ISM’s M-PMI increased for the second month to a three-month high of 51.9, after falling the prior two months from a 16-month high of 53.2 in June to 49.4 in August.

The production index (up to 54.6 from 52.8) moved further into positive territory after contracting in August for the first time this year, while the employment measure (up to 52.9 from 49.7) showed manufacturers hiring again after cutting payrolls in every month of Q3.

Meanwhile, the orders gauge (down to 52.1 from 55.1) deteriorated despite a slight improvement in new export orders (up to 52.5 from 52.0), which were in expansionary territory for the eighth straight month.

There was a further tightening in supplier deliveries (52.2 from 50.3); inventories (47.5 from 49.5) contracted at a faster pace.

Markit’s M-PMI rebounded to 53.4 (the highest reading since last October) after slipping the prior two months from 52.9 in July to 51.5 last month.

According to the report, a marked upturn in both production and orders accounted for the sharp rise in operating conditions, with domestic demand being the key driving force.

New export orders continued to expand, though at a slower pace than in the summer months, and employment increased for the 40th month in a row, but the pace of growth was modest and down from September’s data.

Speaking of Oil

Prices have slipped as we got a glimpse of what the OPEC "deal" looks like.

Supply spiked as cheating likely pretty much torches that deal in the coming weeks. These are short-term elements.

The larger issues remain the same; somewhere between $40-$80 is the new $110 for crude. And we stand by the idea that the oil market of the future will look far different from the past; it will become a smaller and smaller part of how we spend money.

Oil’s days of being a significant drain on costs or asset levels overall are likely over.

Falling under the "I just had to include this" column, note the snapshot above.

It came from a major financial website and greeted all visitors to that site yesterday, noting how November was starting off and how that was an equally bad sign for the "best six months" mantra.

This sounds much like the sell in May crowd and the January indicator.

Pretty soon there will be no good months to be an investor.

Oh, and I love the imagery: Smoky horizon, barren streets, gloomy day; it all feels bad right?

The good news, after trekking through all this quick sand (and scarfing down a few more fruit-flavoured TUMS) is that there is no good news around…anywhere. There’s no celebration, no parties, no bright lights. And there’s no chat about new highs, or ‘How long until Dow 20,000?' headlines.

Nothing is deemed good anymore.

And yet the data is not consistent with the ends of a secular bull market. So that tinge in your gut is a solid sign that we’re in the very early innings and should be hoping for a correction.

Is it boring? Yes. A struggle at times? Oh, yes.

But that’s the way it works.

In Summary

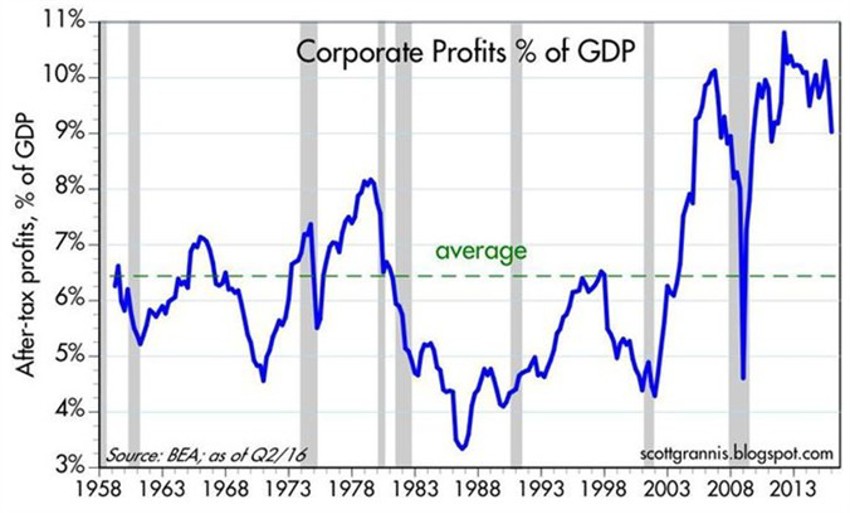

Businesses have been making huge profits during the current expansion (see the chart below), but not investing nearly as much as they could have.

If the US wants a stronger economy it needs to:

- Find ways to encourage businesses to invest more

- Lower taxes - we do NOT want to be the most expensive place to do business, and

- Reduce regulatory burdens - corporations have parked some $3 trillion overseas.

You can bet all that money overseas would be brought back in a heartbeat with a tax benefit deal.

Let’s think growth, instead of choking the goose that lays the golden eggs.

And if/when we take the weights added onto the back of businesses over the last eight years, we would/will likely be greatly surprised by the strength present in the underlying economy.