The Checkers in this Market Chess Game

Trump and the media seem to be getting very good at jumping from one problem to the next, with scant regard for what became of the previous issues.

Folks tend to forget that what we’re seeing today is actually the cumulative of previous events. The media, commentators, politicians and then the public are simply then moving those pieces around the chess board to make them fit their own strategies and perspectives.

In short, there are very few of those who are checkers of what’s gone before – providing a perspective to today in terms of the yesterdays that came before it – in this market chess game; any blame will do.

And any strategy without perspective can build to an ugly crescendo in an investment strategy, because it’s out of synch with what’s really going on.

But if we look beyond the noise, the corporate earnings season continues to move along nicely.

Now, let's be careful not to get ahead of ourselves, but the data so far looks pretty solid, and the rest of the world is improving too; slowly but surely.

Given the global reach of companies in the US, even a mild recovery the world over shows a solid ubiquitous bottom-line impact.

The S&P 500 and Corporate Taxes

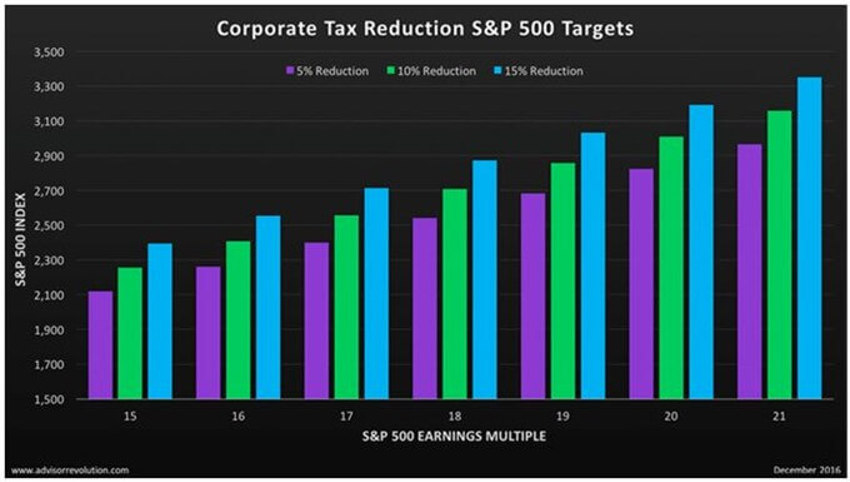

I’ve included a chart we did earlier in the year (below) showing what would happen to the S&P 500 based on various blends of forward multiples and the bottom-line impact of lower corporate tax rates. The numbers are surprising for many:

The Proposed US Corporate Tax Rate Cut

Trump’s one-page tax reform statement heralded a major league corporate tax rate cut. This is a biggie stateside.

Trump remains committed to lowering the federal statutory corporate income tax rate to 15%. And while the GOP proposed a rate of 20%, the 15% number would cost about $500 billion or so more over 10 years to the wonks that run the math.

Note also that most Republicans continue to want a repeal of the alternative minimum tax (AMT) on small businesses and individuals.

The paper also suggests business tax reform would include a “[t]erritorial tax system to level the playing field for American companies.”

This hints that US companies would owe US tax only on what they earn domestically. This is helped along by the one-time, much lower tax rate Trump wants on the estimated $2.6 Trillion (plus) cash hoard sitting overseas.

What’s not specified is the number of elements needed to really quantify what these cuts will mean. Without these details the media is unable to undo the effort publicly before they even have a chance to hammer it out internally between parties and behind closed doors.

And maybe that’s a good thing for all of us at this stage.