The Changes on the Way

I hope you got a chance to review the latest market overview video. If you have not yet grabbed a few minutes to do so - here it is for your viewing now.

Step Back

It's crystal clear that the investor herd and the media are still very focused on short-term events as the dust settles in from the election results.

It’s headline-winning stuff and many of the so-called experts are trying to parlay Trump’s first 10 days of limited activity into meanings and outcomes for the next 4 years.

This, of course, is absurd. It wastes a ton of effort and many of the assumptions will be completely incorrect.

Long-term investors must recognize that while all of this "short-termism" is unfolding, many internal shifts are being made in the markets: Dividends have gone from great to terrible; bonds have gone from saviours to sinners; a strong dollar is good not bad.

This is where we must be patient. Let everyone switch chairs around and then, once they’re comfortable, it will all change again.

The Point?

It’s the Holiday Season and the election sting for many is just receding. Fears are just below the surface and any confidence being built can be erased the first moment someone says Trump made a mistake, or that one of his picks did something terrible when they were like 20-years-old...and then all hell will break loose.

I bring this up because we ought to expect at least one or two of those types of events, especially given the highly sensitive nature in which the media doles out minute-by-minute news cycle coverage.

Let's keep our eye focused on the proper long-term horizon and remind ourselves that the Barbell Economy – the handing over of the economic baton from the Baby Boomer age cohort to the even larger group of Generation Y - continues to move forward for all of its fundamentally strong reasons.

Very few of the short-term issues now clogging the airwaves (and our minds) will mean much of anything as that freight train of demand heads our way; demand that will drive the economic growth profile for many years to come here in the US and abroad.

Larger Issues

If we can have the courage to make the US tax code work for business again, the amount of investment capital which would flow back into the States is set to be staggering.

Making the US something other than the most expensive place to do business will help us more than we can imagine on a global footprint basis. So let's hope that promise is kept in the first 100 days or so.

Good News

Interest rates have risen and the world has not ended.

We are back to where we were last year at this time in the bond market. The dollar is strong (I suspect it slows down or maybe even pulls back in 2017) but that was probably not happening because of the election.

It’s safe to assume that we were seeing a stronger dollar because the economy was improving already as it round-tripped the energy sector collapse and prices stabilized.

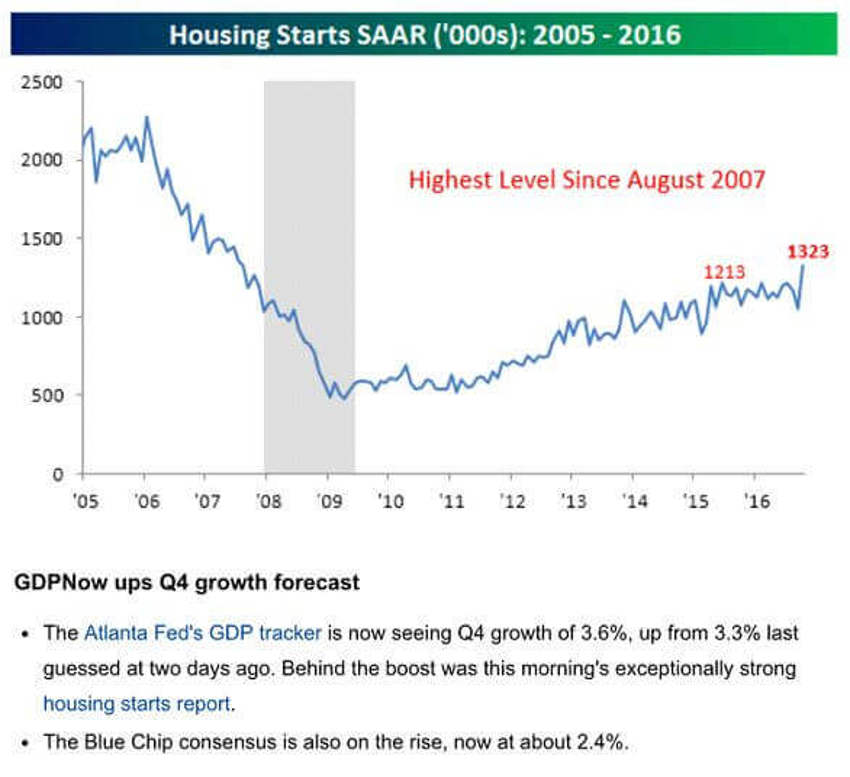

Check the data: Sub 2.0% GDP for the first half of the year, followed by Q3 readings of over 3% with GDPNow on Q4 even a bit higher.

My hunch is this is why rates have risen and the dollar strengthened. And that’s further supported by the fact that we are at new record highs in forward earnings and revenues.

And get this: Gen Y is just beginning its real push into our economy. They will change things in ways which are hard to imagine today. We are just hitting the late 1970s / early 1980s equivalent time frame today when it exploded into the economy.

In other words: Based on history, this economic power shift we’re seeing is in the very early stage.

Be patient, stay focused and relax a bit. Let the garbage in the news roll past you like a strong wind. And let the election results and associated "expert chatter" numb someone else's brain.

As we have seen so many times before though, these periods tend to be pauses along the way. Besides, long-term investors know that something is always hurting a few positions in the Barbell Economy framework.

Here They Come

In case you missed this late last week, US housing starts came in with a very positive bump up; October's reading came in at a SAAR of 1.323 million versus consensus expectations of 1.156 million.

That difference of 167K was the biggest beat relative to expectations since January 2006!

While Building Permits weren't quite as strong relative to expectations, in any other month a beat of 36K would have been impressive. But like I said, it's early.

Earnings Season About Done

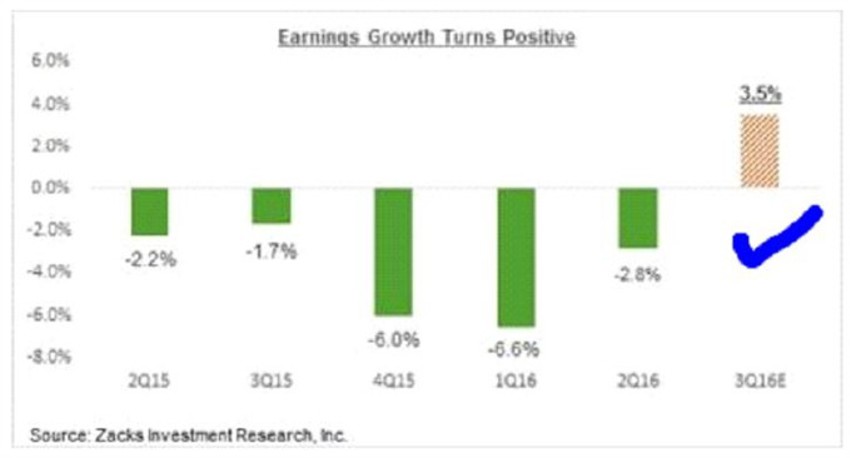

With 470 S&P 500 members, or 94% of the index’s total membership reporting their Q3 results, the numbers are far better than expected.

Remember how we started with assurances that this would be the 6th down quarter in a row? Not!

Total earnings for these 470 index members are up +3.8% from the same period last year on +2.6% higher revenues, with 73.2% beating EPS estimates and 55.3% coming ahead of top-line expectations.

Now, combining the actual results from the 470 index members with estimates from the still-to-come 30 companies, total earnings are expected to be up +3.5% from the same period last year on +1.5% higher revenues.

This is the best growth pace since the first quarter of 2015. The chart below shows the Q3 earnings growth contrasted with declines in the preceding 5 quarters.

So Stop Worrying…

Look, President-Elect Trump has a long road of tough work ahead.

Much of it will not be pretty and will cause stress in the system.

We saw this with Reagan as well - and we lived through it just fine.

US and global growth fundamentals are improving even as the news continues to scare everyone on a daily basis.

Staying back on your heels, always fearing the next shoe to drop is not how to participate in a secular bull market

Let's pay attention to demographics instead, and pray for corrections so you can all use them to your advantage based on your plan.

We're still in the early stages of Trump's policymaking and transformation process. With the generational power shift cycle repeating, it’s helpful to remember that most everyone wanted Reagan's head on a platter - and then what happened?

America is at its best when it has tough problems to solve and solid solutions to deliver.

We should not fear the shift required ahead as change both engulfs and improves the economic demand headed our way.