The Bulls Have Left the Building

The 2008/09 period was ugly.

Fear skyrocketed; lines formed at banks and waves of capital exited stocks and flooded bonds. In short, there was such a high demand for cash that the US Federal Reserve was forced to act by cutting rates.

Fast forward eight years (and 14,000 Dow Jones points later) and that pile of cash sitting in bank accounts tops $9 trillion – wasting away at nearly the lowest interest rates in history.

In that time – then to now – we’ve bounced from the Devil's Doorstep (666 on the intra-day S&P 500 low) to new all-time highs.

But investor sentiment hasn’t really changed. Sure, we’ve seen a slight awakening in bullishness of late, but as I’ve written repeatedly over the last few years, "just give us a couple weeks of red ink and I will show you a crowd as afraid as they were in March 2009."

And Then.....

Well, the red ink finally arrived. And we saw the markets roll down to about 2.5% off their most recent highs; but still higher than about 99% of all days prior to this moment.

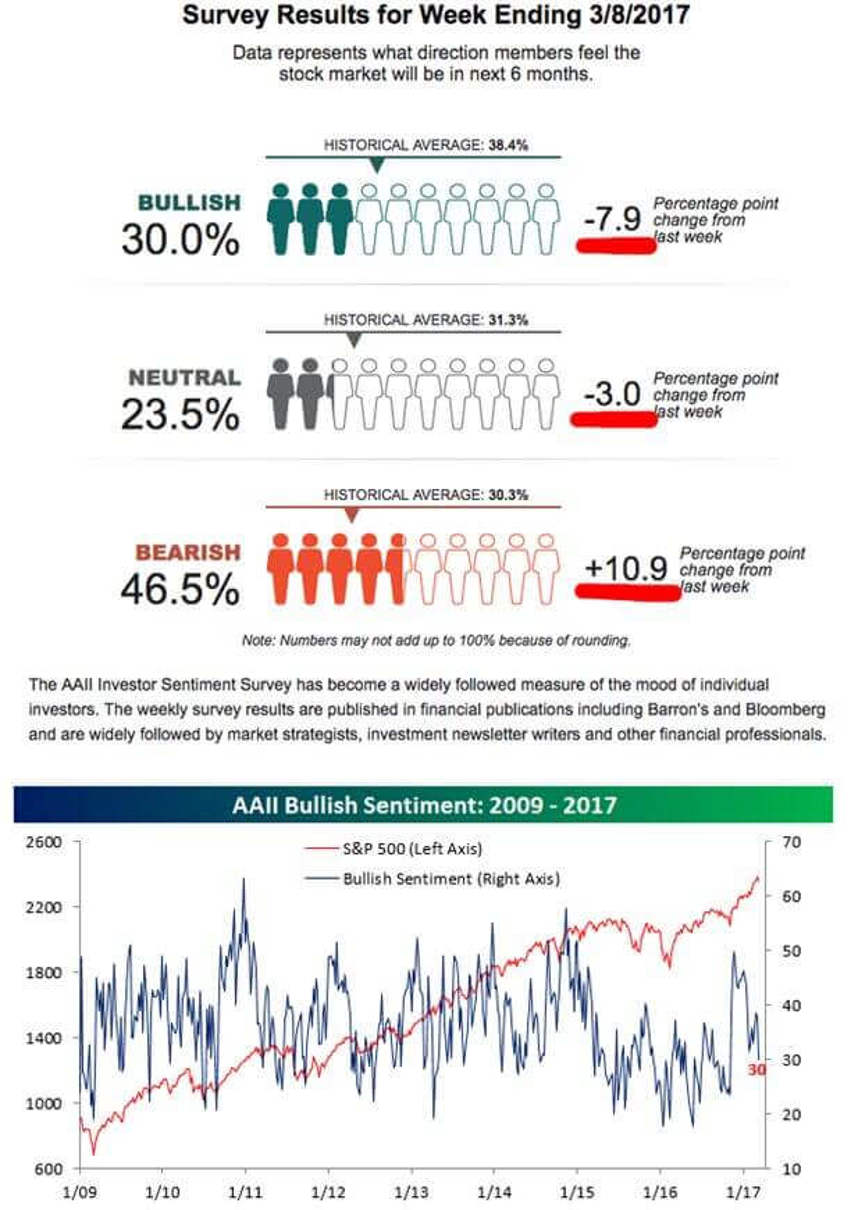

So what happened? Last week’s AAII sentiment data shows it couldn’t be better.

Let’s look at some pictures:

Note in the top chart that the neutral investor camp has all but left the building.

Now, at first blush you might surmise they went to the bullish camp after sitting on the fence for far too long, right?

Eh…well...no.

Instead, the neutral guys, along with a whopping 20% of all the bulls from last week, jumped ship together and all went bearish. Now we have 50% more bears than bulls, and 70% of the marketplace combined who now feel bad about the markets and their future.

These are the types of numbers you’d typically expect to see after major sell-offs, like those of 8,000 - 10,000 Dow Jones points ago.

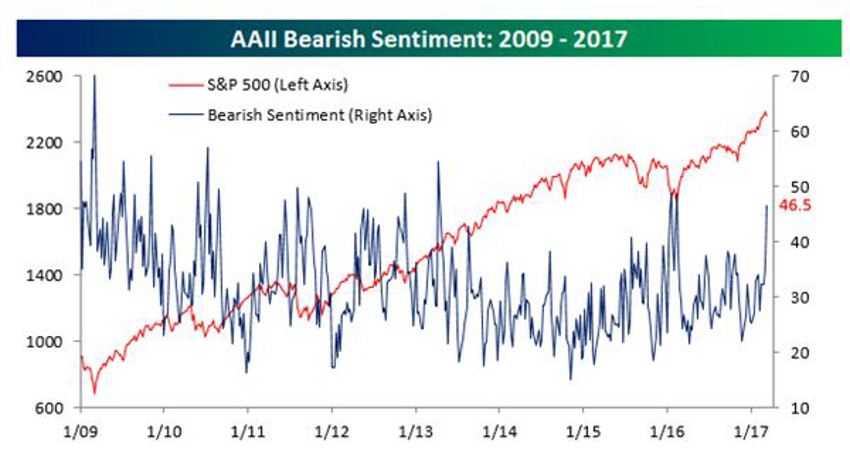

Look now at the next two charts above and see where we are today compared to years ago.

Bulls First....

By the way, last week's percentage is the lowest weekly reading in bullish sentiment since the week before the US Presidential election. In the record-setting award category it is the 114th week in a row without a majority in bullish readings.

You just can't make this stuff up.

Remember in March of 2009 – about 14,000 Dow Jones points ago - the percentage for bulls was 19.7%.

We are a mere 2% to 2.5% off recent highs and yet already within shouting distance of panic fear levels.

And the Bears?

You can see in the last chart above that bearish sentiment staged a big rally last week; the bears ramped to take up 46.5% of the crowd.

Of note: Out of the nearly 420 weekly sentiment reports since the panic low prices in March of 2009, last week's 46.5% is the 20th highest weekly reading!

Simply put, the market has completely fooled a vast number of investors.

And that remains a very good thing for long-term, patient investors who can discipline themselves to look beyond the noise and the negative consensus of opinion.