The Bull Market’s Protein Shake

If I hear anymore references to impending Black Swan events I think I’m going to be ill.

And folks, let’s keep in mind that the minute you start calling a prediction a Black Swan event, it’s no longer a “Black Swan.”

No one sees those coming.

In line with all the negative media noise about scary birds are the continuing poor sentiment readings.

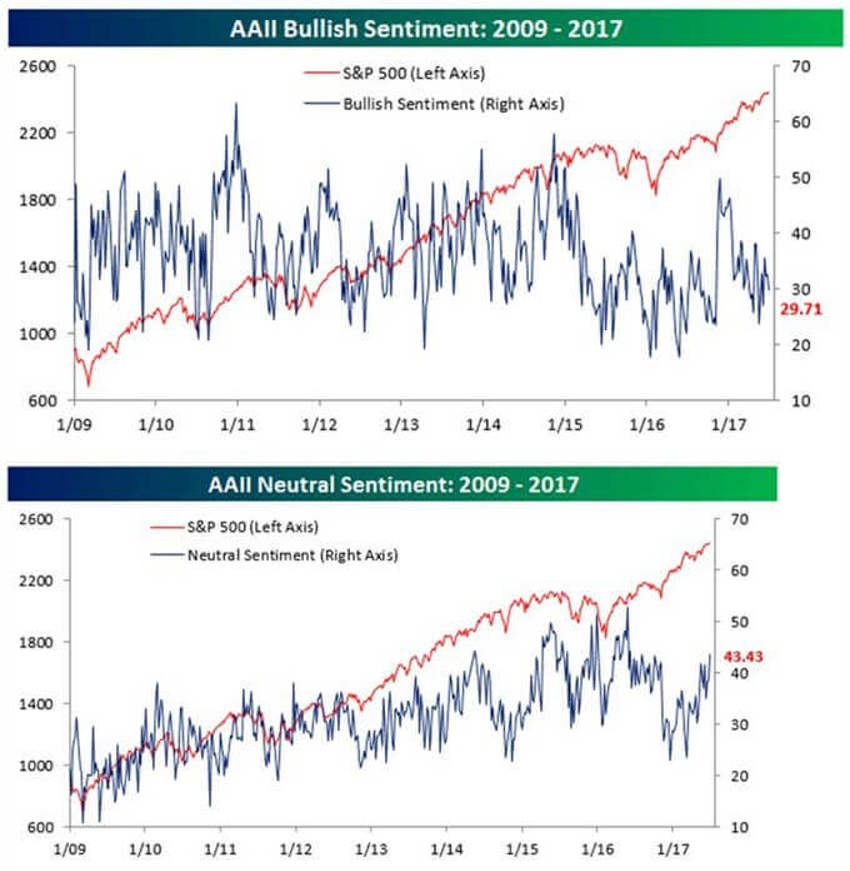

That’s good news. The latest bearish AAII sentiment data looks like this:

If the current levels of market chop continue then I wouldn’t be surprised to see bullish sentiment levels fall down into the “20s” again.

The first chart above shows the obvious: In terms of bullish sentiment, optimism declined this week falling from 32.65% down to 29.71%.

And in case you’re keeping track, that is now a record 130 straight weeks where more than half of the investor audience surveyed was not bullish.

But what’s really kind of striking is the "neutral camp."

Notice the second chart above. See where the current reading is now over 43%?

That’s the highest since August 2016.

In my experience, often these "neutrals" end up becoming “bears” on any little market step down, so it will be interesting to watch what happens with this week’s readings following Friday’s price action.

Here’s the classic reaction:

"Oh, I’d better leave before the summer swoon comes in..."

These are the types of bad mind tricks that we play on ourselves.

As I’ve said many times before: “When it comes to the long-term goal of building wealth, we have met the enemy - and they are us.”

Really Odd

Now, in a contrary investing sense, all this lack of excitement over the markets continues to be the very support for the lack of significant pullbacks.

The fact that a great many investors appear to be fretting over when "It" will come is actually acting like the equivalent of a bull market protein shake just now – it’s using it as energy.

And while all those shenanigans are unfolding, you may have missed several of the more powerful indicators coming out at the end of last week.

I’ve pointed out a few of them below.

But first, remember that I suggested we might expect to have some weak numbers merely because people will be on vacation.

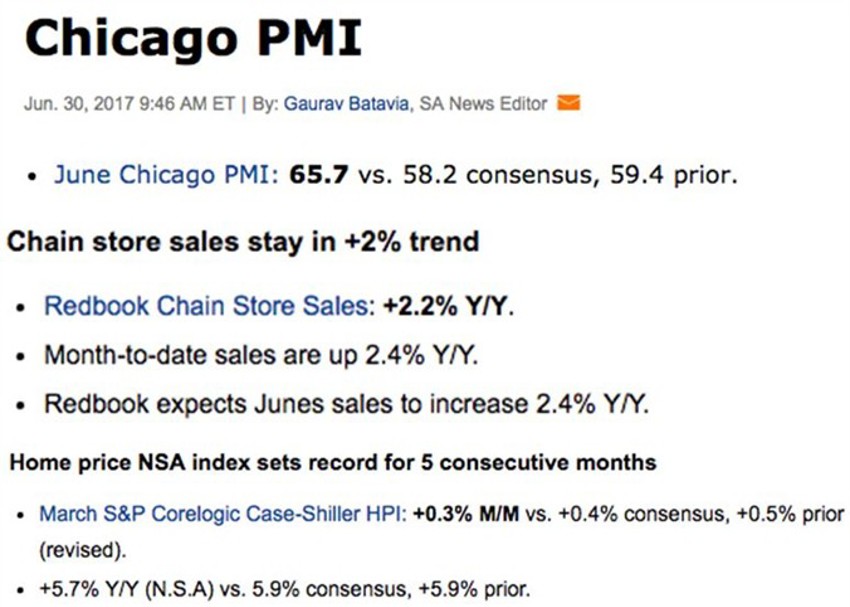

Ha! Well the good news is that didn’t not seem to bother the Chicago PMI data at all – It shows a big miss (to the good side, by the way).

And as for retail sales? Well, they’re just fine thanks:

So What?

Now, a lot of folks out there will sit and wonder at what this all means.

My two cents?

I have a hunch that the masses are waaaaaayyyyy over-thinking this process.

The data makes it clearer that significant growth waves are headed toward the US economy.

Why?

Simples! Lots and lots of people are becoming adults.

Now, we can disagree, and we can worry about how others interpret this data. And we can fret over minute-by-minute headlines. Or we can simply get on our surfboard, paddle out into the break and ride these waves.

Because they're coming.

The Barbell Economy effect – where the Baby Boomers are handing over the economic reigns to the Millennials of Generation Y – shouldn’t be ignored.

Those who chose to do so with this type of data back in the late 1970s and early 1980s were completely mystified by the 20-year secular Bull Run that followed in the 1980s and 1990s.

Today, based on the hard data of the sentiment results above, and the circa $9.3 trillion sitting on deposit in US banks, I’m fairly certain folks are trying to ignore it again.

Add in the massive rush still flowing immediately into bonds or bond funds on any 2-3 day setback in the stock markets, and you can cut the fear with a knife.

Look beyond it and weather the summer haze and chop that happens just about every summer.

There’s lots of churn and way too many political mistakes ahead as we get closer to the August doldrums.

Our focus remains the same:

- Pray for a summer swoon, and

- Think demographics, not economics.

We’re in far better shape than the vast majority of investors realise.