The Boring Norm of Upward Earnings

First, make sure you click here to watch our short video on the surprising strength building in the US economy. Most folks don’t see this coming!

Now, on to the business at hand.

This earnings season so far is looking a good deal like the norm, emotionally speaking, but with a couple of mostly positive data exceptions.

The hurricane chatter suggested company results would suffer. In truth, several have seen a short-term impact, including some of the Barbell Economy companies.

Yet even with those near-term impacts mixed in the season has thus far accelerated.

Remember, analysts crank things downward for the coming quarters as each new quarter unfolds.

And this week the tide really started rolling in as 700 companies reported results, which puts us past the halfway mark. We’ll cover all of that off in my next post.

For now the surprise trend, rarely mentioned in all the hype about never-ending problems, is the positive performance thus far of this reporting cycle.

On the revenue front, growth is edging into acceleration over other recent periods.

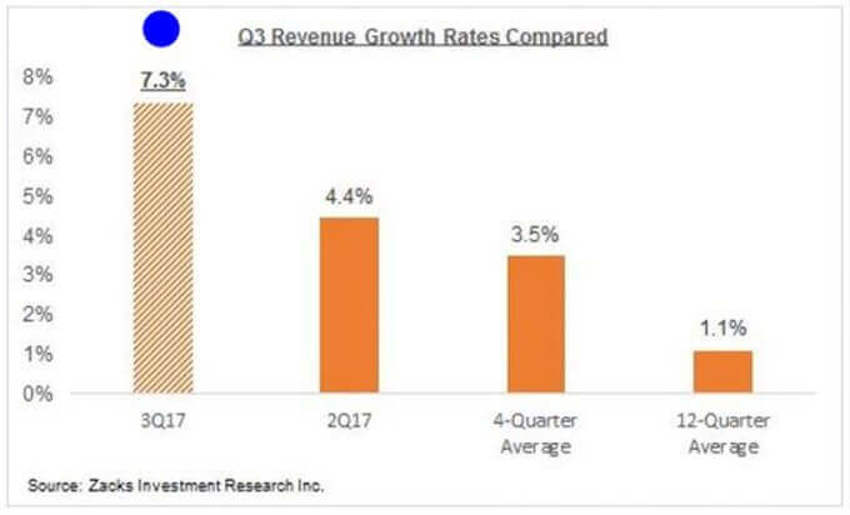

The chart below shows that trend:

Total revenues for the 87 S&P 500 members that had reported at week-ending end 20th October revealed results are already are up +7.3% from the same period last year. That compares to +4.4% top-line growth for the same group of companies in the preceding quarter, and still lower average growth rates in the prior periods.

This is happening on a tougher comparative quarter year-over-year than the previous two of 2017.

Remember, the first half was "round-tripping" very low numbers in Q1 and Q2 of 2016 due to the energy market dislocation.

The emerging trend in the Q3 earnings season, while still early, is notable on a couple fronts.

First, estimates for the quarter have not fallen by as much as has historically been the case before we started - even with the hurricane fears.

Second, the proportion of positive revenue surprises, a much harder variable to manipulate relative to earnings, is only a shade below the preceding quarter’s record level on a much tougher comparison from last year.

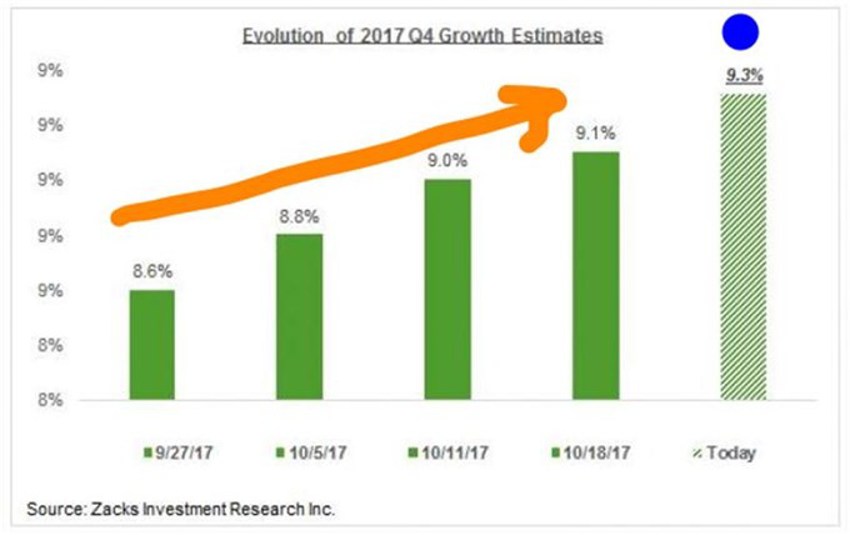

Finally, while again early in the cycle, the revisions trend for the December quarter is shaping up to be very favourable.

And the unusual aspect of Q4 estimates so far is that this time they’ve actually gone up a bit over the last couple of weeks.

This will most likely change as more companies report Q3 results and manage the market’s expectations for the December quarter, but it is nevertheless an unusually positive development.

You can see the shift in Q4 estimates as the quarter has thus far unfolded:

Now Here’s Another Perspective

Most assume markets rise for some nefarious reason - especially when they have cash, bonds and ETFs not participating with the rise.

In this case, logic tells us that the global recovery is becoming more synchronized as data has been showing along the way.

This is now the second time this month where the growth rate of the forward earnings estimate has exceeded 10%.

While still early, this may be showing us that the growth rate is finally looking to turn higher, and perhaps even above 10% for the longer-term.

This has not happened with any regularity since before 2008.

And That's Not All....

Recent data releases continue to poke the bears in the nose, though they’re still assuring everyone that the end must be near.

In Summary

The higher these numbers get, the more intense the market altitude sickness will become.

And make no mistake that the bullishness espoused in the press is only skin-deep amongst the investor herd.

Watch the reaction when we get a week or two of red ink in the markets and the headlines.

The bullish feelings will vanish as everyone imagines the sound of the Black Swans’ beating wings.

Expect fears, concerns and angst in the audience to continue to rise under the following conditions:

- The market continues it's quiet, sometimes choppy and sluggish rise upward, for which more will be concerned that the crash is surely coming, and

- The market takes a step down for a month or two, from which the crowd will run away, believing the crash has finally arrived.

In the end, like it or not, long-term investors must rule that demographics rule the long game.

And Generation Y is set to do much greater things, far beyond what the Baby Boomers accomplished.