The ABCs of Market Emotion

Might that I had 100 years left to watch what is coming at us unfold.

I look at my son Max today and I can only smile because of the unbelievably exciting world that is rushing his, and our way.

And it’s all happening right under our noses, and at a far faster pace than we can imagine; dwarfing everything that we think is possible by today’s standards.

Many times I’ve posed the example of trying to explain an iPhone to someone 30 years ago, or the cloud, or the internet.

Still, 30 years from now today’s developments will seem as technologically embryonic as the space between the phonograph and streaming music.

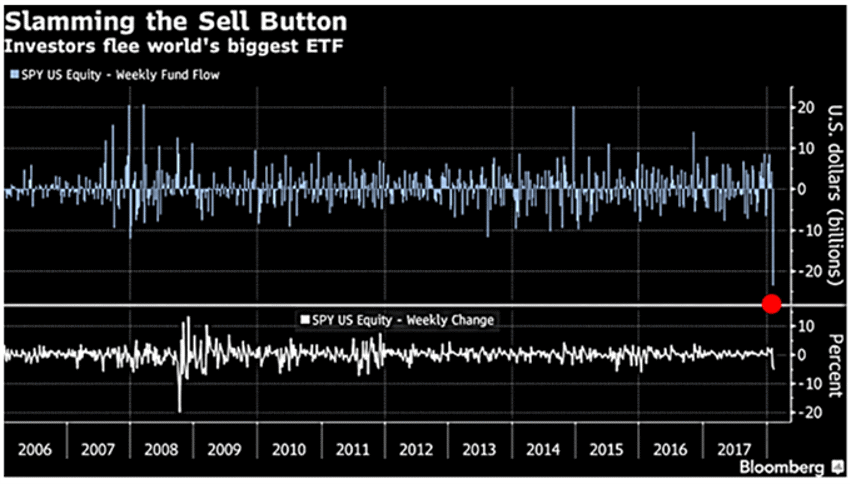

I try to suggest we think about things in perspective because it truly pains me to see that four trading sessions ago, we saw the average investor set a terrible record; more selling of ETFs than ever in history in a one week period.

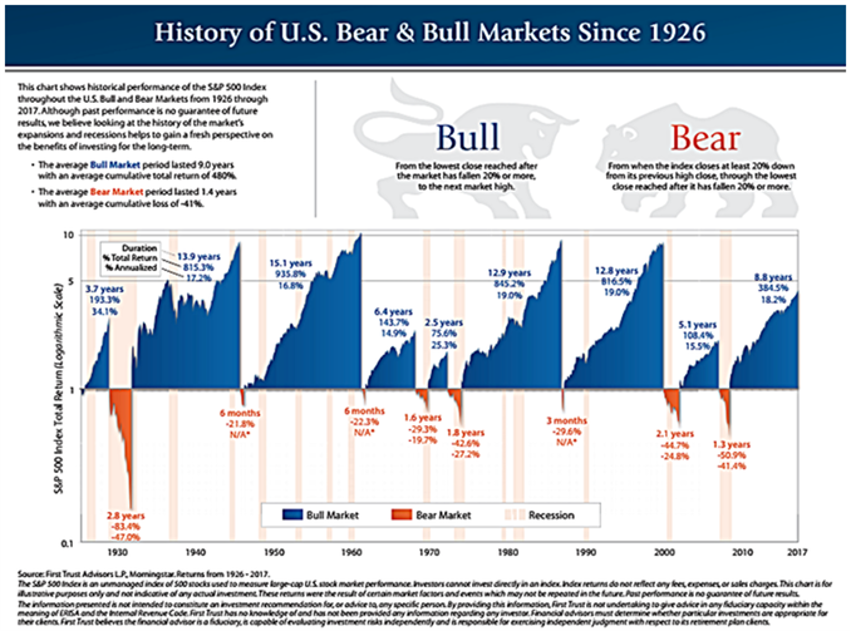

The chart below shows that no matter how much things improve looking forward, we will always face temporary setbacks in the markets.

It's all emotion folks, and it's all short-term in the larger picture.

So, what then followed this mini panic?

An up week, of course, underlining the value of sitting still and being patient.

Orange is bear. Blue is bull.

The simple rules (ABCs):

a) There will be more orange ahead; somewhere, tomorrow or 20 years from now.

b) The orange colour on this chart shows a tiny space of time and a short distance.

c) The blue in this chart is what has birthed more wealth for investors than any other tool on Earth…ever.

So, if you knew nothing else about anything, you would know this: Stop sweating the orange stuff.

It's part and parcel to the game and included in the overall package.

Focus on the blue. Take more TUMS during the orange, or walk on the beach, laugh with your kids, sail the ocean or listen to the waves.

And then be thankful for what's coming after the orange.