Summer Haze: Don’t Sweat It, Welcome It…

Too many investors make the grave error of allowing their political views to interfere with the financial facts.

Like it or not, America’s demographic make-up is set for the next 50 years and will span many different administrations.

But demography will have a substantially more positive and productive impact on your thinking than any amount of time you’ll spend in turmoil over the latest political event(s).

Don’t ignore that simple truth.

Facts about population growth and demographics are real. So is human nature and behaviour. And striving to accomplish things is the goal of most humans.

So what happens if you throw a few hurdles in their way?

Well, overcoming those blockers has marked almost every major surge of accomplishment in our history.

The lesson for us as investors is that we have to learn to welcome that discomfort, the problems that arise and the things we need to do to fix it.

Emotion Drives Money

Outside of the demographic issues driving a significant shift over the next 20 to 25 years (plus), we have to keep an eye on market sentiment.

That’s because emotion drives money.

Think about it. Right now we are just moving into the summer haze. And this period is normally marked by very slow movement - kind of like walking in quicksand.

We can expect some movement up, some movement down, and slower volumes (and even more so on Mondays and Fridays).

The pace will slacken further in July and come almost to a complete stop (or at least it will feel that way sometimes) in August.

This is all normal. So rather than sweat it, welcome it.

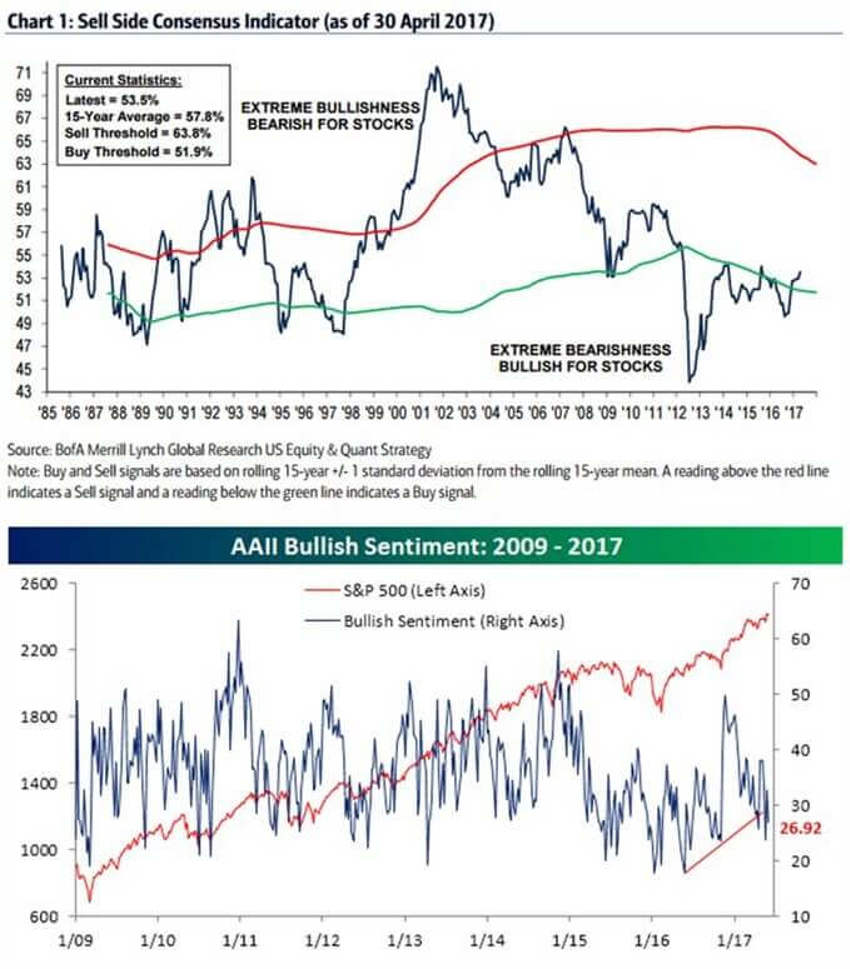

And on that point, sentiment stinks! And, that’s across the board, and all the way down to the Wall Street sell-side groups.

There are a few snapshots below to drive that point home.

First, there’s the latest BAML Wall Street sell-side sentiment data - a real shocker after a 15,000 point run from the March 2009 lows (it is just returning to levels seen back in March 2009 - and in 1985 – Wow!).

Next, there’s the latest weekly AAII sentiment graph that you are accustomed to seeing (lots of noise in it). Right now only 1 in 4 like the market.

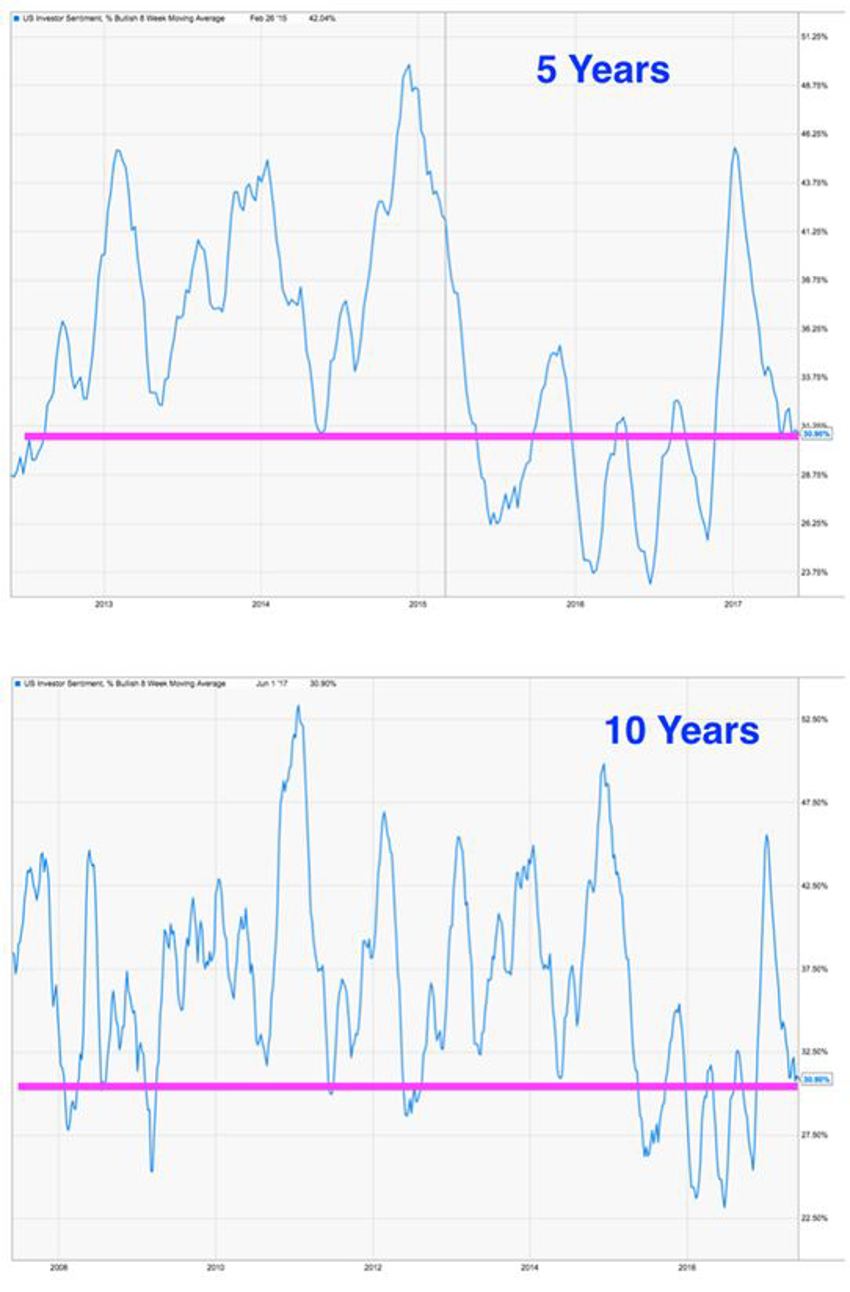

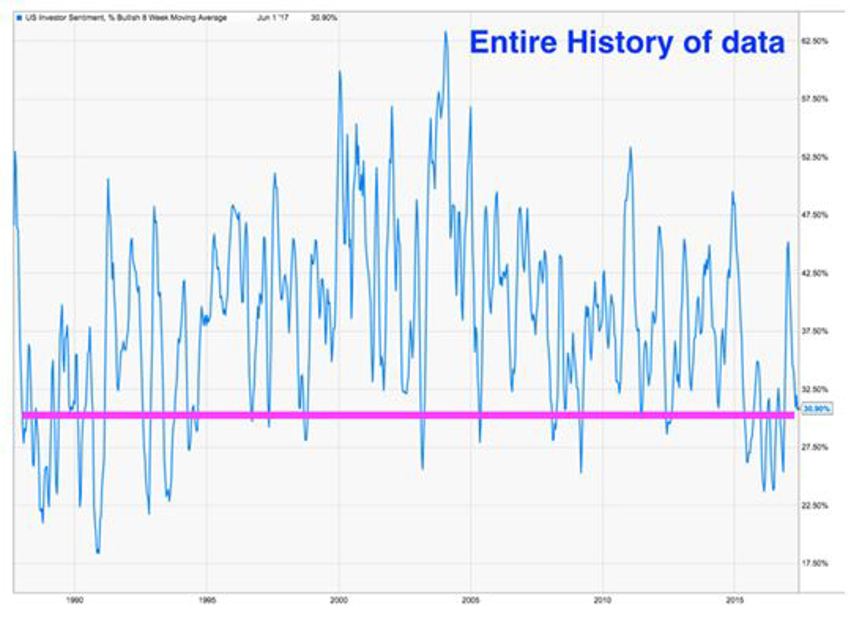

After that - the next three charts show the 8-week moving averages for the last 5 years, 10 years and then the entire history of all bullish sentiment data from AAII going back to 1986!

Why the 8-week average? It tends to let you see just how low we are historically over long periods of time - without all the one-week changes which makes the data a bit more choppy and confusing for some.

The key takeaway is that fear remains very strong under the surface.

And all of that is great news for the long-term, contrary investor.

Now let that repeating message sink in.

The purple lines I have added in to the 5 year, 10 year and Entire History of Data charts is designed to show you just how few bullish feelings there are out there while the market is at record highs.

Just to be clear, historically speaking we’re used to seeing low bullish readings after a market has gone down…not up.

Look at the very small number of times sentiment has been worse than now

Each and every instance showed it was a valuable time to own stocks.

And never was sentiment this low during a market high.

It reminds me of the melt-up we saw back in the 1980s and 1990s, during the Baby Boomer push.

In Closing

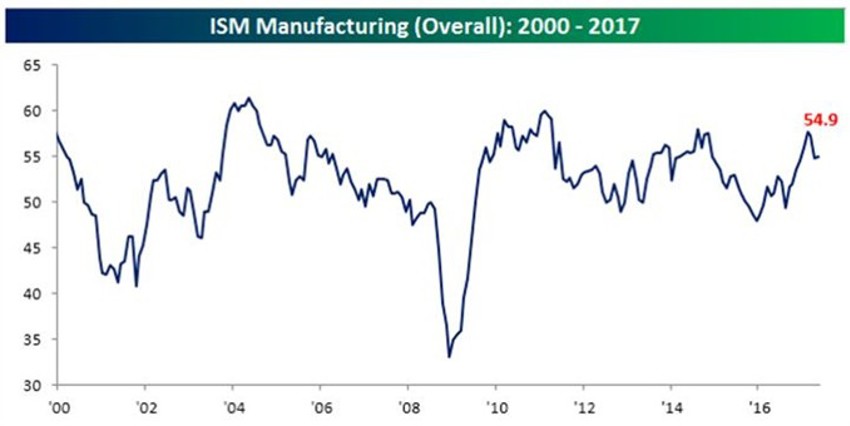

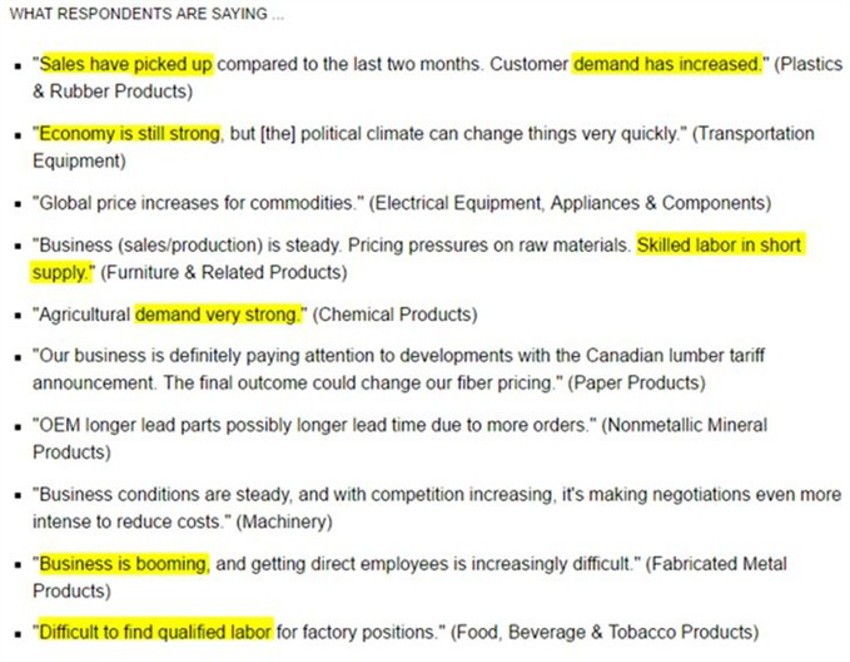

In the latest manufacturing data, you’ll see the ISM data below.

Note the comments from front offices across many industries.

The lesson from that? Ignore Politics - Focus on People.

Reading between the lines, I remind you of what we noted early in the year. We called it our "Fedex-ed Economy.”

It went something like this:

"We have spent so long making sure we do not suffer a repeat of 2008-2009, that we have not planned for one thing - increasing demand in all areas."

We went on to note: "We have squeezed our pipeline down for so long and erased inventory for years. No one keeps any inventory around anymore; if you need something extra, you simply Fedex it. Industry chose to work in the extra shipping costs over risking too much inventory costs. The result? Soon we can expect that we will see longer wait times in many industries - and for some - we will simply run out of stuff."

The Bottom Line

If we are lucky enough to get a "summer swoon" then be ready.

Why?

Take a look at every other summer swoon in history.

They were all at lower prices than where we are now.