Stop the Insanity

Last week the Dow Jones and S&P 500 fell by about 48 basis points.

For you non-maths people that's the equivalent of less than one-half of a percent.

Frightening, right?

Eh, no.

But the market reaction was like a Games of Thrones wedding party.

Folks, the insanity must stop, or many, many millions of investors will continue to misunderstand how powerful and positive the changes rolling through the US economy right now really are.

Seriously, here was the headline and photo moments after the close on CNBC:

Now, forget “the scream” photo for just a moment, and that a 23 year-old producer likely typed the headline about what's really scaring the market (we’ll come back to that in a moment).

Have a look at the comment below the photo instead:

"...worst day since September 5th."

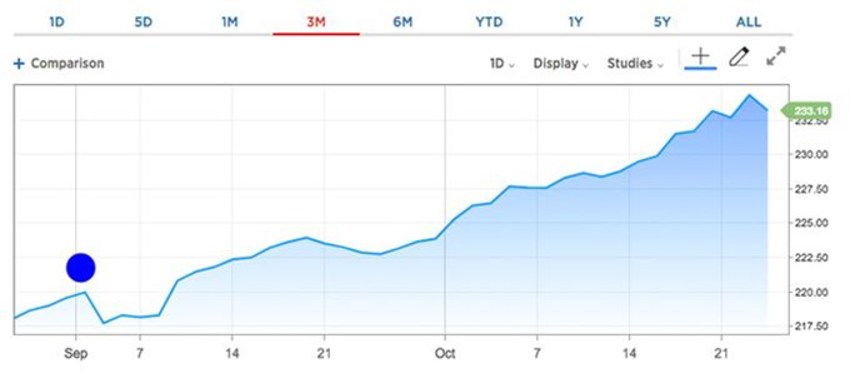

Next, check the short-term chart below which goes back to 4th September.

The blue dot shows you that point in time:

How About Another Perspective…?

The point?

Well, 5th September was definitely a down day as we can see in the dip right after the blue dot.

But that was over 1,300 Dow Points Ago (DPA).

So which pitch then we should be focused on:

- The 1300 points up, or

- The 48 basis points down?

Make certain you know the right pitch before you start to swing (or scream).

Now you may feel this is trivial but let me tell you that it happens in every timeframe imaginable and that it’s been going on for years.

To this day the masses continue to show mortal fear of any red ink, a fear likely burned into the investor psyche from 2008-2009.

And that scar is so deep that it might take decades to mend.

If last week was the beginning of a 3,000 point setback (which would only be 14%) as an example, for the next 5 years we would hear about the "correction" in late 2017, and not the nearly 17,000 points travelled since March 2009.

Make no mistake, watching the wrong pitch is a very expensive past-time indeed as it relates to your investment and wealth-building plans over the long-term, second only to fear itself.