Sorry, I Was Wrong…

I’ve suggested for many moons now how we should consider the claim that the investor crowd is too bullish and complacent with a mountain of salt.

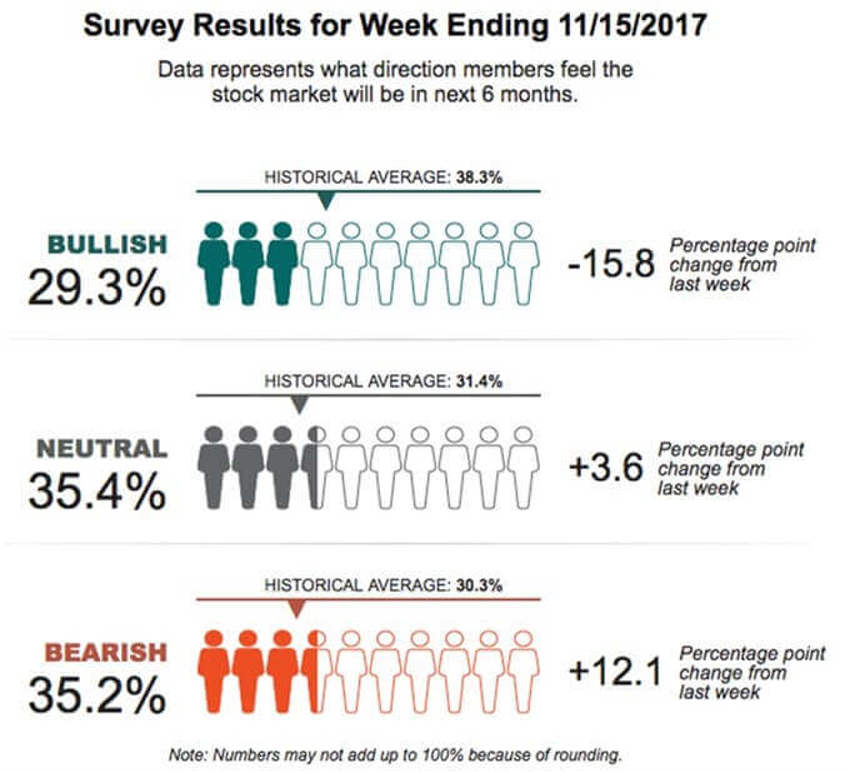

My exact words: “If you find yourself concerned the crowd has become too bullish and it is all about to end, give me two weeks of red ink and a 1,000 points down on the Dow and I will show you a crowd whose bullish reading is back in the 20s."

And that’s usually followed by: “Pray for a correction.”

But folks, I was wrong.

That’s right, I said it.

You see, it only took six days and a loss of about 350 Dow Jones points for bullish sentiment amongst independent investors to plummet (According to the latest AAII survey), down from the 40 per cent range to the 20s.

That’s just 350 points off the most recent high of Dow Jones 23,546.

For me, I hope this happpens over and over again for the benefit of long-term investors.

And yes, I do understand how the internal churn has been significant – the market-weighted indexes are skewing perspectives due to Tech.

In fact, about 29% of S&P 500 stocks are actually down on the year.

Taking that a bit further, if one-quarter of your portfolio is not in the 5 big tech stocks then this is one of those years (rare as they may be) when the broader market's solid gains are pretty far away from the most followed averages in the press.

Example: Here’s the NYSE Composite of recent days: + 10.52%

That’s about 400 basis points below the market-weighted bloat of the S&P 500.

So, I confess, I was way off. It took less than half that time and roughly a third of the points to fall away in order to scare the herd back into their foxholes.

And don't even get me started on the perils and laziness of "passive investing."

I cannot imagine how low it would be if we were actually off 1,000 points from the recent highs.

Here’s Another Apology…

In recent months I’ve found myself a bit energised whenever someone suggests that the world is coming to an end…again.

That reprise has become like a national pastime of late. They should play it before ball games – Lord only knows what the stand, sit or kneel reaction might be!

Better yet, the voices suggesting this might consider a new hobby:

Another Top?

Nuff said (above)!

Ever Wonder?

And have you ever wondered what the guy who made this call last year at RBS is doing these days?

My hunch is that he probably got a promotion for being "prudent":

We should, in fact, be welcoming the deflationary forces upon us.

It’s squeezing costs, increasing margins, cutting out fat, creating better jobs, processes, efficiencies and technologies at a pace so fast we’re having trouble keeping up.

And the best news of all is that these things are just getting started – thank you Generation Y!

But before we chuckle at how this new, largest age cohort ever is considered to be lazy and irreverent, here’s a quick backward glance at the Baby Boomers before they “boomed” back in the dawn of the 80s:

I think I recognize some of the people in this photo…

Sometimes in the throes of all the insanity – once the effects of the bourbon and fruit-flavoured Tums have worn off – it’s important to remember how long-term thinking always wins out over short-term trading.

Worrying about the next setback sells lots of ads but makes almost no money for you.

History proves it.

So forget economics and think demographics instead.

Generation Y is set to do much greater things, far beyond what the Boomers accomplished.