Slaying The Earnings Recession Monster?

Adrift: Floating without being either moored or steered; without purpose or guidance; lost and confused.

There’s a kind of whipsaw effect on the markets with every election story and, here in the final week, don’t be surprised if that quagmire continues well beyond Election Day.

Just remember that these are short-term impacts.

The earnings season, on the back of some very ugly election season antics have seen some harsh reactions in some sectors. And Hillary has clearly taken aim at the healthcare world, which in turn has resulted in a sector-wide run against those stocks for months now.

This in turn likely suggests value in that area for long-term investors, given the future demand that will be driven by the retiring Baby Boomers.

Keep in mind that politicians get far too much campaign money from the drug business to be too tough on them after the election is over.

Earnings Updates

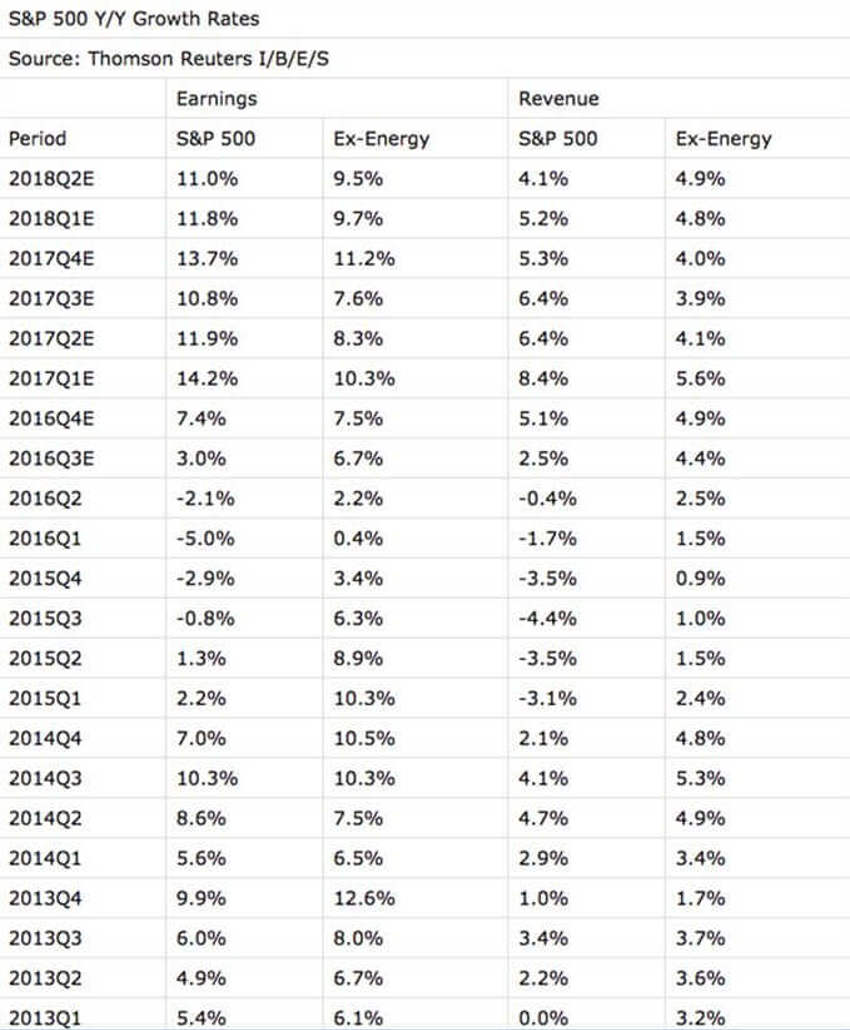

Have a look at the data from Thomson on the latest in earnings through Friday morning of last week:

The above chart clarifies the difference in earnings growth rates over recent quarters and how the data appears both with and without energy included.

When a sector is affected like energy has been in the last two years it’s important to see both perspectives. Glaring change in one sector can blind investors to the underlying continuation of growth elsewhere.

Net-net, earnings results in Q3 continue to suggest that the upward turn is unfolding as the energy sector’s “round-trip” gets marked on the earnings calendar.

We are going to need to find a new monster as it appears the "earnings recession" monster has been killed.

As for the chart, note in the "Ex-Energy" column that by the end of the Q3 2016 reporting cycle (about halfway there) how the 6.7% growth suggests we are slowly returning to the S&P 500 earnings and revenue growth of the 7-8 year range.

See also how the current data suggests Q4 2016 is expected to "equalize" with energy, meaning that the energy sector will return to being additive or at least not a substantial drag on S&P 500 earnings in 2017.

Again, while this is a stabilizing force long-term I would not expect to see anything suggesting that in the current political climate as we come to the end of the electoral fight.

In fact we could see the opposite near-term, given the vitriol of the race.

If we can keep it clean and move on from the mess then we may very well be setting the stage for a nice finish to the year once the world focuses on economies again and longer-term plans return to being the guidepost.

Interest Rate Reality

The media is telling us that markets are fearful of a rate hike.

This week is a focus on same, but we should not expect a hike at this month's meeting. I have a growing hunch that the Fed may not hike at all this year.

Think about it; markets have already tightened rates for them. The hated dollar has rallied. Rates have risen across the spectrum and the Fed's job has already been completed.

An "official" rate hike will be a news event only. The financial aspect has already taken place.

Investor Reality

We can chatter endlessly about the reasons people seem to still be afraid of the future.

The reasons in the end don't matter.

What matters is where their money sits.

History tells us repeatedly that the press, the headlines, the experts and the investor audience become far too greedy at the end of a market-cycle.

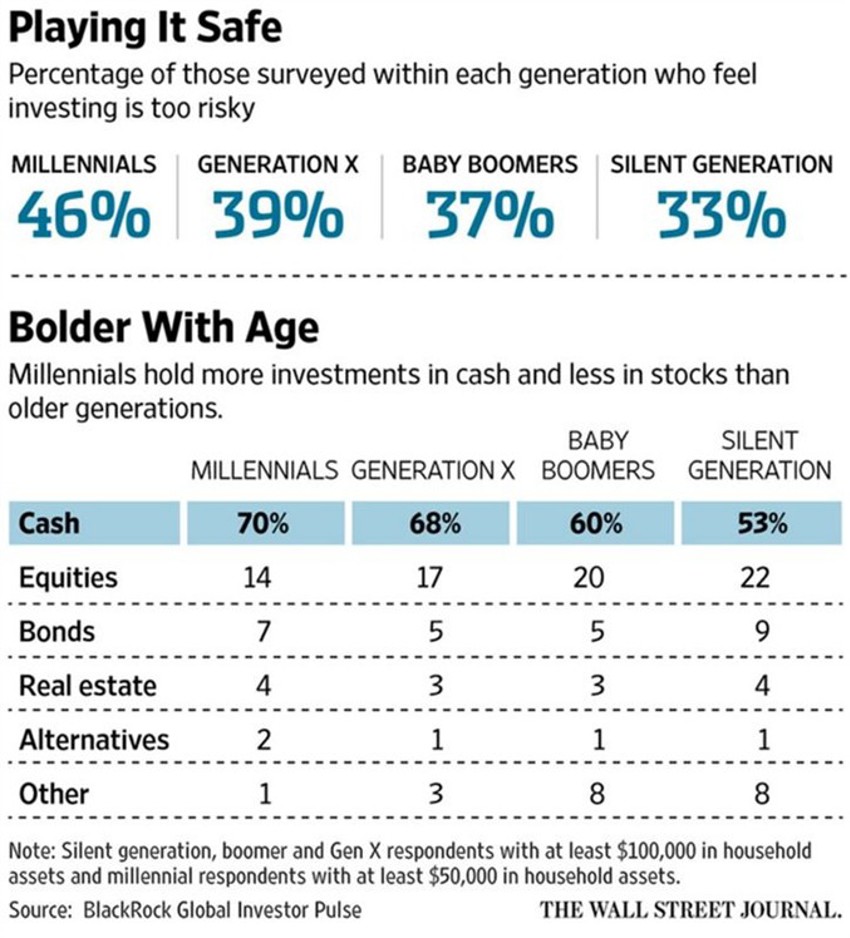

The WSJ has just released findings from a Blackrock/WSJ poll of households that show there is not a single generation or age cohort of people in the current investor audience who could be portrayed as even remotely greedy just now.

And while we regularly shown sentiment as your pathway to this insight, the below chart will show you the other indicator: Money.

You can take as much or as little as you like out of this chart, but I was struck by two items, both supporting what sentiment tells us across the board in all surveys:

- Note the percentage of each generation that feels investing is too risky, and

- Note the cash levels held by the respondents - this helps to explain the $9 Trillion idle in Bank accounts right now.

Now, I suppose this could go down as the first time in history the crowd was the contrary value in the market, but I have a hunch it’s not.

Long-term investors can take some solace in this data as it suggests value creation is unfolding as emotions sway, even as the likelihood of near-term market chop and churn remains top of the list.

One more thing. Those thinking we have entered the next Apocalypse because rates have risen in the bond market would be best served remembering that the major indexes have risen all the way back to levels seen right before Brexit in June.

The Shift Unfolding

We can see that the economic power-shift is moving from the Baby Boomers to Generation Y. The baton is passing. Demand is heading our way in ways that various sectors have likely never seen and certainly aren’t ready for.

And just as important is the capacity of Gen Y to drive change, technology, new tools, new processes and new margin increases that will be surprisingly deflationary. Fear is also deflationary. These forces are likely to continue to fool many experts who are assuming certain things will happen as growth trudges forward.

One more topic on growth: Specifically the 2.9% GDP data report of late.

Expect it to be revised downward slightly as more data comes through and we see the fingerprints of the "election-angst-freeze."

This will pass but I suspect we’ll find we’re still in the same general 2% growth range (albeit at record, all-time highs in GDP). We’ve remained there under the current administration.

The impact on consumers of the massive Obamacare hit coming our way will be an issue to deal with in Q1 and Q2.