Rumours, News & Other Distractions

Well that was timely.

A few weeks back we focused in these notes on the near-term risk of the "buying the rumour and selling the news" summertime market action.

Now it looks like the busiest week of the summer and the Q2 earnings season, along with very low volumes, set the stage for some internal shellacking of several big names.

Despite all that, new records are being set and new forward earnings continue to rise.

The numbers being chalked up for what is the 2018 foundation (pre tax reform and further regulatory burden lift) suggest a steady upside surprise remains on track.

So, what of the crowd’s edginess?

For illustrative purposes, the Income Portfolio saw three events last week that were almost entirely related to ETF reactions – see my article ETFs – Nothing is Certain of Obvious.

STX (Seagate Technology) reported a very big miss last week.

What immediately followed as tech specific ETFs were sold - and since WDC (Western Digital) is a holding in many of those ETFs - it too went down.

But the selling didn’t stop, even as WDC announced stellar earnings, continued growth and results that will now far exceed the earnings numbers from the start of the year. It was a picture-book report.

The result? The stock sold off over three days by more than $10 per share, settling somewhere around 7 times earnings for 2017.

This will give you a sense of just how poor emotions can be as a judge of reality.

More Earnings Data

Don’t confuse the pace of growth in earnings YOY as a bad sign for the future.

Remember that Q1 of 2016 provided a very easy target for growth.

After all, oil was collapsing, write-offs were riddling the industry, banks were still dragging along and concerns abounded as the "worst start for markets in 85 years" abounded.

So, Q1 of 2017 was an easy YOY comparison. The percentage pace of beating the previous year will now slowly fall as last year’s numbers get lapped.

In other words, Q2 2016 was better than Q1 2016 - Q3 2016 was better than Q2 - and so on: The year or year comparable numbers will fall in percentage terms as we get further away from the easier-to-beat numbers.

Some Stats

So far for Q2, the earnings and revenue growth pace is (surprisingly) steadily rising relative to pre-season expectations.

At the present tally, total Q2 earnings for the index are expected to be up +9.2% from the same period last year on +5.0% higher revenues.

This from Zacks: "Please note that the +9.2% growth rate is the blended growth rate; it combines the actual growth for the 286 S&P 500 members that have reported with estimates for the still-to-come 214 index members. At the start of the quarter, the expectation was for earnings growth of +7.9%, which came down as the quarter unfolded, reaching as low as +5.6% just ahead of the start of the reporting season."

Let's keep in mind there are still many results that have yet to be reported. In fact, this week is the second busiest week of the season. We could still see actual Q2 earnings growth go above +10%.

That would follow the +13.3% earnings growth in the previous Q1 reporting season.

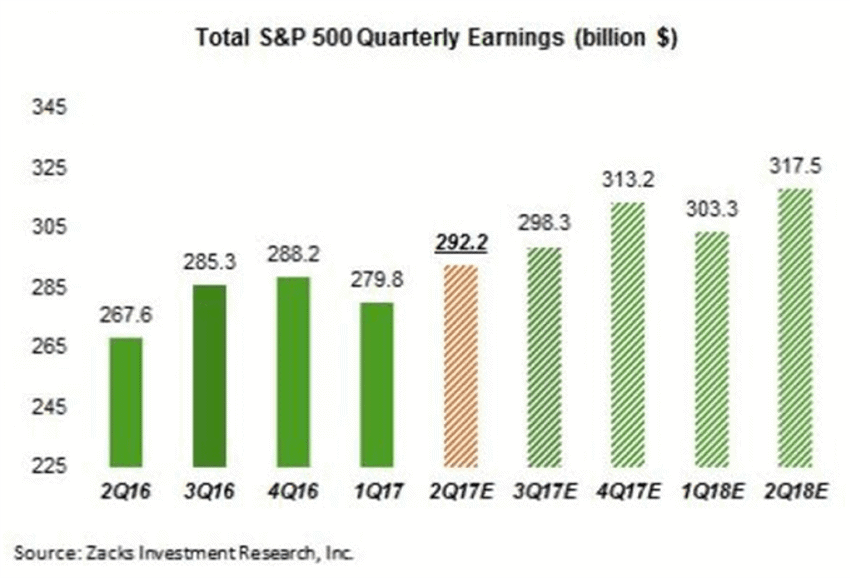

Headlines and bears will growl with fear over that deceleration in Q2 earnings, but try not to lose track of the fact that earnings are on track to reach a new all-time quarterly record, surpassing the 2016 Q4 level.

The chart above provides you a highlight sheet if you will - showing the current (half still estimated) 2017 Q2 total of $292.2 billion, along with the actual earnings for the preceding four quarters and estimates for the following four periods.

Short of a recession on a grand scale, these are steady improvements.

And those figures still don’t include any headway in Washington DC. No matter who is President, those who sit in Congress usually do the same thing: Fight for votes and the power to stay there via bickering and side deals. Until, of course, reality hits and working together is required. That sometimes comes from market setbacks and rising fears.

Hence, the risk still of the summer swoon (I hope).

And if it happens, be prepared to take advantage of it.