People Make Markets

When I was younger and just starting in this industry back in 1982, I remember noticing there always seemed to be two voices in the marketplace.

Sometimes the voices were loud and clear, rising above all of the other chatter. Other times you had to listen carefully to distil its clarity. But the two voices were always there.

Let me give you a few examples:

August 1982

Voice 1: Mike, you are crazy. Inflation is 15.5%, the prime is 20.5%, the economy is struggling, jobs stink, unemployment is 10.5% and the markets are just returning to where they were seven years ago!

Voice 2: Yes, but there are 78 million Baby Boomers who are about to enter the system making a very significant impact on the economy going forward.

October 1987

Voice 1: The markets may not open tomorrow; we just lost 22% of all values invested in one day! The economy is clearly going to be damaged going forward. It's never been this risky.

Voice 2: The market crash did not change the fact that 78 million people are still going to grow up, expand, become adults and build their lives. We can buy again now at prices not seen for years. Besides, even after the crash the market has risen a net 15% per year over the last 5 years. Tech is just getting started as a new driver in our economy.

Summer 1993

Voice 1: Real estate is going to kill this economy. Banks are imploding and being taken over by the Feds every weekend. We have lost 1,500 banks and S&Ls in this purge. Our economy will be burdened with bad debt and over-built commercial real estate markets for decades to come.

Voice 2: You cannot believe how much money you can make by buying assets from the RTC for 10 cents on the dollar.

I could review these same two voices from the struggles after the Russian currency crisis and the Asian Tigers downfall in October of 1998. I could also review the same nightmarish viewpoints from the end of the tech bubble in 2003 or the end of the Great Recession in March of 2009 - both of those points were from well over 10,000 Dow Jones points ago.

So, which voice was the correct voice, and what was the underlying driver of the future demand?

The answer: People. People make markets. They always have and they always will.

I had to learn this a long time ago: Get your ego out of the way and focus on people. If I can be relatively confident that, short of an extinction event for humans, about 60 or 70 or even 80 million people will walk through certain doorways into sectors in the US economy, then we can also be relatively confident that demand will expand.

The Toughest Elements

They’re called simplicity and patience. Getting away from these two elements in the process of planning for a long-term, wealth building/preservation series of goals has always provided lots of space for missteps.

That's just my experience and not a guarantee.

I suppose it could be productive to sit here and fret over every syllable coming from Clinton or Trump. But I have a hunch it’s better for us if we focus on the idea that something productive will unfold just like it always does over time. The other small item of 86 million new consumers headed our way is not a bad part of the deal either no matter who "wins," we’ll all win in the long run.

And sure, we can fret over the next Armageddon depicted in their debates. But do we really think that is what we will be focused on six months from now? How about 12 months from now? Or even two years or five years from now?

Not a chance.

Instead, let's deal with the facts. And those facts are improving even as the media tells us all there is still so much to worry about.

Let's review.

Earnings Stats

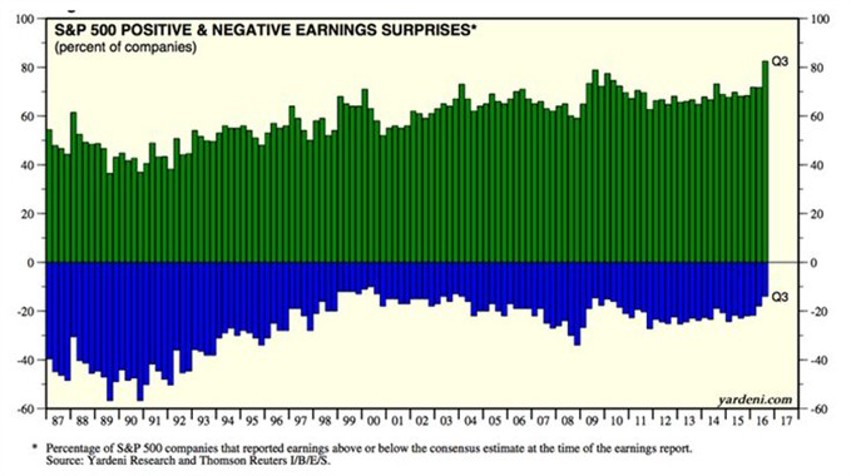

Improving and on the upswing: While still early in the earnings season, 11% of S&P 500 companies have finished reporting Q3-2016 results so far (at the time of writing).

Their revenue and earnings surprise metrics and year-on-year growth comparisons are far stronger than at the comparable point of the Q2 season.

Of the 57 companies in the S&P 500 that have now reported, 83% exceeded industry analysts’ earnings estimates by an average of 7.9%; they have averaged a year-on-year earnings gain of 4.9%.

At the same time period in Q2-2016, a lower percentage of companies (66%) in the S&P 500 beat consensus earnings estimates by a smaller 4.4%.

But the more important element at the time was that earnings were down 6.0% year-on-year then.

On the revenue side, 70% beat sales estimates so far, coming in 1.2% above forecast and 4.4% higher than a year earlier.

Q3 earnings results are higher for 72% of companies versus 59% at the same point in Q2, and revenues are higher for 72% versus 59%.

Although these figures will change markedly as Q3 results begin pouring in, the early read is encouraging and further supports Q2 was the bottom for year-on-year comparisons.

So what does the chart above tell us? Well, as difficult as this will be to drag out of the media meltdown chatter, the cloud of earnings recession driven primarily by the shellacking of the energy sector is slowly lifting on the horizon.

This is where the patience part of the equation noted above is of utmost value.

Fretting Over Rates

Let's make it a basic assumption that the Fed will raise rates in December.

The nonsense of assuming that somehow a 25-basis point hike is going to remotely harm an $18.5 trillion economy is a complete waste of time. Instead let’s plan to take advantage of the actions from others who will get lost in this latest pothole to hell.

Any watching rates would see the following in place:

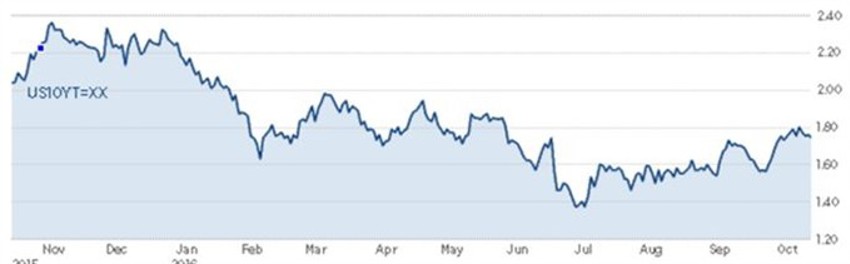

The first chart above shows the last year of movement in rates for the 10-Year Treasury Bond.

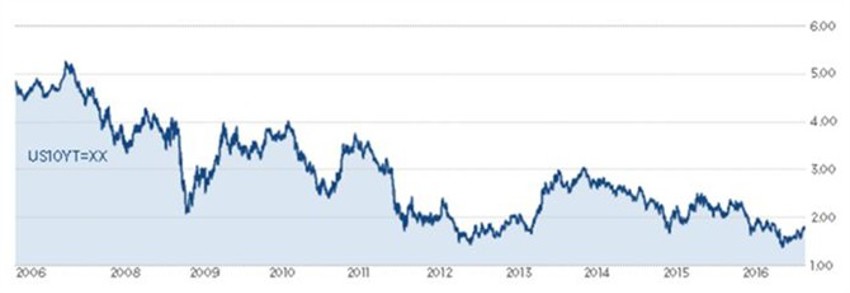

The second chart is the last 10 years of the same vehicle. We are right now where we were the week before "Branic.”

And we are miles away from where we were a year ago, 3 years ago, 5 years ago and 10 years ago.

Fretting over 25 basis points is a pitch in the dirt. It’s energy wasted. Stand ready instead to take advantage of any "panic" over the event.

Re-pricing of dividend stocks is setting the stage for higher dividend pay-outs in the future. And remember that on dividends, you are looking for the annual growth of same over long time periods.

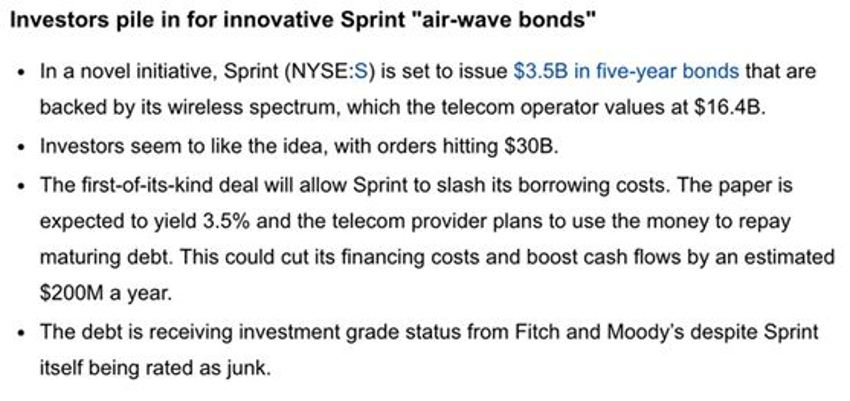

Besides, if you think anyone is running from bonds, check these stats on two big deals just released.

The most important element is to note the massive levels of over-subscription demand for the bonds.

In both cases, it is many multiples of the amounts offered up for buyers.

There is a literal avalanche of scared money still sitting out there.

A Note About Elections

In case you might be worrying that business is being affected by the ugly noise in the US Presidential race, well, rest assured that it is. But before that scares you, remember that this is normal.

Every election causes this process. The last few months before an election causes all wise business people to make plans but then pause for a moment before implementing.

This is not a major deal.

In fact, history suggests it can be a positive. That pent-up demand of inactivity eventually unfolds after the feared election event has passed.

Better implementation decisions are then overlaid on the previous plans to address the election outcome shift - if any.

This is simply smart management on investing and growth and surely not something we should fret over, right?

So let's put that fearful chatter in our heads to rest, and focus instead on finding productive ways to benefit from the massive demand heading our way.

That is a far more productive use of our time.

And yes, that means we have to remain patient and let the waves come to us.

In Summary

While the debates are past let's not assume the ugliness is finished.

Far too many are set to still be swayed into fear and will overlook the positive elements in earnings reports.

Soon, what will be surprising to many is that we will find markets are not that over-valued after all, based on 2017/2018 earnings. Pray for a correction or setback around the election. And be prepared to take advantage of same while many will be focused instead on the short-term.

As long-term investors we are paid to focus on the horizon above the noise. Straying off course due to emotional strain has been a glaring and historically very expensive misstep.

Longer-term, this period of chop and churn, just like the others, is your friend.

After the election, our view remains that surprises are to the upside.

Be patient, stay focused and on your plan. Think demographics - not economics.

We are in great shape with a solid future ahead - but as always - plenty of potholes are always out there to work around - which we like to call "opportunity."